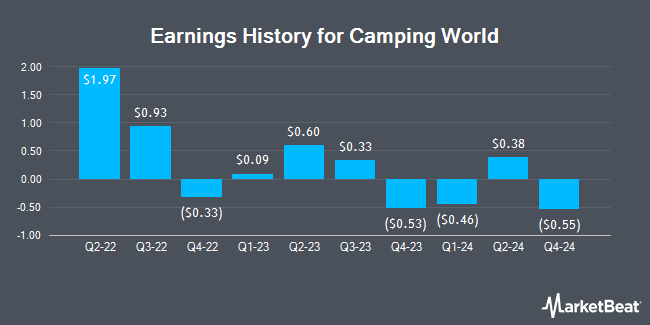

Camping World (NYSE:CWH - Get Free Report) announced its earnings results on Tuesday. The company reported $0.57 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.58 by ($0.01), Briefing.com reports. The company had revenue of $1.98 billion for the quarter, compared to the consensus estimate of $1.87 billion. Camping World had a negative return on equity of 2.81% and a negative net margin of 0.13%. The firm's revenue for the quarter was up 9.4% on a year-over-year basis. During the same period in the prior year, the business earned $0.38 earnings per share.

Camping World Stock Up 0.5%

CWH stock traded up $0.07 during trading on Friday, reaching $13.91. 3,711,593 shares of the stock were exchanged, compared to its average volume of 2,118,836. The firm's 50 day moving average is $17.69 and its 200 day moving average is $17.66. The firm has a market cap of $1.42 billion, a P/E ratio of -69.55 and a beta of 1.76. The company has a current ratio of 1.26, a quick ratio of 0.19 and a debt-to-equity ratio of 3.12. Camping World has a twelve month low of $11.17 and a twelve month high of $25.97.

Camping World Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, June 27th. Investors of record on Friday, June 13th were given a $0.125 dividend. This represents a $0.50 dividend on an annualized basis and a yield of 3.6%. The ex-dividend date of this dividend was Friday, June 13th. Camping World's payout ratio is presently -250.00%.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on the company. JPMorgan Chase & Co. raised Camping World from a "neutral" rating to an "overweight" rating and cut their price objective for the stock from $23.00 to $21.00 in a research note on Thursday, May 1st. Truist Financial boosted their price target on shares of Camping World from $16.00 to $20.00 and gave the stock a "buy" rating in a research report on Tuesday, June 3rd. Robert W. Baird reduced their price objective on shares of Camping World from $18.00 to $15.00 and set a "neutral" rating on the stock in a research note on Thursday, May 1st. Baird R W downgraded shares of Camping World from a "strong-buy" rating to a "hold" rating in a research note on Friday, April 4th. Finally, KeyCorp reaffirmed an "overweight" rating and set a $18.00 price target (up previously from $16.00) on shares of Camping World in a research report on Friday, May 23rd. Three research analysts have rated the stock with a hold rating and eight have given a buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $21.44.

Check Out Our Latest Stock Report on CWH

Institutional Investors Weigh In On Camping World

Hedge funds have recently added to or reduced their stakes in the company. AQR Capital Management LLC bought a new position in shares of Camping World in the 1st quarter worth $1,787,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Camping World by 4.4% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 33,339 shares of the company's stock worth $539,000 after buying an additional 1,401 shares during the last quarter. Goldman Sachs Group Inc. lifted its stake in shares of Camping World by 66.2% in the first quarter. Goldman Sachs Group Inc. now owns 889,377 shares of the company's stock valued at $14,372,000 after buying an additional 354,333 shares in the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC grew its holdings in shares of Camping World by 17.4% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 119,259 shares of the company's stock valued at $1,927,000 after buying an additional 17,665 shares during the last quarter. Institutional investors and hedge funds own 52.54% of the company's stock.

Camping World Company Profile

(

Get Free Report)

Camping World Holdings, Inc, together its subsidiaries, retails recreational vehicles (RVs), and related products and services in the United States. It operates in two segments, Good Sam Services and Plans; and RV and Outdoor Retail. The company provides a portfolio of services, protection plans, products, and resources in the RV industry.

Further Reading

Before you consider Camping World, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Camping World wasn't on the list.

While Camping World currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.