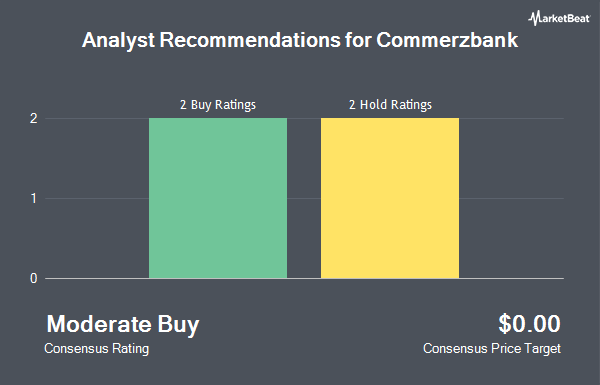

Shares of Commerzbank AG (OTCMKTS:CRZBY - Get Free Report) have received an average rating of "Hold" from the five brokerages that are currently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell recommendation, three have issued a hold recommendation and one has given a buy recommendation to the company.

A number of equities analysts have weighed in on the stock. Morgan Stanley reiterated an "overweight" rating on shares of Commerzbank in a research report on Monday, May 19th. Deutsche Bank Aktiengesellschaft lowered shares of Commerzbank from a "buy" rating to a "hold" rating in a research report on Monday, August 18th. The Goldman Sachs Group lowered shares of Commerzbank from a "hold" rating to a "sell" rating in a research report on Tuesday, August 26th. Royal Bank Of Canada restated a "sector perform" rating on shares of Commerzbank in a research report on Monday, August 11th. Finally, Citigroup restated a "neutral" rating on shares of Commerzbank in a research report on Tuesday, August 5th.

Check Out Our Latest Research Report on CRZBY

Hedge Funds Weigh In On Commerzbank

A number of hedge funds and other institutional investors have recently modified their holdings of CRZBY. GAMMA Investing LLC boosted its position in shares of Commerzbank by 124.6% during the first quarter. GAMMA Investing LLC now owns 4,156 shares of the financial services provider's stock worth $95,000 after acquiring an additional 2,306 shares during the last quarter. Rhumbline Advisers boosted its position in shares of Commerzbank by 14.5% during the first quarter. Rhumbline Advisers now owns 5,140 shares of the financial services provider's stock worth $117,000 after acquiring an additional 650 shares during the last quarter. Finally, Yousif Capital Management LLC boosted its position in shares of Commerzbank by 8.0% during the second quarter. Yousif Capital Management LLC now owns 15,644 shares of the financial services provider's stock worth $492,000 after acquiring an additional 1,165 shares during the last quarter.

Commerzbank Price Performance

Shares of CRZBY traded down $0.68 during mid-day trading on Monday, reaching $37.29. The stock had a trading volume of 29,349 shares, compared to its average volume of 54,179. The firm has a market cap of $44.18 billion, a price-to-earnings ratio of 16.57 and a beta of 0.67. Commerzbank has a 12 month low of $13.60 and a 12 month high of $44.85. The business has a fifty day moving average of $36.87 and a 200 day moving average of $30.30. The company has a debt-to-equity ratio of 14.69, a quick ratio of 33.14 and a current ratio of 12.40.

Commerzbank (OTCMKTS:CRZBY - Get Free Report) last posted its quarterly earnings results on Wednesday, August 6th. The financial services provider reported $0.22 earnings per share for the quarter, missing analysts' consensus estimates of $0.67 by ($0.45). The firm had revenue of $3.49 billion during the quarter, compared to the consensus estimate of $2.97 billion. Commerzbank had a return on equity of 7.49% and a net margin of 10.51%. Equities analysts predict that Commerzbank will post 1.96 EPS for the current year.

Commerzbank Company Profile

(

Get Free Report)

Commerzbank AG provides banking and capital market products and services to private and small business customers, corporate, financial service providers, and institutional clients in Germany, rest of Europe, the Americas, Asia, and internationally. It operates through two segments, Private and Small-Business Customers, and Corporate Clients.

Further Reading

Before you consider Commerzbank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Commerzbank wasn't on the list.

While Commerzbank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.