Equities researchers at JPMorgan Chase & Co. began coverage on shares of Conagra Brands (NYSE:CAG - Get Free Report) in a note issued to investors on Wednesday, Marketbeat reports. The firm set a "neutral" rating and a $20.00 price target on the stock. JPMorgan Chase & Co.'s price target would suggest a potential upside of 3.76% from the company's current price.

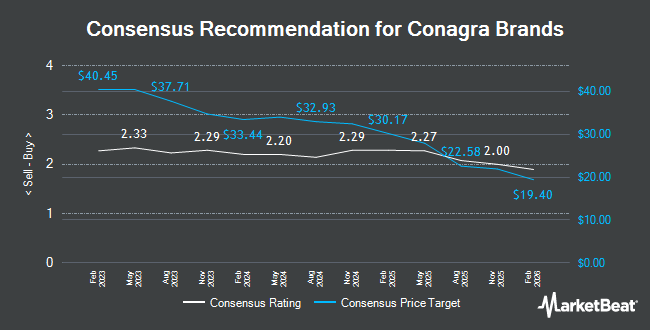

Other analysts have also recently issued research reports about the stock. Royal Bank Of Canada cut their price target on shares of Conagra Brands from $25.00 to $22.00 and set a "sector perform" rating on the stock in a report on Friday, July 11th. Wells Fargo & Company lowered their price objective on Conagra Brands from $23.00 to $22.00 and set an "equal weight" rating for the company in a research report on Wednesday, July 9th. Evercore ISI lowered their price objective on Conagra Brands from $26.00 to $24.00 and set an "in-line" rating for the company in a research report on Friday, July 11th. Morgan Stanley lowered their price objective on Conagra Brands from $22.00 to $20.00 and set an "equal weight" rating for the company in a research report on Friday, July 11th. Finally, Stifel Nicolaus lowered their price objective on Conagra Brands from $26.00 to $21.00 and set a "hold" rating for the company in a research report on Friday, July 11th. One equities research analyst has rated the stock with a Strong Buy rating, one has issued a Buy rating, nine have assigned a Hold rating and two have assigned a Sell rating to the stock. According to MarketBeat, the company has an average rating of "Hold" and a consensus target price of $22.17.

Check Out Our Latest Stock Analysis on Conagra Brands

Conagra Brands Trading Down 2.0%

NYSE:CAG traded down $0.3850 during trading hours on Wednesday, hitting $19.2750. The company had a trading volume of 3,294,316 shares, compared to its average volume of 7,713,113. The company has a market capitalization of $9.23 billion, a PE ratio of 8.06, a price-to-earnings-growth ratio of 1.88 and a beta of 0.08. The stock has a 50-day moving average price of $19.82 and a 200 day moving average price of $22.94. Conagra Brands has a 52 week low of $18.18 and a 52 week high of $33.24. The company has a debt-to-equity ratio of 0.70, a current ratio of 0.71 and a quick ratio of 0.24.

Conagra Brands (NYSE:CAG - Get Free Report) last released its quarterly earnings results on Thursday, July 10th. The company reported $0.56 earnings per share for the quarter, missing the consensus estimate of $0.61 by ($0.05). The company had revenue of $2,781,800 billion during the quarter, compared to the consensus estimate of $2.88 billion. Conagra Brands had a net margin of 9.92% and a return on equity of 12.52%. The business's revenue was down 4.3% on a year-over-year basis. During the same quarter last year, the firm earned $0.61 EPS. On average, equities research analysts predict that Conagra Brands will post 2.35 EPS for the current fiscal year.

Hedge Funds Weigh In On Conagra Brands

A number of hedge funds have recently bought and sold shares of the business. Beacon Investment Advisory Services Inc. raised its position in Conagra Brands by 3.2% in the 1st quarter. Beacon Investment Advisory Services Inc. now owns 14,548 shares of the company's stock worth $388,000 after buying an additional 450 shares during the last quarter. Capital Advisors Ltd. LLC lifted its holdings in Conagra Brands by 82.3% in the first quarter. Capital Advisors Ltd. LLC now owns 1,001 shares of the company's stock valued at $27,000 after acquiring an additional 452 shares during the period. Hexagon Capital Partners LLC increased its position in shares of Conagra Brands by 33.6% during the 1st quarter. Hexagon Capital Partners LLC now owns 2,009 shares of the company's stock valued at $54,000 after purchasing an additional 505 shares during the last quarter. Capstone Triton Financial Group LLC increased its position in shares of Conagra Brands by 1.5% during the 4th quarter. Capstone Triton Financial Group LLC now owns 35,860 shares of the company's stock valued at $995,000 after purchasing an additional 535 shares during the last quarter. Finally, Equitable Trust Co. increased its position in shares of Conagra Brands by 1.8% during the 1st quarter. Equitable Trust Co. now owns 29,927 shares of the company's stock valued at $798,000 after purchasing an additional 536 shares during the last quarter. Hedge funds and other institutional investors own 83.75% of the company's stock.

About Conagra Brands

(

Get Free Report)

Conagra Brands, Inc, together with its subsidiaries, operates as a consumer packaged goods food company primarily in the United States. The company operates through Grocery & Snacks, Refrigerated & Frozen, International, and Foodservice segments. The Grocery & Snacks segment primarily offers shelf stable food products through various retail channels.

See Also

Before you consider Conagra Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conagra Brands wasn't on the list.

While Conagra Brands currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.