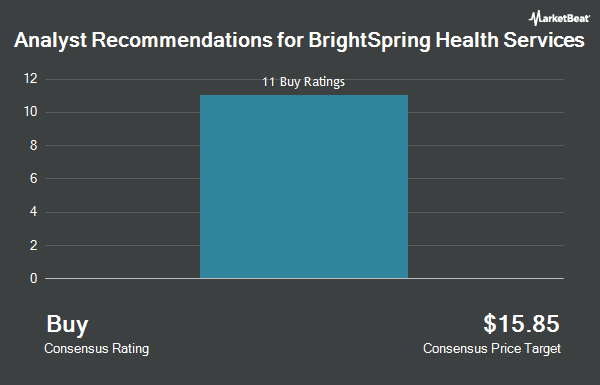

BrightSpring Health Services, Inc. (NASDAQ:BTSG - Get Free Report) has received an average rating of "Moderate Buy" from the eleven ratings firms that are currently covering the stock, Marketbeat reports. One research analyst has rated the stock with a hold rating and ten have given a buy rating to the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $24.90.

A number of research firms recently weighed in on BTSG. Mizuho set a $26.00 price objective on shares of BrightSpring Health Services in a report on Monday, May 5th. TD Cowen began coverage on shares of BrightSpring Health Services in a report on Monday, June 23rd. They issued a "buy" rating and a $37.00 price objective on the stock. Wall Street Zen cut shares of BrightSpring Health Services from a "strong-buy" rating to a "buy" rating in a report on Saturday, July 26th. Wells Fargo & Company increased their price objective on shares of BrightSpring Health Services from $25.00 to $27.00 and gave the stock an "overweight" rating in a report on Tuesday, May 13th. Finally, Morgan Stanley raised their target price on shares of BrightSpring Health Services from $20.00 to $25.00 and gave the company an "overweight" rating in a research note on Friday, May 9th.

Check Out Our Latest Stock Analysis on BTSG

Insider Activity at BrightSpring Health Services

In other news, insider Jon B. Rousseau sold 531,840 shares of BrightSpring Health Services stock in a transaction that occurred on Thursday, June 12th. The shares were sold at an average price of $21.75, for a total value of $11,567,520.00. Following the transaction, the insider owned 1,184,133 shares of the company's stock, valued at $25,754,892.75. The trade was a 30.99% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this link. Also, major shareholder Phoenix Aggregator L.P. Kkr sold 13,288,101 shares of BrightSpring Health Services stock in a transaction that occurred on Thursday, June 12th. The stock was sold at an average price of $21.15, for a total transaction of $281,043,336.15. Following the completion of the transaction, the insider directly owned 79,671,883 shares in the company, valued at $1,685,060,325.45. This represents a 14.29% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 15,919,941 shares of company stock worth $337,025,856 in the last ninety days. Corporate insiders own 3.40% of the company's stock.

Hedge Funds Weigh In On BrightSpring Health Services

Hedge funds have recently made changes to their positions in the business. Quarry LP acquired a new position in shares of BrightSpring Health Services in the 4th quarter worth approximately $29,000. IFP Advisors Inc boosted its holdings in shares of BrightSpring Health Services by 273,666.7% in the first quarter. IFP Advisors Inc now owns 8,213 shares of the company's stock worth $149,000 after buying an additional 8,210 shares during the period. Highland Capital Management LLC acquired a new position in shares of BrightSpring Health Services in the first quarter worth about $181,000. Envestnet Asset Management Inc. acquired a new position in shares of BrightSpring Health Services in the fourth quarter worth about $188,000. Finally, KLP Kapitalforvaltning AS acquired a new position in shares of BrightSpring Health Services in the fourth quarter worth about $206,000.

BrightSpring Health Services Stock Performance

Shares of BTSG stock traded down $0.86 during trading hours on Tuesday, reaching $19.79. The stock had a trading volume of 2,492,361 shares, compared to its average volume of 2,023,748. The company has a debt-to-equity ratio of 1.48, a current ratio of 1.73 and a quick ratio of 1.37. BrightSpring Health Services has a twelve month low of $10.15 and a twelve month high of $25.57. The firm has a 50-day simple moving average of $21.96 and a 200-day simple moving average of $20.47. The firm has a market capitalization of $3.48 billion, a PE ratio of 71.00 and a beta of 2.30.

BrightSpring Health Services (NASDAQ:BTSG - Get Free Report) last released its quarterly earnings data on Friday, August 1st. The company reported $0.22 earnings per share for the quarter, topping analysts' consensus estimates of $0.19 by $0.03. BrightSpring Health Services had a net margin of 0.49% and a return on equity of 7.76%. The business had revenue of $3.15 billion for the quarter, compared to analysts' expectations of $2.99 billion. During the same quarter last year, the company earned $0.10 EPS. The company's revenue for the quarter was up 15.3% compared to the same quarter last year. As a group, equities analysts forecast that BrightSpring Health Services will post 0.59 earnings per share for the current year.

BrightSpring Health Services Company Profile

(

Get Free ReportBrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

Read More

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.