Brinker International (NYSE:EAT - Get Free Report) updated its FY 2025 earnings guidance on Tuesday. The company provided earnings per share guidance of 8.500-8.750 for the period, compared to the consensus earnings per share estimate of 8.470. The company issued revenue guidance of $5.3 billion-$5.4 billion, compared to the consensus revenue estimate of $5.3 billion.

Analyst Upgrades and Downgrades

A number of research firms recently issued reports on EAT. StockNews.com upgraded shares of Brinker International from a "hold" rating to a "buy" rating in a research report on Friday, January 31st. Stifel Nicolaus raised their price objective on Brinker International from $155.00 to $170.00 and gave the company a "buy" rating in a report on Monday, January 27th. JPMorgan Chase & Co. increased their target price on Brinker International from $140.00 to $160.00 and gave the company a "neutral" rating in a research report on Thursday, January 30th. Wells Fargo & Company lowered their price objective on Brinker International from $165.00 to $150.00 and set an "equal weight" rating for the company in a research note on Wednesday. Finally, Barclays cut their target price on shares of Brinker International from $165.00 to $155.00 and set an "equal weight" rating on the stock in a research report on Wednesday. Thirteen research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, Brinker International presently has an average rating of "Hold" and a consensus price target of $141.14.

Check Out Our Latest Research Report on EAT

Brinker International Stock Performance

Shares of EAT stock traded up $3.08 during trading on Friday, hitting $133.13. The company's stock had a trading volume of 1,682,365 shares, compared to its average volume of 1,485,842. The company has a current ratio of 0.33, a quick ratio of 0.27 and a debt-to-equity ratio of 4.96. The company has a market cap of $5.91 billion, a PE ratio of 23.07, a P/E/G ratio of 0.49 and a beta of 2.21. The business has a fifty day moving average of $147.24 and a 200-day moving average of $138.65. Brinker International has a 52 week low of $54.78 and a 52 week high of $192.22.

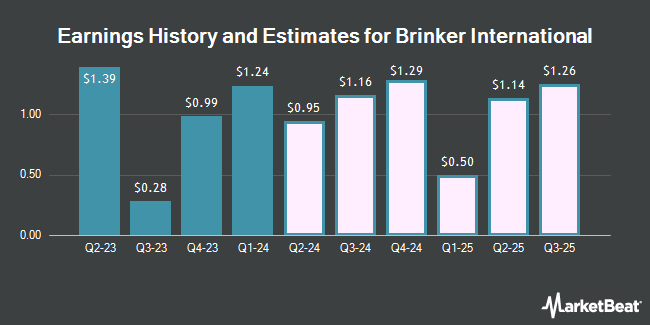

Brinker International (NYSE:EAT - Get Free Report) last announced its earnings results on Tuesday, April 29th. The restaurant operator reported $2.66 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.48 by $0.18. The firm had revenue of $1.43 billion during the quarter, compared to analyst estimates of $1.38 billion. Brinker International had a return on equity of 879.47% and a net margin of 5.45%. The business's revenue was up 27.2% compared to the same quarter last year. During the same period last year, the firm posted $1.24 EPS. As a group, research analysts anticipate that Brinker International will post 8.3 earnings per share for the current year.

Insider Activity

In other Brinker International news, COO Douglas N. Comings sold 7,500 shares of the firm's stock in a transaction on Thursday, February 6th. The stock was sold at an average price of $187.90, for a total value of $1,409,250.00. Following the completion of the sale, the chief operating officer now directly owns 34,252 shares of the company's stock, valued at $6,435,950.80. This trade represents a 17.96 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Cindy L. Davis sold 5,802 shares of the company's stock in a transaction on Monday, February 3rd. The shares were sold at an average price of $187.86, for a total value of $1,089,963.72. Following the transaction, the director now directly owns 11,107 shares in the company, valued at $2,086,561.02. This represents a 34.31 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 20,802 shares of company stock valued at $3,752,464 in the last three months. Company insiders own 1.72% of the company's stock.

About Brinker International

(

Get Free Report)

Brinker International, Inc, together with its subsidiaries, engages in the ownership, development, operation, and franchising of casual dining restaurants in the United States and internationally. It operates and franchises Chili's Grill & Bar and Maggiano's Little Italy restaurant brands.

Featured Stories

Before you consider Brinker International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brinker International wasn't on the list.

While Brinker International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.