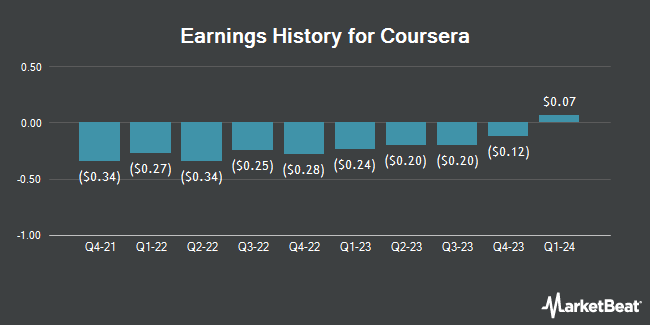

Coursera (NYSE:COUR - Get Free Report) announced its earnings results on Thursday. The company reported $0.12 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.09 by $0.03, Briefing.com reports. Coursera had a negative return on equity of 5.22% and a negative net margin of 7.05%. The firm had revenue of $187.10 million for the quarter, compared to analyst estimates of $180.52 million. During the same quarter last year, the firm posted $0.09 EPS. The business's revenue was up 9.9% on a year-over-year basis. Coursera updated its FY 2025 guidance to EPS and its Q3 2025 guidance to EPS.

Coursera Price Performance

Shares of NYSE:COUR traded down $0.07 during midday trading on Wednesday, reaching $11.94. 4,667,937 shares of the company's stock were exchanged, compared to its average volume of 4,114,091. The firm's 50 day simple moving average is $8.92 and its two-hundred day simple moving average is $8.22. The stock has a market cap of $1.93 billion, a price-to-earnings ratio of -36.18 and a beta of 1.36. Coursera has a fifty-two week low of $5.76 and a fifty-two week high of $13.56.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the company. Morgan Stanley increased their price objective on Coursera from $11.00 to $12.00 and gave the company an "equal weight" rating in a research note on Friday, July 25th. Wall Street Zen raised Coursera from a "hold" rating to a "buy" rating in a research note on Saturday. Cantor Fitzgerald increased their price objective on Coursera from $10.00 to $13.00 and gave the company an "overweight" rating in a research note on Friday, July 25th. UBS Group increased their price objective on Coursera from $8.50 to $10.00 and gave the company a "neutral" rating in a research note on Friday, July 25th. Finally, Royal Bank Of Canada increased their price objective on Coursera from $10.00 to $13.00 and gave the company an "outperform" rating in a research note on Friday, July 25th. One analyst has rated the stock with a sell rating, five have given a hold rating and eight have assigned a buy rating to the stock. According to MarketBeat.com, Coursera has a consensus rating of "Moderate Buy" and a consensus target price of $11.25.

Read Our Latest Research Report on COUR

Insider Transactions at Coursera

In related news, CAO Michele M. Meyers sold 12,500 shares of the firm's stock in a transaction dated Friday, July 25th. The stock was sold at an average price of $11.60, for a total transaction of $145,000.00. Following the completion of the transaction, the chief accounting officer directly owned 253,351 shares in the company, valued at $2,938,871.60. This trade represents a 4.70% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Amanda Clark sold 9,334 shares of the firm's stock in a transaction dated Thursday, May 22nd. The shares were sold at an average price of $8.48, for a total value of $79,152.32. Following the transaction, the director owned 85,573 shares of the company's stock, valued at $725,659.04. This trade represents a 9.83% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 37,270 shares of company stock valued at $356,087. Insiders own 16.80% of the company's stock.

Hedge Funds Weigh In On Coursera

Hedge funds and other institutional investors have recently made changes to their positions in the stock. Dynamic Technology Lab Private Ltd acquired a new stake in Coursera in the first quarter valued at approximately $273,000. Royal Bank of Canada raised its holdings in Coursera by 38.8% in the first quarter. Royal Bank of Canada now owns 55,891 shares of the company's stock valued at $372,000 after acquiring an additional 15,610 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its holdings in Coursera by 2.8% in the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 104,795 shares of the company's stock valued at $698,000 after acquiring an additional 2,847 shares in the last quarter. Finally, AQR Capital Management LLC raised its holdings in Coursera by 36.8% in the first quarter. AQR Capital Management LLC now owns 581,879 shares of the company's stock valued at $3,875,000 after acquiring an additional 156,566 shares in the last quarter. Hedge funds and other institutional investors own 89.55% of the company's stock.

About Coursera

(

Get Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

Featured Articles

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.