Deutsche Bank Aktiengesellschaft upgraded shares of Compass Group (LON:CPG - Free Report) to a buy rating in a research note issued to investors on Thursday morning, Marketbeat reports. Deutsche Bank Aktiengesellschaft currently has GBX 2,900 target price on the stock, up from their prior target price of GBX 2,700.

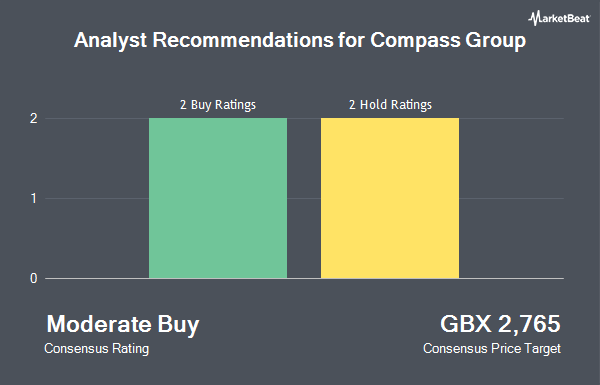

CPG has been the subject of several other reports. Royal Bank Of Canada raised their target price on shares of Compass Group from GBX 2,625 to GBX 2,700 and gave the stock a "sector perform" rating in a research report on Thursday, July 24th. Citigroup lifted their price target on shares of Compass Group from GBX 2,650 to GBX 2,750 and gave the company a "neutral" rating in a research report on Thursday, July 24th. Shore Capital reissued a "buy" rating on shares of Compass Group in a research report on Tuesday, July 22nd. Jefferies Financial Group reissued a "buy" rating and set a GBX 3,000 price target on shares of Compass Group in a research report on Thursday, September 11th. Finally, Berenberg Bank lifted their price target on shares of Compass Group from GBX 2,960 to GBX 3,000 and gave the company a "buy" rating in a research report on Tuesday, July 22nd. Four research analysts have rated the stock with a Buy rating and two have assigned a Hold rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average target price of GBX 2,870.

Read Our Latest Analysis on CPG

Compass Group Price Performance

Shares of LON:CPG remained flat at GBX 2,568 on Thursday. 1,741,179 shares of the stock traded hands, compared to its average volume of 8,060,373. The stock's 50-day moving average is GBX 2,577.11 and its 200-day moving average is GBX 2,566.05. Compass Group has a 12-month low of GBX 2,344 and a 12-month high of GBX 2,853. The company has a quick ratio of 0.86, a current ratio of 0.74 and a debt-to-equity ratio of 86.56. The company has a market cap of £43.58 billion, a price-to-earnings ratio of 2,989.52, a price-to-earnings-growth ratio of 1.42 and a beta of 0.81.

Compass Group Company Profile

(

Get Free Report)

Compass Group PLC is a world leading food service company, which generated annual revenues of $42.2 billion in the year to 30 September 2024. It serves meals to millions of people in c. 30 countries and employs and engages with c. 580,000 people. The Company specialises in providing food and a range of targeted support services across the core sectors of Business & Industry, Healthcare & Senior Living, Education, Sports & Leisure and Defence, Offshore & Remote, with an established brand portfolio.

Featured Articles

Before you consider Compass Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Compass Group wasn't on the list.

While Compass Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.