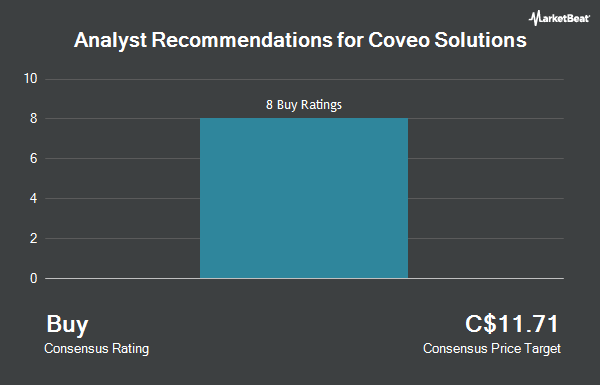

Coveo Solutions Inc. (TSE:CVO - Get Free Report) has been given an average rating of "Buy" by the eight ratings firms that are presently covering the stock, Marketbeat reports. Eight analysts have rated the stock with a buy recommendation. The average 12-month target price among analysts that have updated their coverage on the stock in the last year is C$10.63.

Several research analysts have weighed in on the stock. National Bankshares decreased their price objective on shares of Coveo Solutions from C$8.50 to C$7.50 and set an "outperform" rating for the company in a report on Friday, April 25th. Royal Bank of Canada decreased their price target on Coveo Solutions from C$11.00 to C$10.00 and set an "outperform" rating for the company in a research note on Tuesday, April 22nd. Finally, Stifel Nicolaus boosted their price objective on Coveo Solutions from C$10.00 to C$11.00 in a report on Wednesday, February 12th.

View Our Latest Stock Report on CVO

Coveo Solutions Stock Down 1.4 %

Shares of CVO stock traded down C$0.09 during mid-day trading on Monday, reaching C$6.14. 49,133 shares of the company were exchanged, compared to its average volume of 127,191. The company has a debt-to-equity ratio of 5.36, a quick ratio of 3.14 and a current ratio of 1.85. The business's 50 day simple moving average is C$5.73 and its 200 day simple moving average is C$6.24. The company has a market capitalization of C$412.56 million, a P/E ratio of -37.87, a P/E/G ratio of 0.09 and a beta of 0.75. Coveo Solutions has a fifty-two week low of C$4.92 and a fifty-two week high of C$8.61.

Coveo Solutions Company Profile

(

Get Free ReportCoveo Solutions Inc is an AI-powered platform. It provides applied AI solutions enabling enterprises to deliver relevant digital experiences at scale. The company's solutions provide value to its customers by helping drive revenue growth, reduce customer support costs, increase customer satisfaction and website engagement, and improve employee proficiency and satisfaction.

Featured Stories

Before you consider Coveo Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coveo Solutions wasn't on the list.

While Coveo Solutions currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.