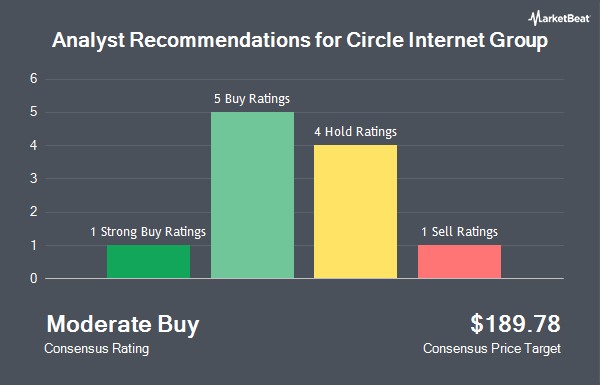

Shares of Circle Internet Group, Inc. (NYSE:CRCL - Get Free Report) have received a consensus rating of "Hold" from the fourteen brokerages that are covering the company, Marketbeat.com reports. Three investment analysts have rated the stock with a sell recommendation, five have assigned a hold recommendation, five have issued a buy recommendation and one has given a strong buy recommendation to the company. The average 12-month target price among analysts that have covered the stock in the last year is $175.27.

Several research analysts have recently issued reports on CRCL shares. Compass Point downgraded shares of Circle Internet Group from a "neutral" rating to a "sell" rating and dropped their target price for the stock from $205.00 to $130.00 in a research note on Monday. Baird R W upgraded shares of Circle Internet Group to a "hold" rating in a research note on Friday, July 11th. JPMorgan Chase & Co. started coverage on shares of Circle Internet Group in a research report on Monday, June 30th. They set an "underweight" rating and a $80.00 price objective on the stock. Robert W. Baird started coverage on shares of Circle Internet Group in a research report on Friday, July 11th. They set a "neutral" rating and a $210.00 price objective on the stock. Finally, Mizuho started coverage on shares of Circle Internet Group in a research report on Tuesday, July 8th. They set an "underperform" rating and a $85.00 price objective on the stock.

Check Out Our Latest Analysis on CRCL

Insider Activity at Circle Internet Group

In other news, insider Nikhil Chandhok sold 300,000 shares of the stock in a transaction dated Friday, June 6th. The shares were sold at an average price of $29.30, for a total value of $8,790,000.00. Following the completion of the sale, the insider directly owned 605,580 shares in the company, valued at $17,743,494. This represents a 33.13% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CEO Jeremy Allaire sold 1,582,160 shares of the stock in a transaction dated Friday, June 6th. The shares were sold at an average price of $29.30, for a total transaction of $46,357,288.00. The disclosure for this sale can be found here. Insiders sold a total of 6,682,884 shares of company stock valued at $195,808,501 in the last three months.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of the stock. Brand Asset Management Group Inc. acquired a new stake in Circle Internet Group in the second quarter valued at approximately $272,000. Westbourne Investments Inc. acquired a new stake in Circle Internet Group in the second quarter valued at approximately $204,000. Baader Bank Aktiengesellschaft acquired a new stake in Circle Internet Group in the second quarter valued at approximately $1,083,000. Wealth Enhancement Advisory Services LLC acquired a new stake in Circle Internet Group in the second quarter valued at approximately $673,000. Finally, Exchange Traded Concepts LLC acquired a new stake in Circle Internet Group during the second quarter worth approximately $18,397,000.

Circle Internet Group Stock Performance

CRCL traded down $0.38 during midday trading on Friday, reaching $192.70. The company's stock had a trading volume of 6,966,741 shares, compared to its average volume of 22,758,100. The stock has a market cap of $42.88 billion and a PE ratio of -15,228.39. Circle Internet Group has a 1 year low of $64.00 and a 1 year high of $298.99.

Circle Internet Group Company Profile

(

Get Free ReportFounded in 2013, Circle's mission is to raise global economic prosperity through the frictionless exchange of value. We intend to connect the world more deeply by building a new global economic system on the foundation of the internet, and to facilitate the creation of a world where everyone, everywhere can share value as easily as we can today share information, content, and communications.

Read More

Before you consider Circle Internet Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Circle Internet Group wasn't on the list.

While Circle Internet Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.