Cleanspark (NASDAQ:CLSK - Get Free Report) had its target price raised by investment analysts at JPMorgan Chase & Co. from $14.00 to $15.00 in a research note issued to investors on Monday,Benzinga reports. The firm presently has an "overweight" rating on the stock. JPMorgan Chase & Co.'s price objective indicates a potential upside of 31.57% from the stock's current price.

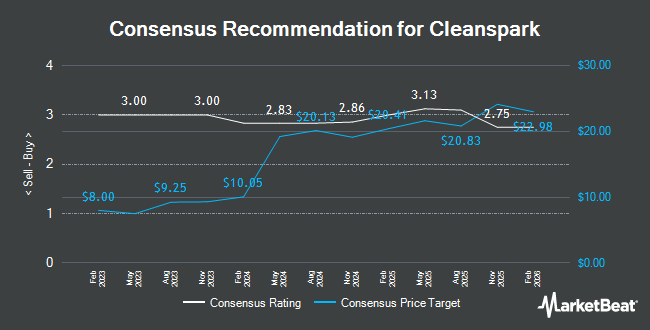

A number of other research analysts have also recently commented on CLSK. Chardan Capital reiterated a "buy" rating and issued a $20.00 price target on shares of Cleanspark in a research note on Tuesday, July 8th. BTIG Research reissued a "buy" rating on shares of Cleanspark in a research report on Friday, June 13th. Finally, B. Riley started coverage on Cleanspark in a research report on Tuesday, July 1st. They issued a "buy" rating and a $16.00 price objective for the company. Nine research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $20.69.

Get Our Latest Stock Report on CLSK

Cleanspark Price Performance

NASDAQ:CLSK traded down $0.02 during trading hours on Monday, reaching $11.40. 15,469,573 shares of the company were exchanged, compared to its average volume of 25,696,887. The company has a market capitalization of $3.20 billion, a P/E ratio of -11.88 and a beta of 4.23. Cleanspark has a 1-year low of $6.45 and a 1-year high of $17.97. The business has a 50 day moving average of $10.75 and a 200 day moving average of $9.58.

Cleanspark (NASDAQ:CLSK - Get Free Report) last issued its earnings results on Thursday, May 8th. The company reported ($0.02) earnings per share for the quarter, missing analysts' consensus estimates of $0.03 by ($0.05). The business had revenue of $181.71 million during the quarter, compared to analyst estimates of $196.43 million. Cleanspark had a negative net margin of 35.43% and a negative return on equity of 4.65%. The company's revenue for the quarter was up 62.5% compared to the same quarter last year. During the same period in the prior year, the business posted $0.59 EPS. As a group, equities research analysts anticipate that Cleanspark will post 0.58 earnings per share for the current fiscal year.

Insider Buying and Selling at Cleanspark

In other news, Director Roger Paul Beynon sold 50,000 shares of the company's stock in a transaction on Wednesday, May 21st. The shares were sold at an average price of $10.51, for a total value of $525,500.00. Following the transaction, the director owned 125,511 shares of the company's stock, valued at approximately $1,319,120.61. This represents a 28.49% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Insiders own 2.65% of the company's stock.

Hedge Funds Weigh In On Cleanspark

Several large investors have recently made changes to their positions in CLSK. Fifth Third Bancorp increased its position in shares of Cleanspark by 145.3% during the second quarter. Fifth Third Bancorp now owns 2,860 shares of the company's stock valued at $32,000 after acquiring an additional 1,694 shares in the last quarter. CX Institutional bought a new stake in Cleanspark in the 1st quarter worth approximately $26,000. Strs Ohio bought a new stake in Cleanspark in the 1st quarter worth approximately $38,000. Russell Investments Group Ltd. grew its position in Cleanspark by 60.0% in the 4th quarter. Russell Investments Group Ltd. now owns 5,859 shares of the company's stock worth $54,000 after purchasing an additional 2,196 shares during the period. Finally, West Oak Capital LLC grew its position in Cleanspark by 3,422.5% in the 2nd quarter. West Oak Capital LLC now owns 6,728 shares of the company's stock worth $74,000 after purchasing an additional 6,537 shares during the period. 43.12% of the stock is currently owned by hedge funds and other institutional investors.

Cleanspark Company Profile

(

Get Free Report)

CleanSpark, Inc operates as a bitcoin miner in the Americas. It owns and operates data centers that primarily run on low-carbon power. Its infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion. The company was formerly known as Stratean Inc and changed its name to CleanSpark, Inc in November 2016.

See Also

Before you consider Cleanspark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cleanspark wasn't on the list.

While Cleanspark currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.