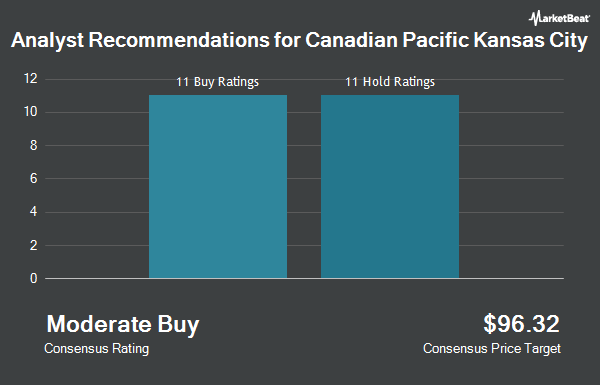

Shares of Canadian Pacific Kansas City Limited (NYSE:CP - Get Free Report) TSE: CP have earned an average rating of "Moderate Buy" from the eighteen ratings firms that are presently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating, twelve have given a buy rating and one has issued a strong buy rating on the company. The average twelve-month target price among analysts that have updated their coverage on the stock in the last year is $91.8750.

A number of equities analysts recently commented on CP shares. Stephens boosted their target price on shares of Canadian Pacific Kansas City from $95.00 to $97.00 and gave the stock an "overweight" rating in a research note on Thursday, July 31st. National Bank Financial raised Canadian Pacific Kansas City from a "hold" rating to a "strong-buy" rating in a report on Wednesday, July 30th. Barclays raised their target price on Canadian Pacific Kansas City from $87.00 to $91.00 and gave the stock an "overweight" rating in a research report on Thursday, July 10th. Scotiabank reiterated an "outperform" rating on shares of Canadian Pacific Kansas City in a research note on Thursday, July 10th. Finally, Wall Street Zen lowered shares of Canadian Pacific Kansas City from a "hold" rating to a "sell" rating in a research note on Saturday, September 13th.

Get Our Latest Analysis on CP

Canadian Pacific Kansas City Stock Performance

Shares of CP opened at $74.26 on Friday. The stock has a 50-day simple moving average of $75.44 and a 200-day simple moving average of $76.31. The stock has a market capitalization of $67.35 billion, a PE ratio of 23.13, a PEG ratio of 2.08 and a beta of 1.06. Canadian Pacific Kansas City has a 1 year low of $66.49 and a 1 year high of $86.56. The company has a debt-to-equity ratio of 0.45, a quick ratio of 0.81 and a current ratio of 0.93.

Canadian Pacific Kansas City (NYSE:CP - Get Free Report) TSE: CP last issued its earnings results on Wednesday, July 30th. The transportation company reported $0.81 earnings per share for the quarter, missing the consensus estimate of $0.82 by ($0.01). Canadian Pacific Kansas City had a net margin of 28.05% and a return on equity of 8.69%. The firm had revenue of $2.72 billion during the quarter, compared to analyst estimates of $2.76 billion. During the same period last year, the business earned $1.05 EPS. The firm's revenue was up 2.7% compared to the same quarter last year. On average, analysts predict that Canadian Pacific Kansas City will post 3.42 earnings per share for the current fiscal year.

Canadian Pacific Kansas City Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Monday, October 27th. Investors of record on Friday, September 26th will be given a $0.1651 dividend. This represents a $0.66 dividend on an annualized basis and a yield of 0.9%. This is a boost from Canadian Pacific Kansas City's previous quarterly dividend of $0.16. The ex-dividend date of this dividend is Friday, September 26th. Canadian Pacific Kansas City's dividend payout ratio is presently 20.56%.

Institutional Trading of Canadian Pacific Kansas City

Hedge funds and other institutional investors have recently made changes to their positions in the company. North Capital Inc. purchased a new position in Canadian Pacific Kansas City during the 1st quarter worth approximately $27,000. Twin Peaks Wealth Advisors LLC purchased a new stake in Canadian Pacific Kansas City in the 2nd quarter valued at $27,000. Cornerstone Planning Group LLC raised its position in Canadian Pacific Kansas City by 209.8% in the 1st quarter. Cornerstone Planning Group LLC now owns 378 shares of the transportation company's stock valued at $28,000 after purchasing an additional 256 shares during the last quarter. Cheviot Value Management LLC purchased a new stake in Canadian Pacific Kansas City in the 1st quarter valued at $30,000. Finally, Hexagon Capital Partners LLC raised its position in Canadian Pacific Kansas City by 49.5% in the 1st quarter. Hexagon Capital Partners LLC now owns 495 shares of the transportation company's stock valued at $35,000 after purchasing an additional 164 shares during the last quarter. Institutional investors and hedge funds own 72.20% of the company's stock.

Canadian Pacific Kansas City Company Profile

(

Get Free Report)

Canadian Pacific Kansas City Limited, together with its subsidiaries, owns and operates a transcontinental freight railway in Canada, the United States, and Mexico. The company transports bulk commodities, including grain, coal, potash, fertilizers, and sulphur; merchandise freight, such as forest products, energy, chemicals and plastics, metals, minerals, consumer products, and automotive; and intermodal traffic comprising retail goods in overseas containers.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Canadian Pacific Kansas City, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canadian Pacific Kansas City wasn't on the list.

While Canadian Pacific Kansas City currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.