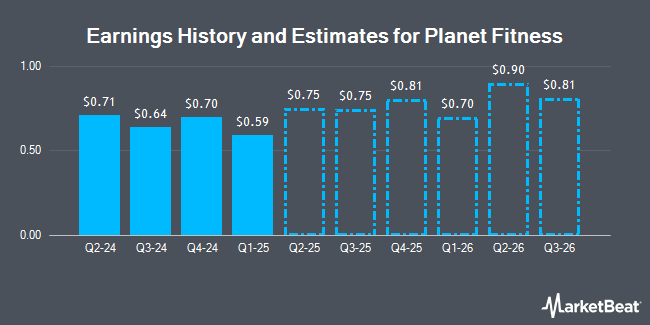

Planet Fitness, Inc. (NYSE:PLNT - Free Report) - William Blair increased their FY2025 earnings estimates for shares of Planet Fitness in a note issued to investors on Wednesday, August 6th. William Blair analyst S. Zackfia now forecasts that the company will earn $2.96 per share for the year, up from their prior forecast of $2.90. The consensus estimate for Planet Fitness' current full-year earnings is $2.51 per share. William Blair also issued estimates for Planet Fitness' Q4 2025 earnings at $0.71 EPS and FY2026 earnings at $3.43 EPS.

PLNT has been the topic of several other research reports. Morgan Stanley boosted their price target on shares of Planet Fitness from $111.00 to $112.00 and gave the company an "overweight" rating in a research report on Friday, May 9th. Macquarie reissued a "neutral" rating and issued a $95.00 price target on shares of Planet Fitness in a report on Tuesday, May 13th. Canaccord Genuity Group set a $126.00 price target on shares of Planet Fitness and gave the stock a "buy" rating in a report on Thursday, June 12th. Raymond James Financial reaffirmed a "strong-buy" rating on shares of Planet Fitness in a report on Thursday, August 7th. Finally, Stifel Nicolaus set a $120.00 target price on shares of Planet Fitness and gave the company a "buy" rating in a report on Thursday, May 22nd. Three investment analysts have rated the stock with a hold rating, twelve have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Planet Fitness currently has an average rating of "Moderate Buy" and an average price target of $107.38.

View Our Latest Report on PLNT

Planet Fitness Stock Performance

PLNT traded up $1.07 during midday trading on Friday, reaching $106.94. The company had a trading volume of 973,395 shares, compared to its average volume of 1,525,490. The stock has a market cap of $9.00 billion, a PE ratio of 47.53, a P/E/G ratio of 2.37 and a beta of 1.40. Planet Fitness has a 12-month low of $77.77 and a 12-month high of $114.47. The business has a 50-day moving average price of $107.74 and a two-hundred day moving average price of $101.87.

Planet Fitness (NYSE:PLNT - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $0.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.79 by $0.07. Planet Fitness had a net margin of 15.11% and a negative return on equity of 110.18%. The firm had revenue of $340.88 million during the quarter, compared to analysts' expectations of $329.59 million. During the same period last year, the company earned $0.71 earnings per share. The business's revenue was up 13.3% on a year-over-year basis.

Institutional Investors Weigh In On Planet Fitness

Several institutional investors and hedge funds have recently modified their holdings of PLNT. Game Plan Financial Advisors LLC purchased a new stake in shares of Planet Fitness in the 2nd quarter worth about $25,000. Hantz Financial Services Inc. lifted its position in shares of Planet Fitness by 964.0% in the 2nd quarter. Hantz Financial Services Inc. now owns 266 shares of the company's stock worth $29,000 after purchasing an additional 241 shares during the period. Brooklyn Investment Group lifted its position in shares of Planet Fitness by 57.8% in the 1st quarter. Brooklyn Investment Group now owns 322 shares of the company's stock worth $31,000 after purchasing an additional 118 shares during the period. First Horizon Advisors Inc. lifted its position in shares of Planet Fitness by 187.6% in the 1st quarter. First Horizon Advisors Inc. now owns 371 shares of the company's stock worth $36,000 after purchasing an additional 242 shares during the period. Finally, CoreCap Advisors LLC lifted its position in shares of Planet Fitness by 1,250.0% in the 4th quarter. CoreCap Advisors LLC now owns 486 shares of the company's stock worth $48,000 after purchasing an additional 450 shares during the period. 95.53% of the stock is owned by hedge funds and other institutional investors.

Planet Fitness Company Profile

(

Get Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

Featured Stories

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.