C4 Therapeutics (NASDAQ:CCCC - Get Free Report)'s stock had its "overweight" rating reiterated by equities researchers at Stephens in a note issued to investors on Monday,Benzinga reports. They currently have a $6.00 price objective on the stock. Stephens' price target would suggest a potential upside of 129.89% from the company's current price.

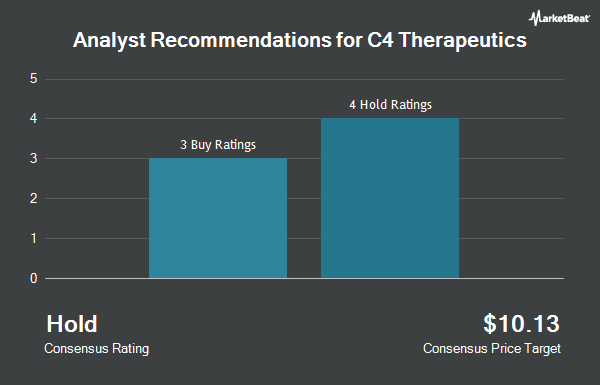

Several other brokerages also recently weighed in on CCCC. Barclays restated an "overweight" rating and set a $10.00 target price on shares of C4 Therapeutics in a research note on Monday. Zacks Research downgraded C4 Therapeutics from a "strong-buy" rating to a "hold" rating in a report on Friday, August 22nd. Guggenheim started coverage on C4 Therapeutics in a research report on Wednesday, September 3rd. They issued a "buy" rating and a $8.00 target price for the company. Finally, Wall Street Zen cut shares of C4 Therapeutics from a "hold" rating to a "sell" rating in a report on Saturday, August 9th. Four research analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the company. Based on data from MarketBeat, C4 Therapeutics has a consensus rating of "Moderate Buy" and a consensus target price of $9.00.

View Our Latest Stock Report on CCCC

C4 Therapeutics Stock Down 17.4%

Shares of NASDAQ:CCCC traded down $0.55 during trading on Monday, hitting $2.61. 3,996,068 shares of the stock traded hands, compared to its average volume of 1,285,280. C4 Therapeutics has a 52-week low of $1.09 and a 52-week high of $7.14. The company has a fifty day moving average price of $2.52 and a two-hundred day moving average price of $1.91. The company has a market cap of $185.75 million, a price-to-earnings ratio of -1.65 and a beta of 2.98.

C4 Therapeutics (NASDAQ:CCCC - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The company reported ($0.37) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.38) by $0.01. C4 Therapeutics had a negative return on equity of 53.91% and a negative net margin of 325.88%.The firm had revenue of $6.46 million during the quarter, compared to the consensus estimate of $5.24 million. On average, equities research analysts predict that C4 Therapeutics will post -1.52 EPS for the current fiscal year.

Institutional Investors Weigh In On C4 Therapeutics

Large investors have recently added to or reduced their stakes in the business. Tower Research Capital LLC TRC raised its holdings in C4 Therapeutics by 458.0% in the second quarter. Tower Research Capital LLC TRC now owns 40,592 shares of the company's stock valued at $58,000 after buying an additional 33,317 shares during the period. Wasatch Advisors LP grew its stake in C4 Therapeutics by 10.4% during the 2nd quarter. Wasatch Advisors LP now owns 7,424,662 shares of the company's stock valued at $10,617,000 after acquiring an additional 700,253 shares in the last quarter. BNP Paribas Financial Markets lifted its holdings in shares of C4 Therapeutics by 1,039.4% during the 2nd quarter. BNP Paribas Financial Markets now owns 206,177 shares of the company's stock valued at $295,000 after buying an additional 188,081 shares during the last quarter. Bank of America Corp DE grew its holdings in C4 Therapeutics by 0.9% during the second quarter. Bank of America Corp DE now owns 2,008,004 shares of the company's stock valued at $2,871,000 after purchasing an additional 17,180 shares during the last quarter. Finally, Jane Street Group LLC raised its position in shares of C4 Therapeutics by 3,816.8% in the second quarter. Jane Street Group LLC now owns 492,612 shares of the company's stock valued at $704,000 after purchasing an additional 480,035 shares during the period. 78.81% of the stock is owned by institutional investors and hedge funds.

About C4 Therapeutics

(

Get Free Report)

C4 Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops novel therapeutic candidates to degrade disease-causing proteins for the treatment of cancer, neurodegenerative conditions, and other diseases. Its lead product candidate is CFT7455, an orally bioavailable MonoDAC degrader of protein that is in Phase 1/2 trial targeting IKZF1 and IKZF3 for multiple myeloma and non-Hodgkin lymphomas, including peripheral T-cell lymphoma and mantle cell lymphoma, currently under Phase 1/2 clinical trials.

Featured Stories

Before you consider C4 Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C4 Therapeutics wasn't on the list.

While C4 Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.