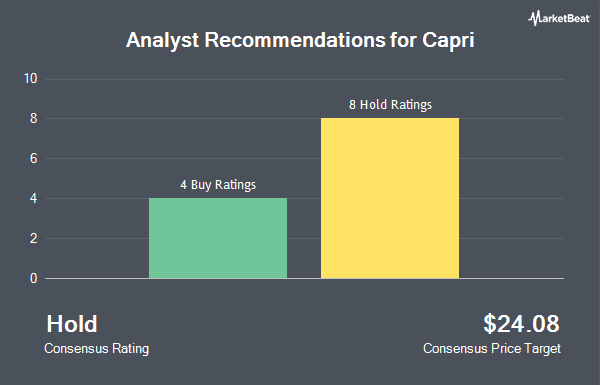

Shares of Capri Holdings Limited (NYSE:CPRI - Get Free Report) have been given a consensus recommendation of "Hold" by the thirteen ratings firms that are currently covering the company, Marketbeat.com reports. Eight analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average twelve-month price objective among analysts that have covered the stock in the last year is $24.0833.

A number of equities analysts have commented on the stock. UBS Group boosted their price objective on shares of Capri from $18.00 to $23.00 and gave the stock a "neutral" rating in a report on Thursday, August 7th. Wall Street Zen raised shares of Capri from a "sell" rating to a "hold" rating in a research report on Saturday, August 9th. Telsey Advisory Group reissued a "market perform" rating and issued a $22.00 target price (up previously from $20.00) on shares of Capri in a research report on Wednesday, August 6th. Zacks Research raised shares of Capri from a "strong sell" rating to a "hold" rating in a research report on Tuesday, August 26th. Finally, JPMorgan Chase & Co. raised shares of Capri from a "neutral" rating to an "overweight" rating and boosted their price objective for the company from $21.00 to $30.00 in a research report on Wednesday, August 13th.

Read Our Latest Stock Analysis on Capri

Institutional Investors Weigh In On Capri

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Farther Finance Advisors LLC lifted its stake in Capri by 758.1% during the first quarter. Farther Finance Advisors LLC now owns 1,433 shares of the company's stock valued at $28,000 after purchasing an additional 1,266 shares during the last quarter. Banque Cantonale Vaudoise acquired a new position in Capri in the 1st quarter valued at $29,000. Mirae Asset Global Investments Co. Ltd. acquired a new position in Capri in the 1st quarter valued at $30,000. UMB Bank n.a. grew its stake in Capri by 134.9% in the 1st quarter. UMB Bank n.a. now owns 1,776 shares of the company's stock valued at $35,000 after buying an additional 1,020 shares during the last quarter. Finally, Quantbot Technologies LP bought a new stake in Capri in the 2nd quarter valued at $39,000. Institutional investors own 84.34% of the company's stock.

Capri Trading Down 1.1%

Shares of CPRI opened at $20.23 on Thursday. The stock's 50-day moving average is $20.37 and its two-hundred day moving average is $18.41. The stock has a market cap of $2.41 billion, a PE ratio of -2.15, a P/E/G ratio of 0.44 and a beta of 1.75. Capri has a 12 month low of $11.86 and a 12 month high of $43.34. The company has a debt-to-equity ratio of 3.97, a current ratio of 1.17 and a quick ratio of 0.61.

Capri (NYSE:CPRI - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $0.50 EPS for the quarter, topping analysts' consensus estimates of $0.13 by $0.37. The company had revenue of $797.00 million for the quarter, compared to analysts' expectations of $773.18 million. Capri had a negative return on equity of 53.50% and a negative net margin of 26.73%.The firm's quarterly revenue was down 6.0% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.04 earnings per share. Equities analysts forecast that Capri will post 0.98 earnings per share for the current fiscal year.

Capri Company Profile

(

Get Free Report)

Capri Holdings Limited designs, markets, distributes, and retails branded women's and men's apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, and Asia. It operates through three segments: Versace, Jimmy Choo, and Michael Kors. The company offers ready-to-wear, accessories, footwear, handbags, scarves and belts, small leather goods, eyewear, watches, jewelry, fragrances, and home furnishings through a distribution network, including boutiques, department, and specialty stores, as well as through e-commerce sites.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Capri, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capri wasn't on the list.

While Capri currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.