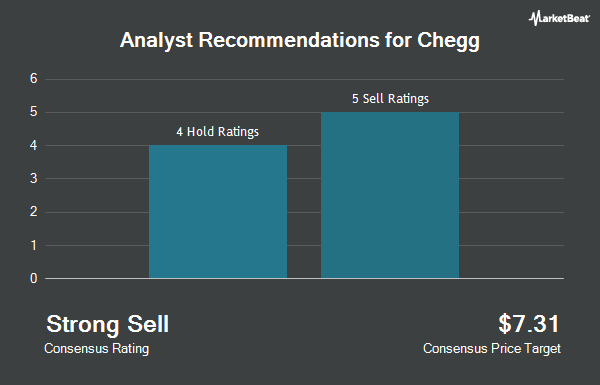

Chegg, Inc. (NYSE:CHGG - Get Free Report) has been assigned a consensus rating of "Reduce" from the seven ratings firms that are covering the stock, Marketbeat.com reports. Three investment analysts have rated the stock with a sell rating and four have assigned a hold rating to the company. The average 12 month target price among analysts that have covered the stock in the last year is $1.70.

Several analysts have issued reports on CHGG shares. Wall Street Zen started coverage on Chegg in a research note on Thursday, April 17th. They issued a "hold" rating on the stock. JPMorgan Chase & Co. reissued an "underweight" rating on shares of Chegg in a research note on Tuesday, April 8th. Finally, Needham & Company LLC reaffirmed a "hold" rating on shares of Chegg in a research report on Monday, May 12th.

Check Out Our Latest Stock Report on Chegg

Chegg Trading Up 7.5%

CHGG stock traded up $0.10 during midday trading on Friday, hitting $1.36. 904,700 shares of the company's stock were exchanged, compared to its average volume of 3,338,473. The stock's fifty day moving average price is $1.35 and its 200-day moving average price is $1.09. The company has a debt-to-equity ratio of 0.34, a quick ratio of 1.23 and a current ratio of 1.23. The company has a market cap of $144.40 million, a PE ratio of -0.16 and a beta of 1.77. Chegg has a one year low of $0.44 and a one year high of $2.98.

Institutional Investors Weigh In On Chegg

Institutional investors have recently made changes to their positions in the company. Ameriprise Financial Inc. boosted its holdings in shares of Chegg by 54.0% during the fourth quarter. Ameriprise Financial Inc. now owns 266,655 shares of the technology company's stock worth $429,000 after acquiring an additional 93,528 shares during the period. Susquehanna Fundamental Investments LLC bought a new stake in shares of Chegg during the fourth quarter worth approximately $559,000. Arrowstreet Capital Limited Partnership boosted its holdings in shares of Chegg by 247.0% during the fourth quarter. Arrowstreet Capital Limited Partnership now owns 1,464,022 shares of the technology company's stock worth $2,357,000 after acquiring an additional 1,042,136 shares during the period. Millennium Management LLC boosted its stake in shares of Chegg by 35.7% in the fourth quarter. Millennium Management LLC now owns 1,874,158 shares of the technology company's stock valued at $3,017,000 after buying an additional 492,902 shares during the period. Finally, ProShare Advisors LLC boosted its stake in shares of Chegg by 51.2% in the fourth quarter. ProShare Advisors LLC now owns 28,360 shares of the technology company's stock valued at $46,000 after buying an additional 9,600 shares during the period. Institutional investors own 95.18% of the company's stock.

About Chegg

(

Get Free Report)

Chegg, Inc operates a direct-to-student learning platform that helps learners build essential life and job skills to accelerate their path from learning programs in the United States and internationally. Its subscription services include Chegg Study, which offers personalized step-by-step learning support from AI, computational engines, and subject matter experts, as well as Tinger Gold and DashPash Student services; Chegg Writing that provides students with a suite of tools, such as plagiarism detection scans, grammar and writing fluency checking, expert personalized writing feedback, and premium citation generation; Chegg Math, a step-by-step math problem solver and calculator that helps students to solve problems; Chegg Study Pack, a bundle of various subscription product offerings, including Chegg Study, Chegg Writing, and Chegg Math services; and Busuu, an online language learning platform that offers comprehensive support through self-paced lessons, live classes with expert tutors, and a community of members to practice alongside.

Featured Articles

Before you consider Chegg, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chegg wasn't on the list.

While Chegg currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.