Collar Capital Management LLC purchased a new position in Lumentum Holdings Inc. (NASDAQ:LITE - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 19,269 shares of the technology company's stock, valued at approximately $1,618,000.

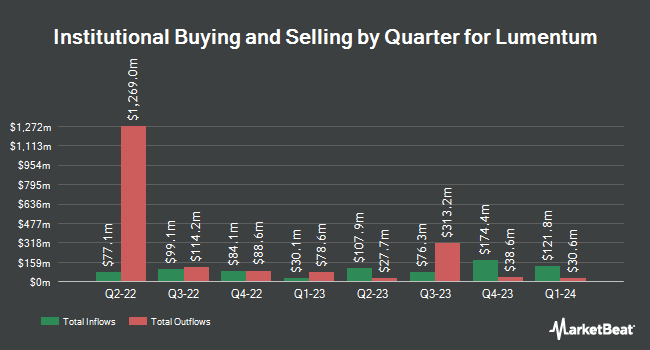

Several other hedge funds and other institutional investors have also made changes to their positions in LITE. Capital World Investors grew its position in shares of Lumentum by 108.3% during the 4th quarter. Capital World Investors now owns 3,600,132 shares of the technology company's stock worth $302,231,000 after buying an additional 1,871,572 shares in the last quarter. Alliancebernstein L.P. raised its stake in Lumentum by 1.4% in the fourth quarter. Alliancebernstein L.P. now owns 1,711,956 shares of the technology company's stock worth $143,719,000 after buying an additional 23,136 shares in the last quarter. Geode Capital Management LLC lifted its holdings in Lumentum by 0.8% during the fourth quarter. Geode Capital Management LLC now owns 1,195,605 shares of the technology company's stock worth $100,402,000 after buying an additional 9,442 shares during the period. Fuller & Thaler Asset Management Inc. boosted its position in Lumentum by 8.1% during the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 838,289 shares of the technology company's stock valued at $70,374,000 after acquiring an additional 62,937 shares in the last quarter. Finally, Norges Bank acquired a new position in shares of Lumentum during the fourth quarter worth $68,962,000. Hedge funds and other institutional investors own 94.05% of the company's stock.

Lumentum Price Performance

LITE stock traded up $5.56 during mid-day trading on Monday, reaching $70.43. The company's stock had a trading volume of 1,725,355 shares, compared to its average volume of 1,938,126. The company has a current ratio of 4.76, a quick ratio of 3.60 and a debt-to-equity ratio of 2.94. The company's 50 day moving average is $60.21 and its two-hundred day moving average is $74.74. The stock has a market cap of $4.87 billion, a PE ratio of -9.11 and a beta of 1.18. Lumentum Holdings Inc. has a fifty-two week low of $38.29 and a fifty-two week high of $104.00.

Lumentum (NASDAQ:LITE - Get Free Report) last released its quarterly earnings data on Tuesday, May 6th. The technology company reported $0.57 earnings per share for the quarter, topping analysts' consensus estimates of $0.50 by $0.07. Lumentum had a negative return on equity of 7.25% and a negative net margin of 36.98%. The company had revenue of $425.20 million for the quarter, compared to analyst estimates of $418.18 million. During the same quarter in the previous year, the company posted $0.09 earnings per share. The firm's revenue for the quarter was up 16.0% compared to the same quarter last year. Equities research analysts expect that Lumentum Holdings Inc. will post 0.03 EPS for the current year.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on LITE. Raymond James reduced their price objective on Lumentum from $82.00 to $80.00 and set a "strong-buy" rating for the company in a research note on Wednesday, May 7th. JPMorgan Chase & Co. reduced their price objective on Lumentum from $105.00 to $73.00 and set an "overweight" rating for the company in a research note on Thursday, April 17th. BNP Paribas upgraded Lumentum from a "neutral" rating to an "outperform" rating and set a $92.00 price objective for the company in a research note on Tuesday, March 11th. Rosenblatt Securities raised their target price on Lumentum from $85.00 to $94.00 and gave the stock a "buy" rating in a report on Wednesday, May 7th. Finally, Needham & Company LLC lowered their price objective on Lumentum from $110.00 to $100.00 and set a "buy" rating on the stock in a research report on Wednesday, May 7th. One equities research analyst has rated the stock with a sell rating, three have issued a hold rating, ten have issued a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, Lumentum has a consensus rating of "Moderate Buy" and a consensus target price of $82.20.

Read Our Latest Stock Analysis on Lumentum

Insider Transactions at Lumentum

In related news, CFO Wajid Ali sold 2,172 shares of the company's stock in a transaction dated Tuesday, February 18th. The stock was sold at an average price of $78.34, for a total value of $170,154.48. Following the completion of the sale, the chief financial officer now directly owns 51,976 shares of the company's stock, valued at $4,071,799.84. This represents a 4.01% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Corporate insiders own 0.19% of the company's stock.

Lumentum Profile

(

Free Report)

Lumentum Holdings Inc manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa. The company operates through two segments: Optical Communications (OpComms) and Commercial Lasers (Lasers). The OpComms segment offers components, modules, and subsystems that enable the transmission and transport of video, audio, and data over high-capacity fiber optic cables.

Featured Articles

Before you consider Lumentum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lumentum wasn't on the list.

While Lumentum currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.