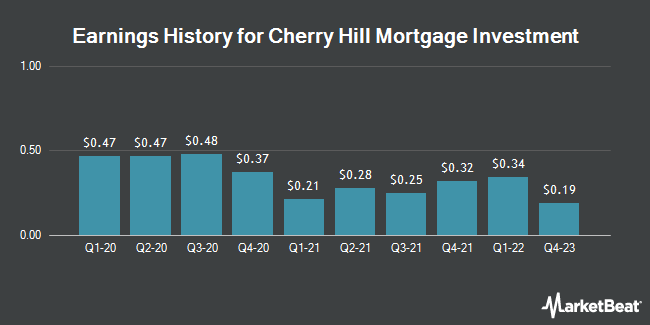

Cherry Hill Mortgage Investment (NYSE:CHMI - Get Free Report) is projected to release its Q2 2025 earnings data after the market closes on Thursday, August 7th. Analysts expect Cherry Hill Mortgage Investment to post earnings of $0.13 per share and revenue of $2.19 million for the quarter.

Cherry Hill Mortgage Investment (NYSE:CHMI - Get Free Report) last released its quarterly earnings results on Tuesday, May 6th. The real estate investment trust reported $0.17 EPS for the quarter, topping analysts' consensus estimates of $0.11 by $0.06. Cherry Hill Mortgage Investment had a negative net margin of 11.62% and a positive return on equity of 14.65%. The company had revenue of ($3.05) million for the quarter, compared to the consensus estimate of $2.39 million. On average, analysts expect Cherry Hill Mortgage Investment to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Cherry Hill Mortgage Investment Trading Up 3.3%

Shares of NYSE CHMI traded up $0.09 during midday trading on Tuesday, reaching $2.85. The company's stock had a trading volume of 283,869 shares, compared to its average volume of 298,569. The company has a 50 day moving average price of $2.84 and a 200 day moving average price of $3.06. Cherry Hill Mortgage Investment has a one year low of $2.34 and a one year high of $3.81. The company has a market cap of $93.08 million, a price-to-earnings ratio of -5.18 and a beta of 0.97.

Cherry Hill Mortgage Investment Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, July 31st. Investors of record on Monday, June 30th were issued a $0.15 dividend. This represents a $0.60 dividend on an annualized basis and a dividend yield of 21.1%. The ex-dividend date was Monday, June 30th. Cherry Hill Mortgage Investment's payout ratio is presently -109.09%.

Institutional Trading of Cherry Hill Mortgage Investment

A hedge fund recently bought a new stake in Cherry Hill Mortgage Investment stock. Envestnet Asset Management Inc. purchased a new stake in shares of Cherry Hill Mortgage Investment Corporation (NYSE:CHMI - Free Report) during the second quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 16,541 shares of the real estate investment trust's stock, valued at approximately $45,000. Envestnet Asset Management Inc. owned 0.05% of Cherry Hill Mortgage Investment at the end of the most recent reporting period. 18.49% of the stock is currently owned by institutional investors and hedge funds.

About Cherry Hill Mortgage Investment

(

Get Free Report)

Cherry Hill Mortgage Investment Corporation, a residential real estate finance company, acquires, invests in, and manages residential mortgage assets in the United States. It operates through Investments in RMBS (residential mortgage-backed securities) and Investments in Servicing Related Assets segments.

Read More

Before you consider Cherry Hill Mortgage Investment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cherry Hill Mortgage Investment wasn't on the list.

While Cherry Hill Mortgage Investment currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.