Brookfield (NYSE:BN - Get Free Report) has been assigned a $82.00 target price by stock analysts at National Bankshares in a research note issued to investors on Tuesday,BayStreet.CA reports. The firm currently has an "outperform" rating on the stock. National Bankshares' target price indicates a potential upside of 20.68% from the stock's current price.

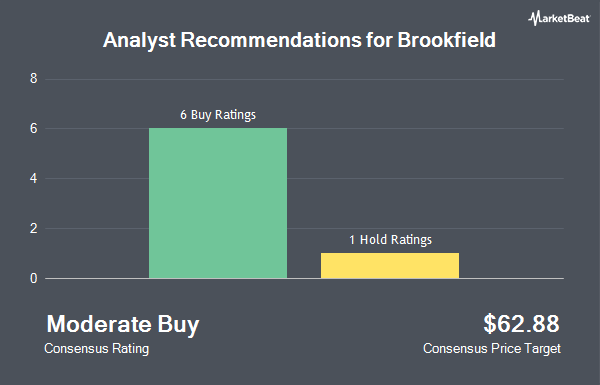

BN has been the subject of a number of other reports. Wall Street Zen lowered Brookfield from a "hold" rating to a "sell" rating in a research report on Saturday, July 12th. Royal Bank Of Canada assumed coverage on Brookfield in a research report on Wednesday, June 18th. They issued an "outperform" rating and a $81.00 price objective for the company. Scotiabank lowered their price objective on Brookfield from $71.00 to $68.00 and set a "sector outperform" rating for the company in a research report on Monday, April 7th. CIBC lowered their price objective on Brookfield from $74.00 to $72.00 and set an "outperformer" rating for the company in a research report on Friday, May 9th. Finally, National Bank Financial assumed coverage on Brookfield in a research report on Tuesday. They issued an "outperform" rating and a $82.00 price objective for the company. One equities research analyst has rated the stock with a sell rating, one has issued a hold rating and eight have assigned a buy rating to the company's stock. According to data from MarketBeat.com, Brookfield currently has an average rating of "Moderate Buy" and an average price target of $69.30.

Check Out Our Latest Stock Report on BN

Brookfield Price Performance

Shares of Brookfield stock traded up $0.40 during trading on Tuesday, reaching $67.95. The company's stock had a trading volume of 1,243,233 shares, compared to its average volume of 2,638,653. The stock has a 50-day moving average price of $61.27 and a two-hundred day moving average price of $57.24. The company has a current ratio of 1.30, a quick ratio of 1.18 and a debt-to-equity ratio of 1.49. Brookfield has a one year low of $42.21 and a one year high of $68.75. The stock has a market capitalization of $112.03 billion, a P/E ratio of 242.54 and a beta of 1.66.

Brookfield (NYSE:BN - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The company reported $0.98 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.90 by $0.08. Brookfield had a return on equity of 4.20% and a net margin of 0.76%. The business had revenue of $1.37 billion during the quarter, compared to analysts' expectations of $1.36 billion. As a group, sell-side analysts anticipate that Brookfield will post 3.85 EPS for the current fiscal year.

Hedge Funds Weigh In On Brookfield

Several institutional investors have recently modified their holdings of the stock. Loring Wolcott & Coolidge Fiduciary Advisors LLP MA acquired a new position in shares of Brookfield in the 1st quarter valued at approximately $26,000. North Capital Inc. acquired a new position in shares of Brookfield in the 1st quarter valued at approximately $27,000. ST Germain D J Co. Inc. acquired a new position in shares of Brookfield in the 1st quarter valued at approximately $28,000. CoreCap Advisors LLC acquired a new position in shares of Brookfield in the 4th quarter valued at approximately $29,000. Finally, Hilltop National Bank acquired a new position in shares of Brookfield in the 2nd quarter valued at approximately $30,000. 61.60% of the stock is currently owned by institutional investors and hedge funds.

Brookfield Company Profile

(

Get Free Report)

Brookfield Corporation is an alternative asset manager and REIT/Real Estate Investment Manager firm focuses on real estate, renewable power, infrastructure and venture capital and private equity assets. It manages a range of public and private investment products and services for institutional and retail clients.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Brookfield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brookfield wasn't on the list.

While Brookfield currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.