NetApp (NASDAQ:NTAP - Free Report) had its price objective increased by Citigroup from $110.00 to $115.00 in a research note issued to investors on Monday morning,Benzinga reports. The brokerage currently has a neutral rating on the data storage provider's stock.

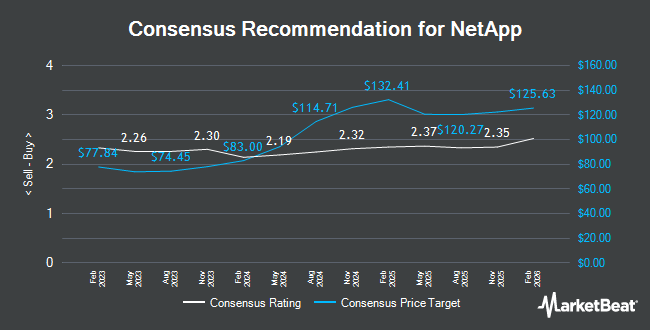

Several other research firms also recently commented on NTAP. UBS Group reduced their price objective on NetApp from $115.00 to $108.00 and set a "neutral" rating for the company in a research note on Friday, May 30th. Evercore ISI dropped their target price on NetApp from $120.00 to $100.00 and set an "in-line" rating for the company in a report on Monday, April 28th. Barclays upped their target price on NetApp from $115.00 to $117.00 and gave the company an "overweight" rating in a report on Friday, May 30th. Morgan Stanley restated a "cautious" rating on shares of NetApp in a report on Tuesday, May 20th. Finally, Wells Fargo & Company dropped their target price on NetApp from $115.00 to $100.00 and set an "equal weight" rating for the company in a report on Friday, May 30th. One analyst has rated the stock with a sell rating, ten have issued a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus target price of $119.21.

Check Out Our Latest Research Report on NetApp

NetApp Price Performance

Shares of NTAP stock traded up $0.16 during trading hours on Monday, hitting $109.56. 1,965,300 shares of the company's stock were exchanged, compared to its average volume of 2,033,078. The company has a quick ratio of 1.22, a current ratio of 1.25 and a debt-to-equity ratio of 2.39. The firm has a market cap of $21.95 billion, a P/E ratio of 19.29, a P/E/G ratio of 2.48 and a beta of 1.44. The firm has a 50 day moving average of $105.02 and a two-hundred day moving average of $101.11. NetApp has a fifty-two week low of $71.84 and a fifty-two week high of $135.45.

NetApp (NASDAQ:NTAP - Get Free Report) last posted its quarterly earnings data on Thursday, May 29th. The data storage provider reported $1.93 EPS for the quarter, beating the consensus estimate of $1.90 by $0.03. NetApp had a return on equity of 126.96% and a net margin of 18.05%. The firm had revenue of $1.73 billion during the quarter, compared to the consensus estimate of $1.72 billion. During the same period in the prior year, the company earned $1.80 EPS. The firm's revenue was up 3.8% compared to the same quarter last year. Sell-side analysts forecast that NetApp will post 5.89 EPS for the current year.

NetApp Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Wednesday, July 23rd. Investors of record on Thursday, July 3rd were issued a dividend of $0.52 per share. This represents a $2.08 dividend on an annualized basis and a yield of 1.9%. The ex-dividend date was Thursday, July 3rd. NetApp's dividend payout ratio (DPR) is 36.62%.

Insider Activity at NetApp

In other NetApp news, CAO Lorenzo Daniel De sold 302 shares of the stock in a transaction dated Tuesday, June 3rd. The stock was sold at an average price of $98.77, for a total value of $29,828.54. Following the sale, the chief accounting officer owned 455 shares of the company's stock, valued at $44,940.35. This trade represents a 39.89% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CEO George Kurian sold 8,500 shares of the company's stock in a transaction that occurred on Monday, June 16th. The stock was sold at an average price of $101.78, for a total transaction of $865,130.00. Following the sale, the chief executive officer owned 296,805 shares in the company, valued at $30,208,812.90. The trade was a 2.78% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 19,302 shares of company stock worth $2,026,379 in the last three months. 0.28% of the stock is owned by company insiders.

Institutional Trading of NetApp

A number of large investors have recently made changes to their positions in the company. Worldquant Millennium Advisors LLC purchased a new stake in shares of NetApp during the second quarter worth approximately $20,255,000. Canada Pension Plan Investment Board raised its position in shares of NetApp by 29.8% during the 2nd quarter. Canada Pension Plan Investment Board now owns 300,751 shares of the data storage provider's stock worth $32,045,000 after acquiring an additional 69,129 shares in the last quarter. Quantinno Capital Management LP raised its position in shares of NetApp by 104.2% during the 2nd quarter. Quantinno Capital Management LP now owns 129,497 shares of the data storage provider's stock worth $13,798,000 after acquiring an additional 66,070 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of NetApp by 16.2% during the 2nd quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 57,007 shares of the data storage provider's stock worth $6,074,000 after acquiring an additional 7,937 shares in the last quarter. Finally, Diversify Advisory Services LLC raised its position in shares of NetApp by 73.6% during the 2nd quarter. Diversify Advisory Services LLC now owns 7,665 shares of the data storage provider's stock worth $826,000 after acquiring an additional 3,249 shares in the last quarter. 92.17% of the stock is currently owned by hedge funds and other institutional investors.

About NetApp

(

Get Free Report)

NetApp, Inc provides cloud-led and data-centric services to manage and share data on-premises, and private and public clouds worldwide. It operates in two segments, Hybrid Cloud and Public Could. The company offers intelligent data management software, such as NetApp ONTAP, NetApp Snapshot, NetApp SnapCenter Backup Management, NetApp SnapMirror Data Replication, NetApp SnapLock Data Compliance, and storage infrastructure solutions, including NetApp All-Flash FAS series, NetApp Fabric Attached Storage, NetApp E/EF series, and NetApp StorageGRID.

See Also

Before you consider NetApp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NetApp wasn't on the list.

While NetApp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report