Bumble (NASDAQ:BMBL - Get Free Report) is expected to issue its Q2 2025 quarterly earnings data after the market closes on Wednesday, August 6th. Analysts expect the company to announce earnings of $0.36 per share and revenue of $243.72 million for the quarter. Bumble has set its Q2 2025 guidance at EPS.

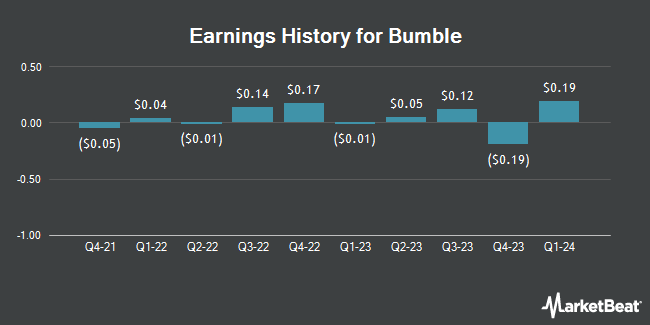

Bumble (NASDAQ:BMBL - Get Free Report) last posted its earnings results on Wednesday, May 7th. The company reported $0.13 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.16 by ($0.03). Bumble had a negative net margin of 54.06% and a positive return on equity of 5.81%. The firm had revenue of $247.10 million during the quarter, compared to the consensus estimate of $246.68 million. During the same quarter last year, the firm posted $0.19 EPS. The business's revenue was down 7.7% on a year-over-year basis. On average, analysts expect Bumble to post $4 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Bumble Price Performance

Shares of NASDAQ:BMBL traded down $0.19 during trading on Friday, reaching $7.59. The stock had a trading volume of 3,084,165 shares, compared to its average volume of 2,560,335. Bumble has a 52 week low of $3.55 and a 52 week high of $9.22. The business's 50-day moving average price is $6.30 and its 200 day moving average price is $5.88. The company has a debt-to-equity ratio of 0.75, a current ratio of 2.83 and a quick ratio of 2.83. The stock has a market capitalization of $783.97 million, a PE ratio of -1.55, a P/E/G ratio of 0.26 and a beta of 1.96.

Wall Street Analyst Weigh In

BMBL has been the topic of several research analyst reports. The Goldman Sachs Group increased their price target on shares of Bumble from $8.00 to $9.00 and gave the company a "buy" rating in a research note on Thursday, May 8th. Wells Fargo & Company reissued a "positive" rating on shares of Bumble in a research note on Friday, June 27th. UBS Group increased their price target on shares of Bumble from $6.00 to $7.50 and gave the company a "neutral" rating in a research note on Wednesday, July 23rd. Citigroup increased their price target on shares of Bumble from $4.80 to $7.00 and gave the company a "neutral" rating in a research note on Friday, June 27th. Finally, Stifel Nicolaus decreased their price target on shares of Bumble from $6.00 to $4.00 and set a "hold" rating on the stock in a research note on Wednesday, April 23rd. Two analysts have rated the stock with a sell rating, fourteen have assigned a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat, Bumble has a consensus rating of "Hold" and a consensus price target of $6.60.

Check Out Our Latest Analysis on Bumble

Hedge Funds Weigh In On Bumble

A hedge fund recently raised its stake in Bumble stock. Royal Bank of Canada grew its position in Bumble Inc. (NASDAQ:BMBL - Free Report) by 409.3% during the 1st quarter, according to the company in its most recent disclosure with the SEC. The firm owned 325,121 shares of the company's stock after purchasing an additional 261,281 shares during the period. Royal Bank of Canada owned about 0.31% of Bumble worth $1,410,000 at the end of the most recent reporting period. Institutional investors and hedge funds own 94.85% of the company's stock.

About Bumble

(

Get Free Report)

Bumble Inc provides online dating and social networking platforms in North America, Europe, internationally. It owns and operates websites and applications that offers subscription and in-app purchases dating products. The company operates apps, including Bumble, a dating app built with women at the center, where women make the first move; Badoo, the web and mobile free-to-use dating app; Official app where users connect their profile with that of their partner enabling a shared, linked product experience; Bumble BFF and Bumble Bizz Modes that have a format similar to the date mode requiring users to set up profiles and matching users through yes and no votes, similar to the dating platform; and Bumble for Friends, a friendship app where people in all stages of life can meet people nearby and create meaningful platonic connections, as well as Fruitz app is centered around encouraging honesty and transparency by sharing dating intentions from the first touch point.

See Also

Before you consider Bumble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bumble wasn't on the list.

While Bumble currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.