Telsey Advisory Group reiterated their outperform rating on shares of Coursera (NYSE:COUR - Free Report) in a report published on Friday morning,Benzinga reports. The brokerage currently has a $14.00 target price on the stock.

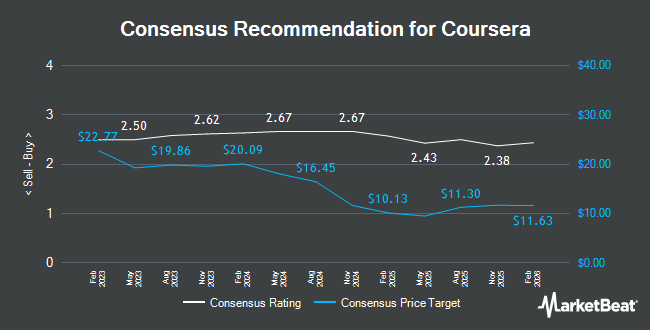

Several other research analysts also recently commented on COUR. Cantor Fitzgerald raised their price objective on Coursera from $10.00 to $13.00 and gave the stock an "overweight" rating in a research note on Friday, July 25th. Loop Capital lifted their price target on shares of Coursera from $12.00 to $15.00 and gave the company a "buy" rating in a report on Friday, July 25th. Bank of America raised shares of Coursera from an "underperform" rating to a "neutral" rating and increased their price objective for the stock from $7.00 to $12.00 in a research note on Friday, July 25th. UBS Group raised their price objective on shares of Coursera from $8.50 to $10.00 and gave the company a "neutral" rating in a research report on Friday, July 25th. Finally, KeyCorp reiterated an "overweight" rating and issued a $12.00 price target (up previously from $11.00) on shares of Coursera in a research note on Friday, July 25th. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and eight have issued a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $11.40.

Get Our Latest Stock Report on Coursera

Coursera Price Performance

Shares of COUR remained flat at $11.91 during trading hours on Friday. The company had a trading volume of 2,122,660 shares, compared to its average volume of 5,257,859. The company has a market cap of $1.92 billion, a price-to-earnings ratio of -36.09 and a beta of 1.40. Coursera has a one year low of $5.76 and a one year high of $13.56. The firm has a 50 day moving average price of $9.78 and a two-hundred day moving average price of $8.52.

Coursera (NYSE:COUR - Get Free Report) last released its quarterly earnings results on Thursday, July 24th. The company reported $0.12 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.09 by $0.03. The business had revenue of $187.10 million during the quarter, compared to the consensus estimate of $180.52 million. Coursera had a negative return on equity of 5.16% and a negative net margin of 7.05%. The business's quarterly revenue was up 9.9% compared to the same quarter last year. During the same period in the previous year, the company posted $0.09 EPS. As a group, analysts forecast that Coursera will post -0.28 EPS for the current fiscal year.

Insider Activity at Coursera

In other news, Director Amanda Clark sold 9,334 shares of Coursera stock in a transaction on Thursday, May 22nd. The stock was sold at an average price of $8.48, for a total value of $79,152.32. Following the transaction, the director directly owned 85,573 shares in the company, valued at approximately $725,659.04. This trade represents a 9.83% decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, Director Sabrina Simmons sold 9,335 shares of the stock in a transaction that occurred on Thursday, May 22nd. The shares were sold at an average price of $8.48, for a total transaction of $79,160.80. Following the sale, the director directly owned 50,215 shares of the company's stock, valued at $425,823.20. The trade was a 15.68% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 137,270 shares of company stock worth $1,544,337 over the last three months. Corporate insiders own 16.80% of the company's stock.

Institutional Investors Weigh In On Coursera

Hedge funds have recently added to or reduced their stakes in the business. Tower Research Capital LLC TRC lifted its holdings in Coursera by 315.7% in the second quarter. Tower Research Capital LLC TRC now owns 20,105 shares of the company's stock valued at $176,000 after acquiring an additional 15,269 shares during the period. Captrust Financial Advisors purchased a new stake in Coursera during the second quarter worth $111,000. Man Group plc boosted its holdings in Coursera by 63.8% during the second quarter. Man Group plc now owns 491,973 shares of the company's stock worth $4,310,000 after buying an additional 191,582 shares in the last quarter. Lazard Asset Management LLC grew its position in Coursera by 260.7% during the second quarter. Lazard Asset Management LLC now owns 1,259,227 shares of the company's stock valued at $11,030,000 after buying an additional 910,123 shares during the period. Finally, Holocene Advisors LP purchased a new position in Coursera in the second quarter valued at $166,000. 89.55% of the stock is owned by hedge funds and other institutional investors.

About Coursera

(

Get Free Report)

Coursera, Inc operates an online educational content platform in the United States, Europe, Africa, the Asia Pacific, the Middle East, and internationally. It operates in three segments: Consumer, Enterprise, and Degrees. The company offers guided projects, courses, and specializations, as well as online degrees; and certificates for entry-level professional, non-entry level professional, university, and MasterTrack.

Featured Articles

Before you consider Coursera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coursera wasn't on the list.

While Coursera currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.