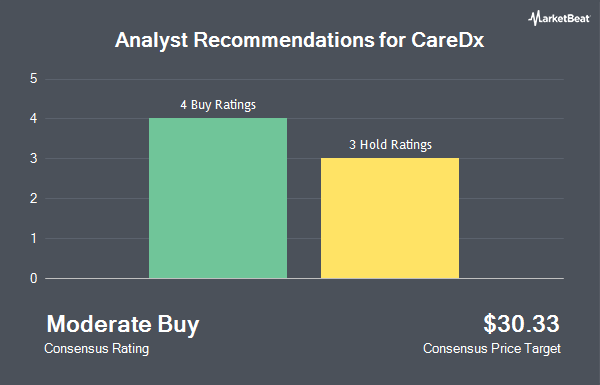

CareDx, Inc. (NASDAQ:CDNA - Get Free Report) has been given a consensus rating of "Hold" by the eight research firms that are covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, three have assigned a hold recommendation and four have given a buy recommendation to the company. The average 12-month price target among analysts that have issued a report on the stock in the last year is $25.50.

A number of equities analysts have commented on CDNA shares. Craig Hallum cut their price target on shares of CareDx from $40.00 to $26.00 and set a "buy" rating for the company in a research note on Friday, July 18th. Wall Street Zen raised shares of CareDx from a "sell" rating to a "hold" rating in a research note on Saturday. Weiss Ratings reissued a "sell (d+)" rating on shares of CareDx in a research note on Saturday, September 27th. Wells Fargo & Company cut their price target on shares of CareDx from $19.00 to $14.00 and set an "equal weight" rating for the company in a research note on Friday, August 8th. Finally, BTIG Research reissued a "buy" rating and issued a $22.00 price target on shares of CareDx in a research note on Tuesday, September 23rd.

Check Out Our Latest Research Report on CareDx

Institutional Investors Weigh In On CareDx

Institutional investors have recently made changes to their positions in the business. MCF Advisors LLC boosted its stake in shares of CareDx by 292.9% in the 2nd quarter. MCF Advisors LLC now owns 1,336 shares of the company's stock valued at $26,000 after purchasing an additional 996 shares in the last quarter. Allworth Financial LP purchased a new stake in shares of CareDx in the 2nd quarter valued at $40,000. PNC Financial Services Group Inc. boosted its stake in shares of CareDx by 20,200.0% in the 1st quarter. PNC Financial Services Group Inc. now owns 4,466 shares of the company's stock valued at $79,000 after purchasing an additional 4,444 shares in the last quarter. Morse Asset Management Inc purchased a new stake in shares of CareDx in the 1st quarter valued at $103,000. Finally, Tower Research Capital LLC TRC boosted its stake in shares of CareDx by 120.6% in the 2nd quarter. Tower Research Capital LLC TRC now owns 7,608 shares of the company's stock valued at $149,000 after purchasing an additional 4,160 shares in the last quarter.

CareDx Trading Down 1.9%

CareDx stock opened at $14.67 on Wednesday. The firm's 50 day simple moving average is $13.45 and its 200 day simple moving average is $16.13. The firm has a market capitalization of $780.88 million, a PE ratio of 14.38 and a beta of 2.37. CareDx has a 1-year low of $10.96 and a 1-year high of $32.65.

CareDx (NASDAQ:CDNA - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The company reported ($0.16) EPS for the quarter, missing analysts' consensus estimates of $0.12 by ($0.28). CareDx had a return on equity of 18.03% and a net margin of 17.97%.The company had revenue of $90.51 million during the quarter, compared to analysts' expectations of $90.72 million. During the same period in the prior year, the firm earned $0.25 EPS. CareDx's quarterly revenue was down 6.1% on a year-over-year basis. Research analysts forecast that CareDx will post -0.9 earnings per share for the current year.

CareDx Company Profile

(

Get Free Report)

CareDx, Inc engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally. It also provides AlloSure Kidney, a donor-derived cell-free DNA (dd-cfDNA) solution for kidney transplant patients; AlloMap Heart, a gene expression solution for heart transplant patients; AlloSure Heart, a dd-cfDNA solution for heart transplant patients; and AlloSure Lung, a dd-cfDNA solution for lung transplant patients.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CareDx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CareDx wasn't on the list.

While CareDx currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.