Cavco Industries (NASDAQ:CVCO - Get Free Report) is expected to be issuing its Q1 2026 quarterly earnings data after the market closes on Thursday, July 31st. Analysts expect the company to announce earnings of $5.81 per share and revenue of $524.97 million for the quarter.

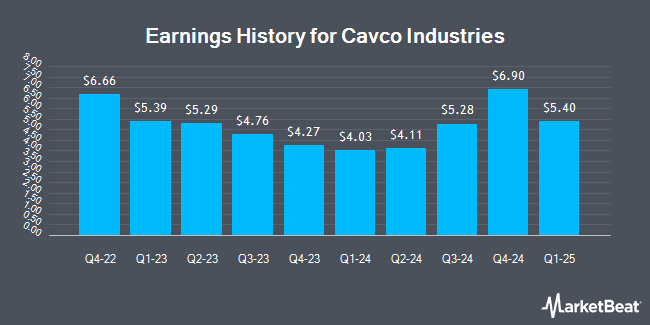

Cavco Industries (NASDAQ:CVCO - Get Free Report) last posted its earnings results on Thursday, May 22nd. The construction company reported $5.40 EPS for the quarter, topping analysts' consensus estimates of $5.23 by $0.17. The firm had revenue of $508.36 million during the quarter, compared to analysts' expectations of $504.15 million. Cavco Industries had a net margin of 8.49% and a return on equity of 17.00%. On average, analysts expect Cavco Industries to post $22 EPS for the current fiscal year and $25 EPS for the next fiscal year.

Cavco Industries Stock Down 0.7%

Cavco Industries stock traded down $2.95 during trading hours on Monday, hitting $414.52. The stock had a trading volume of 75,204 shares, compared to its average volume of 146,320. The business's 50 day simple moving average is $437.04 and its 200-day simple moving average is $479.88. The stock has a market cap of $3.35 billion, a price-to-earnings ratio of 19.97 and a beta of 1.15. Cavco Industries has a one year low of $351.28 and a one year high of $549.99.

Analysts Set New Price Targets

Several analysts have recently weighed in on the stock. Wedbush reiterated a "neutral" rating and issued a $550.00 price objective on shares of Cavco Industries in a research note on Tuesday, May 27th. Wall Street Zen downgraded Cavco Industries from a "buy" rating to a "hold" rating in a research note on Saturday, July 5th.

Check Out Our Latest Research Report on CVCO

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of CVCO. Royal Bank of Canada increased its holdings in shares of Cavco Industries by 5.2% during the first quarter. Royal Bank of Canada now owns 18,951 shares of the construction company's stock valued at $9,849,000 after acquiring an additional 934 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its holdings in shares of Cavco Industries by 1.9% during the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 4,799 shares of the construction company's stock valued at $2,494,000 after purchasing an additional 90 shares during the last quarter. United Services Automobile Association bought a new position in shares of Cavco Industries during the 1st quarter valued at approximately $266,000. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC lifted its holdings in shares of Cavco Industries by 15.4% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 17,876 shares of the construction company's stock valued at $9,289,000 after acquiring an additional 2,384 shares during the last quarter. Institutional investors own 95.56% of the company's stock.

Cavco Industries Company Profile

(

Get Free Report)

Cavco Industries, Inc designs, produces, and retails factory-built homes primarily in the United States. It operates in two segments, Factory-Built Housing and Financial Services. The company markets its factory-built homes under the Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood, MidCountry, and Solitaire brands.

See Also

Before you consider Cavco Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cavco Industries wasn't on the list.

While Cavco Industries currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.