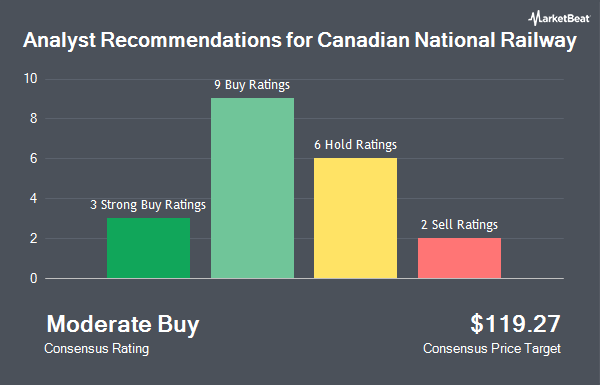

Shares of Canadian National Railway Company (NYSE:CNI - Get Free Report) TSE: CNR have been assigned a consensus recommendation of "Hold" from the twenty research firms that are presently covering the company, Marketbeat Ratings reports. Two analysts have rated the stock with a sell recommendation, nine have issued a hold recommendation, seven have assigned a buy recommendation and two have issued a strong buy recommendation on the company. The average 1-year price objective among brokerages that have updated their coverage on the stock in the last year is $118.3575.

CNI has been the subject of several analyst reports. Wells Fargo & Company decreased their price target on shares of Canadian National Railway from $120.00 to $117.00 and set an "overweight" rating for the company in a research report on Wednesday, July 23rd. Evercore ISI cut shares of Canadian National Railway from an "outperform" rating to an "in-line" rating and set a $105.00 target price for the company. in a research report on Wednesday, July 23rd. Wall Street Zen raised shares of Canadian National Railway from a "sell" rating to a "hold" rating in a report on Friday, May 30th. JPMorgan Chase & Co. reiterated a "neutral" rating on shares of Canadian National Railway in a report on Wednesday, July 23rd. Finally, Citigroup lowered their price objective on Canadian National Railway from $124.00 to $123.00 and set a "buy" rating for the company in a research report on Wednesday, July 9th.

Get Our Latest Stock Analysis on Canadian National Railway

Canadian National Railway Price Performance

NYSE:CNI traded down $0.82 during trading hours on Friday, reaching $92.42. The stock had a trading volume of 1,591,105 shares, compared to its average volume of 1,820,000. Canadian National Railway has a 52 week low of $91.65 and a 52 week high of $121.12. The stock has a market capitalization of $57.70 billion, a PE ratio of 17.77, a PEG ratio of 2.14 and a beta of 0.94. The company has a 50 day moving average price of $97.19 and a two-hundred day moving average price of $99.62. The company has a debt-to-equity ratio of 0.90, a quick ratio of 0.58 and a current ratio of 0.82.

Canadian National Railway (NYSE:CNI - Get Free Report) TSE: CNR last released its earnings results on Tuesday, July 22nd. The transportation company reported $1.35 EPS for the quarter, missing analysts' consensus estimates of $1.37 by ($0.02). The business had revenue of $3.14 billion for the quarter, compared to the consensus estimate of $4.34 billion. Canadian National Railway had a net margin of 26.63% and a return on equity of 21.71%. The company's quarterly revenue was down 1.3% compared to the same quarter last year. During the same period in the prior year, the company posted $1.84 EPS. As a group, sell-side analysts anticipate that Canadian National Railway will post 5.52 earnings per share for the current fiscal year.

Canadian National Railway Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Stockholders of record on Monday, September 8th will be issued a dividend of $0.6507 per share. This represents a $2.60 annualized dividend and a dividend yield of 2.8%. This is an increase from Canadian National Railway's previous quarterly dividend of $0.62. The ex-dividend date is Monday, September 8th. Canadian National Railway's dividend payout ratio is currently 50.19%.

Institutional Trading of Canadian National Railway

Several large investors have recently bought and sold shares of the stock. Troy Asset Management Ltd boosted its holdings in shares of Canadian National Railway by 0.3% in the 2nd quarter. Troy Asset Management Ltd now owns 1,058,149 shares of the transportation company's stock valued at $110,090,000 after acquiring an additional 3,060 shares during the last quarter. Osaic Holdings Inc. boosted its holdings in Canadian National Railway by 5.0% in the second quarter. Osaic Holdings Inc. now owns 31,334 shares of the transportation company's stock valued at $3,256,000 after purchasing an additional 1,482 shares during the last quarter. Orion Porfolio Solutions LLC grew its position in Canadian National Railway by 19.0% during the 2nd quarter. Orion Porfolio Solutions LLC now owns 15,469 shares of the transportation company's stock worth $1,609,000 after purchasing an additional 2,469 shares during the period. Monarch Capital Management Inc. lifted its holdings in shares of Canadian National Railway by 9.9% in the 2nd quarter. Monarch Capital Management Inc. now owns 3,537 shares of the transportation company's stock valued at $369,000 after buying an additional 320 shares during the period. Finally, State of Wyoming boosted its stake in shares of Canadian National Railway by 61.9% in the second quarter. State of Wyoming now owns 10,956 shares of the transportation company's stock worth $1,140,000 after buying an additional 4,187 shares during the last quarter. Hedge funds and other institutional investors own 80.74% of the company's stock.

Canadian National Railway Company Profile

(

Get Free Report)

Canadian National Railway Company, together with its subsidiaries, engages in the rail, intermodal, trucking, and marine transportation and logistics business in Canada and the United States. The company provides rail services, which include equipment, custom brokerage services, transloading and distribution, business development and real estate, and private car storage services; and intermodal services, such as temperature controlled cargo, port partnerships, and logistics parks.

Featured Articles

Before you consider Canadian National Railway, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian National Railway wasn't on the list.

While Canadian National Railway currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.