Circle Internet Group (NYSE:CRCL - Get Free Report) had its price objective cut by equities research analysts at Robert W. Baird from $210.00 to $185.00 in a report issued on Wednesday, Marketbeat.com reports. The firm currently has a "neutral" rating on the stock. Robert W. Baird's price objective would indicate a potential upside of 21.08% from the company's current price.

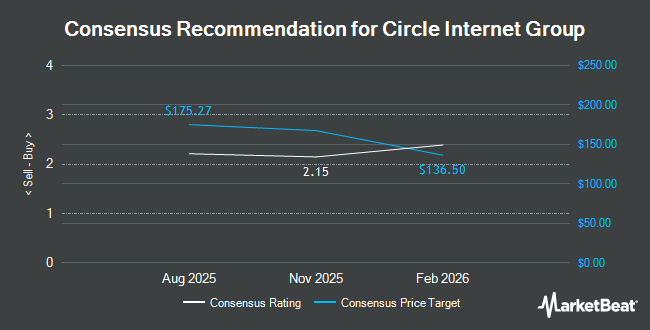

CRCL has been the topic of several other research reports. Mizuho set a $85.00 price objective on Circle Internet Group in a research report on Tuesday. Canaccord Genuity Group assumed coverage on shares of Circle Internet Group in a report on Monday, June 30th. They issued a "buy" rating and a $247.00 price target on the stock. Oppenheimer initiated coverage on Circle Internet Group in a research note on Tuesday. They issued a "market perform" rating for the company. Baird R W upgraded Circle Internet Group to a "hold" rating in a research note on Friday, July 11th. Finally, JPMorgan Chase & Co. started coverage on shares of Circle Internet Group in a research note on Monday, June 30th. They set an "underweight" rating and a $80.00 price objective for the company. Four analysts have rated the stock with a sell rating, five have assigned a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, Circle Internet Group presently has a consensus rating of "Hold" and an average target price of $173.00.

Read Our Latest Research Report on CRCL

Circle Internet Group Price Performance

NYSE:CRCL traded down $10.42 during trading hours on Wednesday, reaching $152.79. The stock had a trading volume of 17,821,699 shares, compared to its average volume of 28,047,037. Circle Internet Group has a 52 week low of $64.00 and a 52 week high of $298.99. The company's 50 day moving average price is $184.93. The company has a market capitalization of $34.00 billion and a PE ratio of -12,074.44.

Insiders Place Their Bets

In related news, insider Nikhil Chandhok sold 300,000 shares of the business's stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $29.30, for a total transaction of $8,790,000.00. Following the completion of the transaction, the insider owned 605,580 shares in the company, valued at $17,743,494. The trade was a 33.13% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, major shareholder Catalyst Group Vi L.P General sold 3,550,724 shares of the business's stock in a transaction that occurred on Friday, June 6th. The stock was sold at an average price of $29.30, for a total value of $104,036,213.20. Following the sale, the insider directly owned 20,120,769 shares in the company, valued at approximately $589,538,531.70. The trade was a 15.00% decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 6,682,884 shares of company stock valued at $195,808,501.

Institutional Trading of Circle Internet Group

Hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Marshall Wace LLP bought a new stake in shares of Circle Internet Group during the second quarter valued at approximately $1,547,214,000. Baird Financial Group Inc. bought a new stake in shares of Circle Internet Group during the second quarter worth $2,649,000. Walleye Capital LLC acquired a new position in shares of Circle Internet Group during the second quarter worth about $13,597,000. EverSource Wealth Advisors LLC acquired a new position in shares of Circle Internet Group during the second quarter worth about $27,000. Finally, Invesco Ltd. acquired a new position in shares of Circle Internet Group during the second quarter worth about $47,640,000.

Circle Internet Group Company Profile

(

Get Free Report)

Founded in 2013, Circle's mission is to raise global economic prosperity through the frictionless exchange of value. We intend to connect the world more deeply by building a new global economic system on the foundation of the internet, and to facilitate the creation of a world where everyone, everywhere can share value as easily as we can today share information, content, and communications.

Featured Stories

Before you consider Circle Internet Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Circle Internet Group wasn't on the list.

While Circle Internet Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.