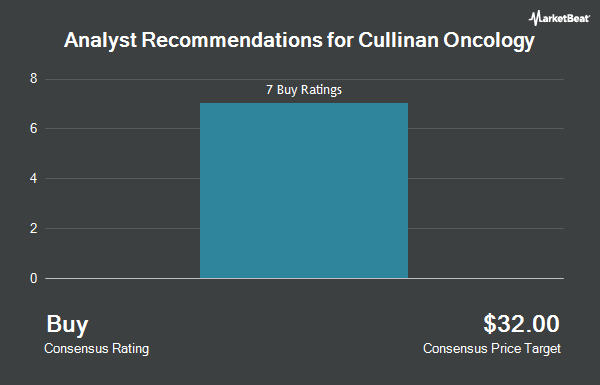

Cullinan Therapeutics, Inc. (NASDAQ:CGEM - Get Free Report) has received an average rating of "Buy" from the five analysts that are presently covering the firm, MarketBeat reports. Five equities research analysts have rated the stock with a buy recommendation. The average 1-year price objective among brokerages that have updated their coverage on the stock in the last year is $30.00.

CGEM has been the topic of several research analyst reports. Stifel Nicolaus initiated coverage on Cullinan Therapeutics in a research report on Wednesday, June 11th. They set a "buy" rating and a $22.00 price target on the stock. HC Wainwright reaffirmed a "buy" rating and issued a $33.00 target price on shares of Cullinan Therapeutics in a research report on Wednesday, April 16th. Finally, UBS Group reduced their price objective on Cullinan Therapeutics from $30.00 to $24.00 and set a "buy" rating for the company in a research report on Monday, May 12th.

View Our Latest Stock Report on Cullinan Therapeutics

Cullinan Therapeutics Price Performance

CGEM traded down $0.28 on Friday, reaching $7.80. The company's stock had a trading volume of 84,399 shares, compared to its average volume of 421,623. The business's 50 day moving average is $8.11 and its 200 day moving average is $8.43. Cullinan Therapeutics has a 1 year low of $6.85 and a 1 year high of $19.89. The stock has a market cap of $460.34 million, a price-to-earnings ratio of -2.69 and a beta of -0.08.

Cullinan Therapeutics (NASDAQ:CGEM - Get Free Report) last issued its quarterly earnings data on Thursday, May 8th. The company reported ($0.74) EPS for the quarter, topping analysts' consensus estimates of ($0.78) by $0.04. As a group, research analysts forecast that Cullinan Therapeutics will post -3.04 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently modified their holdings of the business. Brooklyn Investment Group acquired a new position in Cullinan Therapeutics in the 1st quarter worth $34,000. Federated Hermes Inc. lifted its stake in Cullinan Therapeutics by 67.0% in the 4th quarter. Federated Hermes Inc. now owns 3,802 shares of the company's stock valued at $46,000 after purchasing an additional 1,525 shares during the last quarter. GAMMA Investing LLC increased its holdings in shares of Cullinan Therapeutics by 1,214.8% during the first quarter. GAMMA Investing LLC now owns 6,995 shares of the company's stock worth $53,000 after purchasing an additional 6,463 shares during the period. Virtus ETF Advisers LLC increased its stake in Cullinan Therapeutics by 37.8% in the fourth quarter. Virtus ETF Advisers LLC now owns 5,828 shares of the company's stock valued at $71,000 after acquiring an additional 1,600 shares during the last quarter. Finally, Aquatic Capital Management LLC acquired a new position in shares of Cullinan Therapeutics during the fourth quarter worth $77,000. 86.31% of the stock is owned by institutional investors and hedge funds.

About Cullinan Therapeutics

(

Get Free Report)

Cullinan Therapeutics, Inc, a biopharmaceutical company, focuses on developing oncology therapies for cancer patients in the United States. The company's lead program comprises CLN-619, a monoclonal antibody that is in Phase I clinical trial for the treatment of solid tumors. Its development portfolio also includes CLN-049, a humanized bispecific antibody that is in Phase I clinical trial for the treatment of acute myeloid leukemia or myelodysplastic syndrome; CLN-418, a human bispecific immune activator that is in Phase 1 clinical trial for the treatment of multiple solid tumors; and Zipalertinib, a bioavailable small-molecule for treating patients with non-small cell lung cancer.

Featured Articles

Before you consider Cullinan Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cullinan Therapeutics wasn't on the list.

While Cullinan Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.