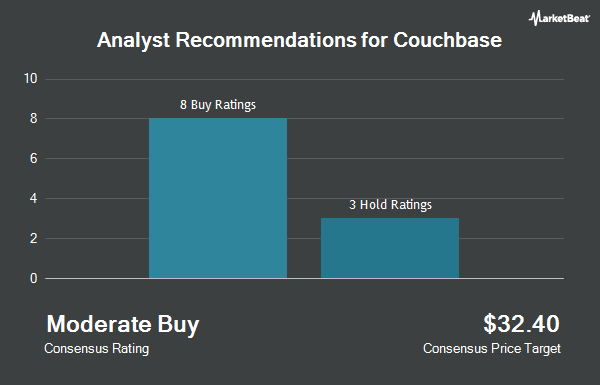

Couchbase, Inc. (NASDAQ:BASE - Get Free Report) has been assigned a consensus rating of "Hold" from the nineteen research firms that are covering the company, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, thirteen have assigned a hold recommendation and five have assigned a buy recommendation to the company. The average twelve-month price target among brokerages that have covered the stock in the last year is $23.0882.

A number of research firms have recently weighed in on BASE. Wells Fargo & Company cut Couchbase from a "strong-buy" rating to a "hold" rating and lifted their price target for the company from $20.00 to $24.50 in a report on Friday, June 20th. Needham & Company LLC downgraded Couchbase from a "moderate buy" rating to a "hold" rating and set a $22.00 target price on the stock. in a research note on Friday, June 20th. Piper Sandler lowered Couchbase from a "strong-buy" rating to a "hold" rating and boosted their price target for the stock from $20.00 to $24.50 in a research report on Friday, June 20th. Robert W. Baird reaffirmed a "neutral" rating and issued a $25.00 price objective (up previously from $22.00) on shares of Couchbase in a report on Monday, June 23rd. Finally, William Blair cut Couchbase from a "strong-buy" rating to a "hold" rating in a research report on Friday, June 20th.

Check Out Our Latest Report on Couchbase

Insiders Place Their Bets

In other Couchbase news, CFO William Robert Carey sold 2,300 shares of the company's stock in a transaction that occurred on Wednesday, June 4th. The shares were sold at an average price of $19.50, for a total value of $44,850.00. Following the transaction, the chief financial officer owned 94,780 shares in the company, valued at approximately $1,848,210. This represents a 2.37% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Matthew M. Cain sold 63,600 shares of the business's stock in a transaction dated Friday, June 20th. The shares were sold at an average price of $24.25, for a total value of $1,542,300.00. Following the completion of the transaction, the chief executive officer owned 888,747 shares in the company, valued at $21,552,114.75. This trade represents a 6.68% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 134,084 shares of company stock worth $3,172,904 over the last quarter. Company insiders own 14.80% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds have recently made changes to their positions in the stock. Quarry LP bought a new stake in Couchbase during the fourth quarter valued at about $35,000. AlphaQuest LLC lifted its position in Couchbase by 20.5% in the first quarter. AlphaQuest LLC now owns 3,631 shares of the company's stock worth $57,000 after purchasing an additional 617 shares during the period. Summit Investment Advisors Inc. boosted its position in shares of Couchbase by 24.1% during the 4th quarter. Summit Investment Advisors Inc. now owns 4,161 shares of the company's stock valued at $65,000 after acquiring an additional 807 shares in the last quarter. CWM LLC boosted its holdings in Couchbase by 272.9% during the first quarter. CWM LLC now owns 4,191 shares of the company's stock valued at $66,000 after purchasing an additional 3,067 shares in the last quarter. Finally, State of Wyoming bought a new stake in Couchbase in the first quarter valued at $100,000. Institutional investors and hedge funds own 96.07% of the company's stock.

Couchbase Price Performance

NASDAQ:BASE traded down $0.02 during midday trading on Tuesday, reaching $24.31. 115,376 shares of the company traded hands, compared to its average volume of 882,807. The firm has a market capitalization of $1.31 billion, a price-to-earnings ratio of -17.74 and a beta of 0.93. The company has a fifty day moving average price of $22.75 and a 200 day moving average price of $18.80. Couchbase has a twelve month low of $12.78 and a twelve month high of $25.16.

Couchbase (NASDAQ:BASE - Get Free Report) last announced its quarterly earnings results on Tuesday, June 3rd. The company reported ($0.06) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.08) by $0.02. Couchbase had a negative net margin of 33.23% and a negative return on equity of 55.25%. The company had revenue of $56.52 million during the quarter, compared to the consensus estimate of $55.59 million. During the same quarter in the previous year, the company posted ($0.10) earnings per share. The company's revenue for the quarter was up 10.1% compared to the same quarter last year. On average, equities research analysts forecast that Couchbase will post -1.48 earnings per share for the current fiscal year.

About Couchbase

(

Get Free Report)

Couchbase, Inc provides cloud database platform for enterprise applications in the United States and internationally. Its database works in multiple configurations, ranging from cloud to multi- or hybrid-cloud to on-premise environments to the edge. The company offers Couchbase Capella, an automated and secure Database-as-a-Service that simplifies database management by deploying, managing, and operating Couchbase Server across cloud environments; and Couchbase Server, a multi-service NoSQL database, which provides SQL-compatible query language and SQL++ that allows for a various array of data manipulation functions.

See Also

Before you consider Couchbase, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Couchbase wasn't on the list.

While Couchbase currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.