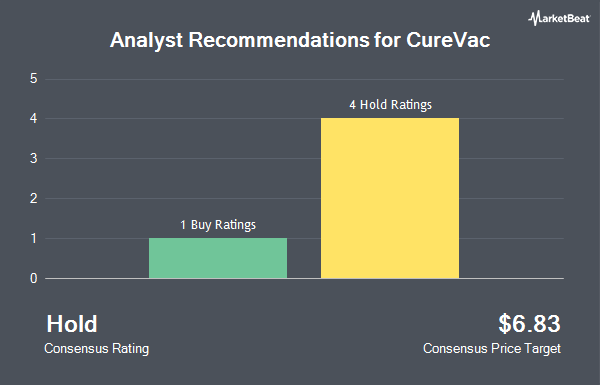

CureVac N.V. (NASDAQ:CVAC - Get Free Report) has been given a consensus recommendation of "Hold" by the six brokerages that are covering the company, Marketbeat.com reports. Five research analysts have rated the stock with a hold rating and one has given a buy rating to the company. The average 1 year price target among analysts that have issued ratings on the stock in the last year is $6.8333.

Several equities research analysts have recently weighed in on the company. Citigroup cut CureVac to a "market perform" rating in a research note on Thursday, June 12th. UBS Group cut CureVac from a "strong-buy" rating to a "neutral" rating and decreased their price target for the company from $12.00 to $5.50 in a research note on Thursday, June 26th. Weiss Ratings reissued a "hold (c-)" rating on shares of CureVac in a research note on Saturday, September 27th. Jefferies Financial Group reissued a "hold" rating and issued a $5.00 price target (down previously from $7.00) on shares of CureVac in a research note on Friday, June 13th. Finally, Citizens Jmp cut CureVac from a "strong-buy" rating to a "hold" rating in a research note on Thursday, June 12th.

View Our Latest Report on CVAC

Institutional Investors Weigh In On CureVac

Several large investors have recently added to or reduced their stakes in CVAC. Alpine Associates Management Inc. acquired a new stake in CureVac during the second quarter worth approximately $10,703,000. Qube Research & Technologies Ltd acquired a new stake in CureVac during the second quarter worth approximately $6,419,000. Water Island Capital LLC acquired a new stake in CureVac during the second quarter worth approximately $5,197,000. JPMorgan Chase & Co. acquired a new stake in CureVac during the second quarter worth approximately $1,705,000. Finally, GSA Capital Partners LLP acquired a new stake in CureVac during the first quarter worth approximately $853,000. Institutional investors and hedge funds own 17.26% of the company's stock.

CureVac Trading Up 1.1%

CureVac stock traded up $0.06 during trading hours on Friday, hitting $5.45. The stock had a trading volume of 531,989 shares, compared to its average volume of 870,187. The company has a quick ratio of 6.16, a current ratio of 6.17 and a debt-to-equity ratio of 0.05. The stock has a market cap of $1.22 billion, a price-to-earnings ratio of 5.68 and a beta of 2.51. CureVac has a one year low of $2.37 and a one year high of $5.72. The business's 50 day simple moving average is $5.40 and its 200-day simple moving average is $4.56.

CureVac (NASDAQ:CVAC - Get Free Report) last posted its earnings results on Thursday, August 21st. The company reported ($0.30) EPS for the quarter, missing the consensus estimate of ($0.15) by ($0.15). The firm had revenue of $1.41 million during the quarter, compared to the consensus estimate of $4.27 million. CureVac had a net margin of 38.21% and a return on equity of 29.57%. On average, equities analysts predict that CureVac will post 0.72 EPS for the current fiscal year.

CureVac Company Profile

(

Get Free Report)

CureVac N.V., a biopharmaceutical company, focuses on developing various transformative medicines based on messenger ribonucleic acid (mRNA). It is developing prophylactic vaccines, such as mRNA-based vaccine candidates CV2CoV, which is in Phase 1 clinical trial against SARS-CoV-2; CV7202 which is in Phase 1 clinical trial for the treatment of rabies; and CVSQIV to treat multivalent seasonal influenza; Flu SV mRNA fot treating nucleotides, single antigen seasonal influenza.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CureVac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CureVac wasn't on the list.

While CureVac currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.