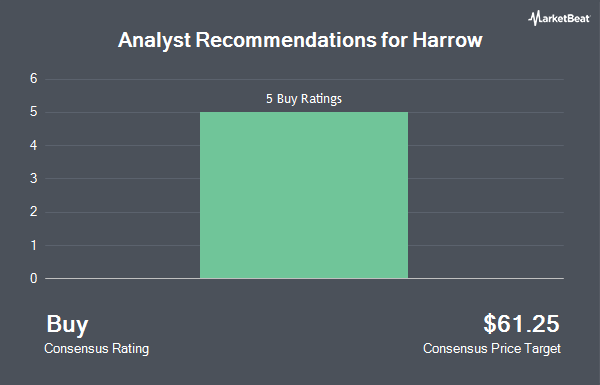

Harrow (NASDAQ:HROW - Get Free Report) had its price target raised by stock analysts at BTIG Research from $62.00 to $63.00 in a report issued on Thursday, Marketbeat reports. The brokerage currently has a "buy" rating on the stock. BTIG Research's price target would suggest a potential upside of 66.65% from the company's previous close.

Other equities research analysts also recently issued research reports about the company. William Blair began coverage on Harrow in a report on Tuesday, June 10th. They issued an "outperform" rating on the stock. HC Wainwright raised their target price on Harrow from $60.00 to $64.00 and gave the company a "buy" rating in a report on Wednesday, August 13th. Finally, Cantor Fitzgerald began coverage on Harrow in a report on Friday, July 11th. They issued an "overweight" rating and a $76.00 target price on the stock. One analyst has rated the stock with a Strong Buy rating and seven have assigned a Buy rating to the company's stock. According to MarketBeat.com, Harrow presently has a consensus rating of "Buy" and an average price target of $64.67.

View Our Latest Stock Analysis on HROW

Harrow Price Performance

NASDAQ:HROW traded down $0.5170 during trading hours on Thursday, reaching $37.8030. 375,749 shares of the company were exchanged, compared to its average volume of 482,060. The company has a market capitalization of $1.40 billion, a P/E ratio of -151.21 and a beta of 0.41. Harrow has a 1-year low of $20.85 and a 1-year high of $59.23. The company has a debt-to-equity ratio of 0.78, a current ratio of 0.62 and a quick ratio of 0.58. The business has a 50 day moving average of $33.34 and a 200 day moving average of $28.92.

Harrow (NASDAQ:HROW - Get Free Report) last issued its quarterly earnings results on Monday, August 11th. The company reported $0.24 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.01 by $0.23. The business had revenue of $63.74 million for the quarter, compared to the consensus estimate of $64.23 million. Harrow had a negative return on equity of 2.18% and a negative net margin of 4.49%. Harrow has set its FY 2025 guidance at EPS. Research analysts forecast that Harrow will post -0.53 EPS for the current year.

Institutional Investors Weigh In On Harrow

Hedge funds have recently modified their holdings of the company. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its holdings in shares of Harrow by 89.5% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 61,940 shares of the company's stock valued at $2,078,000 after acquiring an additional 29,262 shares in the last quarter. GAMMA Investing LLC lifted its holdings in Harrow by 2,401.2% during the 1st quarter. GAMMA Investing LLC now owns 6,278 shares of the company's stock worth $1,670,000 after buying an additional 6,027 shares during the period. Northern Trust Corp lifted its holdings in Harrow by 7.5% during the 4th quarter. Northern Trust Corp now owns 319,084 shares of the company's stock worth $10,705,000 after buying an additional 22,266 shares during the period. Tower Research Capital LLC TRC lifted its holdings in Harrow by 769.5% during the 4th quarter. Tower Research Capital LLC TRC now owns 1,652 shares of the company's stock worth $55,000 after buying an additional 1,462 shares during the period. Finally, Price T Rowe Associates Inc. MD lifted its holdings in Harrow by 8.1% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 19,076 shares of the company's stock worth $640,000 after buying an additional 1,428 shares during the period. Institutional investors and hedge funds own 72.76% of the company's stock.

About Harrow

(

Get Free Report)

Harrow, Inc operates as an ophthalmic-focused healthcare company. The company owns ImprimisRx, an ophthalmology outsourcing and pharmaceutical compounding business. The company was formerly known as Imprimis Pharmaceuticals, Inc and changed its name to Harrow Health, Inc in December 2018. Harrow Health, Inc was incorporated in 2006 and is headquartered in Nashville, Tennessee.

Featured Articles

Before you consider Harrow, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Harrow wasn't on the list.

While Harrow currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

We are about to experience the greatest A.I. boom in stock market history...

Thanks to a pivotal economic catalyst, specific tech stocks will skyrocket just like they did during the "dot com" boom in the 1990s.

That’s why, we’ve hand-selected 7 tiny tech disruptor stocks positioned to surge.

- The first pick is a tiny under-the-radar A.I. stock that's trading for just $3.00. This company already has 98 registered patents for cutting-edge voice and sound recognition technology... And has lined up major partnerships with some of the biggest names in the auto, tech, and music industry... plus many more.

- The second pick presents an affordable avenue to bolster EVs and AI development…. Analysts are calling this stock a “buy” right now and predict a high price target of $19.20, substantially more than its current $6 trading price.

- Our final and favorite pick is generating a brand-new kind of AI. It's believed this tech will be bigger than the current well-known leader in this industry… Analysts predict this innovative tech is gearing up to create a tidal wave of new wealth, fueling a $15.7 TRILLION market boom.

Right now, we’re staring down the barrel of a true once-in-a-lifetime moment. As an investment opportunity, this kind of breakthrough doesn't come along every day.

And the window to get in on the ground-floor — maximizing profit potential from this expected market surge — is closing quickly...

Simply enter your email below to get the names and tickers of the 7 small stocks with potential to make investors very, very happy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.