Commercial Metals (NYSE:CMC - Get Free Report) was upgraded by equities researchers at Zacks Research from a "hold" rating to a "strong-buy" rating in a research note issued on Tuesday,Zacks.com reports. Zacks Research also issued estimates for Commercial Metals' Q2 2026 earnings at $0.69 EPS, Q3 2026 earnings at $1.00 EPS, Q4 2026 earnings at $1.49 EPS, FY2026 earnings at $4.18 EPS, Q1 2027 earnings at $1.24 EPS, Q2 2027 earnings at $0.85 EPS, Q3 2027 earnings at $1.00 EPS, Q4 2027 earnings at $1.46 EPS and FY2027 earnings at $4.56 EPS.

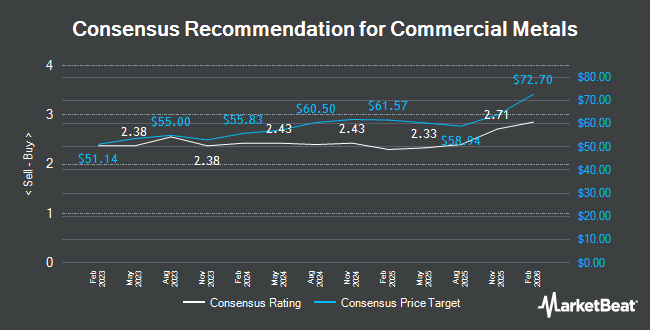

Other equities analysts have also issued research reports about the stock. Morgan Stanley set a $57.50 target price on shares of Commercial Metals in a research report on Wednesday, June 25th. Wolfe Research raised shares of Commercial Metals from a "peer perform" rating to an "outperform" rating in a report on Friday, June 20th. JPMorgan Chase & Co. lifted their price objective on shares of Commercial Metals from $54.00 to $63.00 and gave the company a "neutral" rating in a research note on Monday. UBS Group increased their target price on Commercial Metals from $48.00 to $56.00 and gave the stock a "neutral" rating in a research report on Wednesday, August 13th. Finally, Jefferies Financial Group reaffirmed a "buy" rating on shares of Commercial Metals in a report on Friday, June 20th. One investment analyst has rated the stock with a Strong Buy rating, five have given a Buy rating and six have assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $61.39.

View Our Latest Report on CMC

Commercial Metals Price Performance

Commercial Metals stock opened at $59.59 on Tuesday. Commercial Metals has a 12 month low of $37.92 and a 12 month high of $64.53. The company has a current ratio of 2.86, a quick ratio of 2.00 and a debt-to-equity ratio of 0.32. The business's 50 day simple moving average is $57.75 and its 200 day simple moving average is $51.27. The company has a market cap of $6.67 billion, a price-to-earnings ratio of 192.21, a PEG ratio of 2.06 and a beta of 1.32.

Institutional Trading of Commercial Metals

A number of large investors have recently modified their holdings of the business. CWM LLC increased its position in shares of Commercial Metals by 64.9% in the third quarter. CWM LLC now owns 6,392 shares of the basic materials company's stock worth $366,000 after purchasing an additional 2,516 shares during the last quarter. Pacer Advisors Inc. purchased a new position in Commercial Metals in the 3rd quarter worth approximately $845,000. Green Alpha Advisors LLC grew its stake in Commercial Metals by 4.2% in the 3rd quarter. Green Alpha Advisors LLC now owns 20,457 shares of the basic materials company's stock worth $1,172,000 after buying an additional 832 shares in the last quarter. Drummond Knight Asset Management Pty Ltd bought a new position in shares of Commercial Metals in the 3rd quarter worth $15,579,000. Finally, Farther Finance Advisors LLC raised its position in shares of Commercial Metals by 30.4% during the 3rd quarter. Farther Finance Advisors LLC now owns 9,846 shares of the basic materials company's stock valued at $564,000 after buying an additional 2,296 shares in the last quarter. Institutional investors own 86.90% of the company's stock.

Commercial Metals Company Profile

(

Get Free Report)

Commercial Metals Company manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally. It operates through two segments, North America and Europe. The company processes and sells ferrous and nonferrous scrap metals to steel mills and foundries, aluminum sheet and ingot manufacturers, brass and bronze ingot makers, copper refineries and mills, secondary lead smelters, specialty steel mills, high temperature alloy manufacturers, and other consumers.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Commercial Metals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commercial Metals wasn't on the list.

While Commercial Metals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.