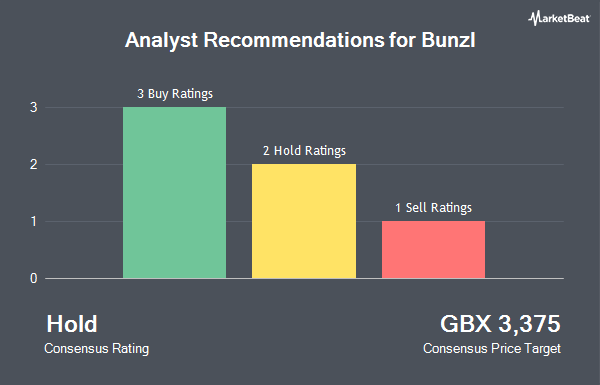

Bunzl plc (LON:BNZL - Get Free Report) has been given an average rating of "Hold" by the six ratings firms that are currently covering the firm, MarketBeat Ratings reports. Two analysts have rated the stock with a sell rating, one has issued a hold rating and three have issued a buy rating on the company. The average 12-month price target among analysts that have issued ratings on the stock in the last year is GBX 2,908.

BNZL has been the subject of a number of recent analyst reports. Shore Capital reaffirmed a "buy" rating and set a GBX 3,040 price target on shares of Bunzl in a report on Tuesday, August 26th. Royal Bank Of Canada reissued a "sector perform" rating and issued a GBX 2,350 target price on shares of Bunzl in a research note on Tuesday, August 26th. Finally, UBS Group reissued a "sell" rating and issued a GBX 2,200 target price on shares of Bunzl in a research note on Friday, August 15th.

View Our Latest Research Report on BNZL

Insider Activity

In related news, insider Peter Ventress acquired 4,172 shares of the firm's stock in a transaction that occurred on Tuesday, June 24th. The stock was acquired at an average cost of GBX 2,385 per share, with a total value of £99,502.20. Also, insider Richard Howes acquired 4,471 shares of the firm's stock in a transaction that occurred on Wednesday, June 18th. The shares were bought at an average cost of GBX 2,219 per share, with a total value of £99,211.49. In the last ninety days, insiders bought 15,132 shares of company stock valued at $34,939,160. Company insiders own 0.38% of the company's stock.

Bunzl Price Performance

BNZL stock traded down GBX 30 during midday trading on Tuesday, reaching GBX 2,496. 1,068,862 shares of the company's stock traded hands, compared to its average volume of 2,319,304. The company has a 50-day simple moving average of GBX 2,360.89 and a two-hundred day simple moving average of GBX 2,527.23. Bunzl has a 1-year low of GBX 2,210 and a 1-year high of GBX 3,732. The company has a market cap of £8.11 billion, a price-to-earnings ratio of 1,716.64, a PEG ratio of 5.40 and a beta of 0.45. The company has a quick ratio of 0.73, a current ratio of 1.15 and a debt-to-equity ratio of 123.00.

Bunzl (LON:BNZL - Get Free Report) last released its quarterly earnings results on Tuesday, August 26th. The company reported GBX 77.80 earnings per share for the quarter. Bunzl had a return on equity of 16.82% and a net margin of 4.20%. On average, analysts anticipate that Bunzl will post 213.3413462 earnings per share for the current year.

Bunzl Company Profile

(

Get Free Report)

Bunzl plc operates as a distribution and services company in the North America, Continental Europe, the United Kingdom, Ireland, and internationally. The company offers food packaging, films, labels, cleaning and hygiene supplies, and personal protection equipment to grocery stores, supermarkets, and convenience stores.

Featured Articles

Before you consider Bunzl, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunzl wasn't on the list.

While Bunzl currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.