Bunzl (LON:BNZL - Get Free Report)'s stock had its "underperform" rating reissued by Jefferies Financial Group in a report released on Thursday, Marketbeat Ratings reports. They presently have a GBX 1,900 target price on the stock. Jefferies Financial Group's price objective would suggest a potential downside of 21.75% from the stock's previous close.

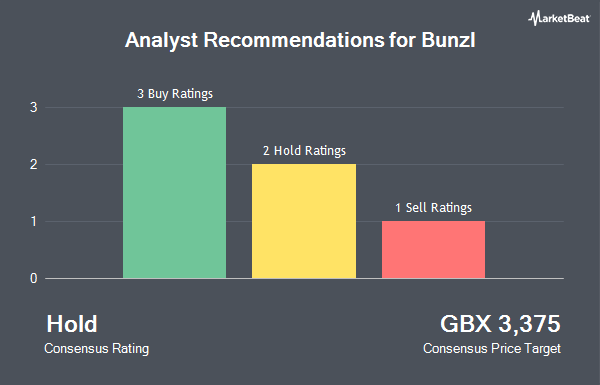

Other analysts have also issued reports about the stock. Royal Bank Of Canada reiterated a "sector perform" rating and issued a GBX 2,350 price target on shares of Bunzl in a research report on Thursday. UBS Group reiterated a "sell" rating and issued a GBX 2,200 price target on shares of Bunzl in a research report on Friday, August 15th. Finally, Shore Capital reiterated a "buy" rating and issued a GBX 3,040 price target on shares of Bunzl in a research report on Tuesday, August 26th. Three research analysts have rated the stock with a Buy rating, one has issued a Hold rating and two have given a Sell rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of GBX 2,728.

Check Out Our Latest Report on BNZL

Bunzl Trading Down 0.4%

Shares of BNZL opened at GBX 2,428 on Thursday. The company has a current ratio of 1.15, a quick ratio of 0.73 and a debt-to-equity ratio of 123.00. The firm's 50-day moving average is GBX 2,400.61 and its two-hundred day moving average is GBX 2,447.68. Bunzl has a twelve month low of GBX 2,210 and a twelve month high of GBX 3,634. The firm has a market capitalization of £7.85 billion, a P/E ratio of 1,669.88, a PEG ratio of 5.40 and a beta of 0.45.

Bunzl (LON:BNZL - Get Free Report) last issued its earnings results on Tuesday, August 26th. The company reported GBX 77.80 earnings per share for the quarter. Bunzl had a net margin of 4.20% and a return on equity of 16.82%. On average, research analysts predict that Bunzl will post 213.3413462 earnings per share for the current fiscal year.

About Bunzl

(

Get Free Report)

Bunzl plc operates as a distribution and services company in the North America, Continental Europe, the United Kingdom, Ireland, and internationally. The company offers food packaging, films, labels, cleaning and hygiene supplies, and personal protection equipment to grocery stores, supermarkets, and convenience stores.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bunzl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunzl wasn't on the list.

While Bunzl currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.