Cidara Therapeutics (NASDAQ:CDTX - Get Free Report) has been given a $68.00 target price by Guggenheim in a note issued to investors on Tuesday, MarketBeat Ratings reports. The firm currently has a "buy" rating on the biotechnology company's stock. Guggenheim's price target would suggest a potential upside of 40.52% from the company's current price.

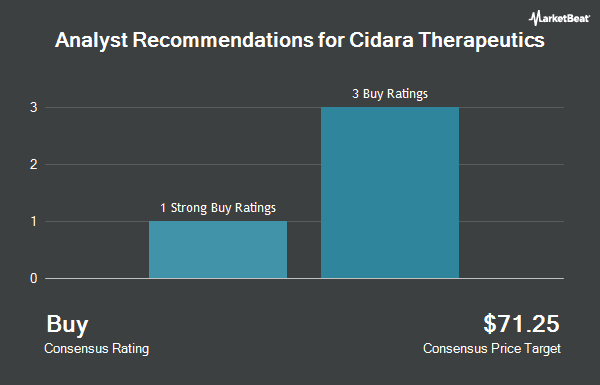

A number of other research firms have also recently weighed in on CDTX. Needham & Company LLC increased their price objective on Cidara Therapeutics from $36.00 to $54.00 and gave the stock a "buy" rating in a research report on Monday. HC Wainwright upgraded shares of Cidara Therapeutics to a "buy" rating and set a $41.00 price objective on the stock in a research report on Wednesday, June 18th. Wall Street Zen upgraded shares of Cidara Therapeutics to a "sell" rating in a research report on Saturday, May 10th. Citizens Jmp started coverage on shares of Cidara Therapeutics in a report on Wednesday, March 12th. They issued an "outperform" rating and a $46.00 target price on the stock. Finally, Cantor Fitzgerald restated an "overweight" rating on shares of Cidara Therapeutics in a research report on Tuesday, June 10th. One research analyst has rated the stock with a sell rating, eight have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $55.43.

Check Out Our Latest Research Report on Cidara Therapeutics

Cidara Therapeutics Trading Up 0.7%

Shares of Cidara Therapeutics stock traded up $0.36 during trading on Tuesday, reaching $48.39. The company's stock had a trading volume of 1,145,785 shares, compared to its average volume of 156,298. The firm has a market cap of $607.29 million, a PE ratio of -1.63 and a beta of 0.79. The company has a 50-day moving average price of $24.44 and a two-hundred day moving average price of $22.70. Cidara Therapeutics has a fifty-two week low of $10.14 and a fifty-two week high of $56.83.

Cidara Therapeutics (NASDAQ:CDTX - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The biotechnology company reported ($1.66) EPS for the quarter, beating analysts' consensus estimates of ($5.45) by $3.79. On average, analysts predict that Cidara Therapeutics will post -8.74 earnings per share for the current fiscal year.

Institutional Trading of Cidara Therapeutics

Several large investors have recently bought and sold shares of CDTX. BVF Inc. IL boosted its position in shares of Cidara Therapeutics by 55.4% in the 4th quarter. BVF Inc. IL now owns 1,092,796 shares of the biotechnology company's stock worth $29,374,000 after buying an additional 389,731 shares in the last quarter. RA Capital Management L.P. lifted its holdings in shares of Cidara Therapeutics by 55.4% in the fourth quarter. RA Capital Management L.P. now owns 1,092,796 shares of the biotechnology company's stock valued at $29,374,000 after purchasing an additional 389,716 shares in the last quarter. TCG Crossover Management LLC acquired a new stake in shares of Cidara Therapeutics in the fourth quarter valued at approximately $26,092,000. Adage Capital Partners GP L.L.C. increased its stake in shares of Cidara Therapeutics by 167.6% during the 1st quarter. Adage Capital Partners GP L.L.C. now owns 990,000 shares of the biotechnology company's stock worth $21,325,000 after purchasing an additional 620,046 shares in the last quarter. Finally, VR Adviser LLC purchased a new position in shares of Cidara Therapeutics during the 4th quarter worth approximately $20,583,000. Institutional investors and hedge funds own 35.82% of the company's stock.

About Cidara Therapeutics

(

Get Free Report)

Cidara Therapeutics, Inc, a biotechnology company, focuses on developing targeted therapies for patients facing cancers and other serious diseases. The company's product includes rezafungin acetate, a novel molecule in the echinocandin class of antifungals for the treatment and prevention of invasive fungal infections, including candidemia and invasive candidiasis, which are fungal infections associated with high mortality rates.

Featured Articles

Before you consider Cidara Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cidara Therapeutics wasn't on the list.

While Cidara Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.