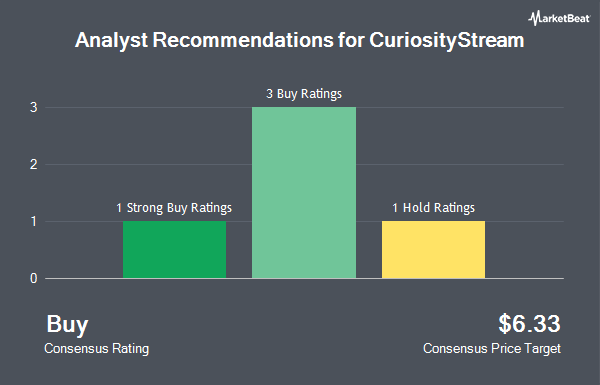

Shares of CuriosityStream Inc. (NASDAQ:CURI - Get Free Report) have earned a consensus recommendation of "Buy" from the five ratings firms that are covering the stock, MarketBeat Ratings reports. One research analyst has rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company. The average 12 month price target among brokers that have issued ratings on the stock in the last year is $6.3333.

Several research analysts have commented on CURI shares. Needham & Company LLC raised their price target on shares of CuriosityStream from $5.50 to $6.00 and gave the company a "buy" rating in a report on Thursday, September 25th. Wall Street Zen downgraded shares of CuriosityStream from a "buy" rating to a "hold" rating in a report on Sunday, September 28th. Craig Hallum started coverage on shares of CuriosityStream in a report on Monday, August 18th. They issued a "buy" rating and a $7.00 price target for the company. Singular Research raised shares of CuriosityStream to a "strong-buy" rating in a report on Wednesday, August 20th. Finally, Weiss Ratings reissued a "hold (c)" rating on shares of CuriosityStream in a report on Saturday, September 27th.

Read Our Latest Stock Analysis on CURI

Insiders Place Their Bets

In related news, CFO Phillip Brady Hayden sold 16,149 shares of CuriosityStream stock in a transaction on Tuesday, September 2nd. The shares were sold at an average price of $4.56, for a total value of $73,639.44. Following the transaction, the chief financial officer owned 38,325 shares in the company, valued at $174,762. This trade represents a 29.65% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Jonathan Huberman sold 50,000 shares of CuriosityStream stock in a transaction on Friday, September 12th. The stock was sold at an average price of $4.75, for a total transaction of $237,500.00. Following the completion of the transaction, the director owned 1,233,576 shares in the company, valued at approximately $5,859,486. The trade was a 3.90% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 8,328,727 shares of company stock valued at $29,438,661 over the last ninety days. 52.00% of the stock is currently owned by insiders.

Hedge Funds Weigh In On CuriosityStream

Hedge funds have recently modified their holdings of the company. Merit Financial Group LLC purchased a new position in shares of CuriosityStream in the first quarter valued at about $29,000. Algert Global LLC purchased a new position in shares of CuriosityStream in the first quarter valued at about $39,000. Police & Firemen s Retirement System of New Jersey purchased a new position in shares of CuriosityStream in the second quarter valued at about $41,000. The Manufacturers Life Insurance Company purchased a new position in shares of CuriosityStream in the second quarter valued at about $64,000. Finally, Vanguard Personalized Indexing Management LLC purchased a new position in shares of CuriosityStream in the second quarter valued at about $74,000. Hedge funds and other institutional investors own 6.79% of the company's stock.

CuriosityStream Trading Down 0.2%

Shares of CURI stock traded down $0.01 during trading hours on Friday, hitting $5.13. 430,418 shares of the company were exchanged, compared to its average volume of 585,671. The firm has a fifty day simple moving average of $4.63 and a 200 day simple moving average of $4.46. CuriosityStream has a 52-week low of $1.47 and a 52-week high of $7.15. The stock has a market capitalization of $297.18 million, a price-to-earnings ratio of -56.99 and a beta of 1.85.

CuriosityStream (NASDAQ:CURI - Get Free Report) last released its quarterly earnings data on Tuesday, August 5th. The company reported $0.01 earnings per share for the quarter, meeting analysts' consensus estimates of $0.01. CuriosityStream had a negative net margin of 7.84% and a negative return on equity of 8.37%. The business had revenue of $19.01 million during the quarter, compared to analyst estimates of $16.75 million. CuriosityStream has set its Q3 2025 guidance at EPS. Sell-side analysts anticipate that CuriosityStream will post -0.2 EPS for the current year.

CuriosityStream Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, September 19th. Stockholders of record on Friday, September 5th were issued a dividend of $0.08 per share. This represents a $0.32 dividend on an annualized basis and a dividend yield of 6.2%. The ex-dividend date of this dividend was Friday, September 5th. CuriosityStream's payout ratio is currently -355.56%.

CuriosityStream Company Profile

(

Get Free Report)

CuriosityStream Inc operates as a factual content streaming service and media company. The company provides premium video and audio programming services in various categories of factual entertainment, including science, history, society, nature, lifestyle, and technology through direct subscription video on-demand (SVoD) platforms accessible by internet connected devices, or indirectly via distribution partners who deliver CuriosityStream content via distributor's platform or system, as well as through bundled content licenses for SVoD and linear offerings, talks and courses, and partner bulk sales.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CuriosityStream, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CuriosityStream wasn't on the list.

While CuriosityStream currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.