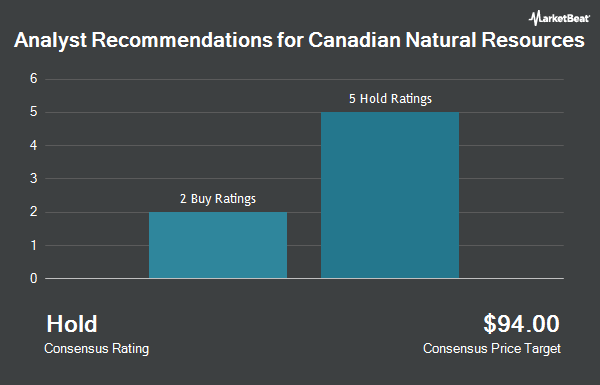

Shares of Canadian Natural Resources Limited (NYSE:CNQ - Get Free Report) TSE: CNQ have been assigned an average rating of "Moderate Buy" from the six analysts that are currently covering the stock, MarketBeat.com reports. Two equities research analysts have rated the stock with a hold recommendation and four have assigned a buy recommendation to the company. The average 1-year target price among brokers that have updated their coverage on the stock in the last year is $63.00.

A number of research analysts have recently weighed in on CNQ shares. Scotiabank upgraded shares of Canadian Natural Resources from a "sector perform" rating to a "sector outperform" rating in a report on Wednesday, March 19th. Evercore ISI raised Canadian Natural Resources from an "in-line" rating to an "outperform" rating in a research report on Friday, March 7th. Tudor Pickering lowered Canadian Natural Resources from a "strong-buy" rating to a "hold" rating in a report on Monday, February 10th. Raymond James upgraded Canadian Natural Resources from a "market perform" rating to an "outperform" rating in a report on Wednesday, April 9th. Finally, Royal Bank of Canada reiterated an "outperform" rating and set a $63.00 price target on shares of Canadian Natural Resources in a report on Thursday, March 27th.

View Our Latest Research Report on CNQ

Canadian Natural Resources Stock Up 0.2 %

CNQ traded up $0.07 during midday trading on Tuesday, hitting $28.99. 4,351,372 shares of the company's stock traded hands, compared to its average volume of 5,377,907. The company has a debt-to-equity ratio of 0.21, a current ratio of 0.84 and a quick ratio of 0.53. The company has a market cap of $60.81 billion, a PE ratio of 11.26 and a beta of 1.10. The stock's fifty day simple moving average is $28.84 and its 200-day simple moving average is $31.00. Canadian Natural Resources has a one year low of $24.65 and a one year high of $39.20.

Canadian Natural Resources Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Friday, April 4th. Investors of record on Friday, March 21st were given a dividend of $0.4117 per share. This represents a $1.65 annualized dividend and a dividend yield of 5.68%. The ex-dividend date was Friday, March 21st. This is a boost from Canadian Natural Resources's previous quarterly dividend of $0.39. Canadian Natural Resources's payout ratio is currently 77.88%.

Institutional Trading of Canadian Natural Resources

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Duncker Streett & Co. Inc. bought a new stake in shares of Canadian Natural Resources in the fourth quarter valued at approximately $25,000. Lee Danner & Bass Inc. acquired a new position in Canadian Natural Resources during the 4th quarter valued at $25,000. Hurley Capital LLC bought a new stake in Canadian Natural Resources in the 4th quarter valued at $31,000. Sandy Spring Bank acquired a new stake in Canadian Natural Resources in the 4th quarter worth $31,000. Finally, CoreFirst Bank & Trust bought a new position in shares of Canadian Natural Resources during the 4th quarter worth about $31,000. Institutional investors and hedge funds own 74.03% of the company's stock.

About Canadian Natural Resources

(

Get Free ReportCanadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs). The company offers light and medium crude oil, primary heavy crude oil, Pelican Lake heavy crude oil, bitumen (thermal oil), and synthetic crude oil (SCO).

Featured Stories

Before you consider Canadian Natural Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Natural Resources wasn't on the list.

While Canadian Natural Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.