Cushman & Wakefield (NYSE:CWK - Get Free Report) was upgraded by stock analysts at Wall Street Zen from a "buy" rating to a "strong-buy" rating in a report issued on Saturday.

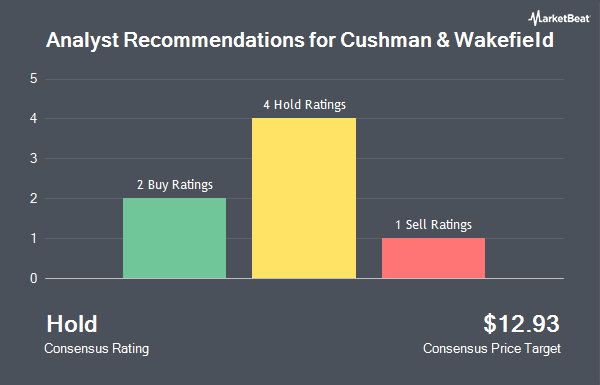

A number of other research firms have also recently weighed in on CWK. JMP Securities raised their price target on shares of Cushman & Wakefield from $15.00 to $16.00 and gave the company a "market outperform" rating in a report on Wednesday, August 6th. Morgan Stanley set a $14.50 price target on shares of Cushman & Wakefield and gave the company an "overweight" rating in a report on Thursday, June 12th. The Goldman Sachs Group upgraded shares of Cushman & Wakefield from a "sell" rating to a "buy" rating and set a $17.50 target price for the company in a research note on Friday, August 8th. Citizens Jmp assumed coverage on shares of Cushman & Wakefield in a research report on Monday, July 21st. They set a "strong-buy" rating and a $15.00 price target for the company. Finally, UBS Group raised their price target on shares of Cushman & Wakefield from $9.00 to $12.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 2nd. Four analysts have rated the stock with a hold rating, three have given a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, Cushman & Wakefield currently has a consensus rating of "Moderate Buy" and an average target price of $14.38.

View Our Latest Stock Report on Cushman & Wakefield

Cushman & Wakefield Stock Up 3.2%

Cushman & Wakefield stock traded up $0.46 during midday trading on Friday, hitting $14.67. 646,832 shares of the company's stock were exchanged, compared to its average volume of 2,074,201. The company has a debt-to-equity ratio of 1.48, a quick ratio of 1.13 and a current ratio of 1.13. Cushman & Wakefield has a 12 month low of $7.64 and a 12 month high of $16.11. The firm has a 50-day moving average of $11.52 and a two-hundred day moving average of $10.96. The company has a market cap of $3.40 billion, a PE ratio of 16.66 and a beta of 1.50.

Cushman & Wakefield (NYSE:CWK - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported $0.30 earnings per share for the quarter, beating analysts' consensus estimates of $0.22 by $0.08. Cushman & Wakefield had a net margin of 2.11% and a return on equity of 14.33%. The business had revenue of $1.65 billion for the quarter, compared to analysts' expectations of $2.38 billion. During the same period last year, the business earned $0.20 EPS. The company's revenue was up 7.2% compared to the same quarter last year. As a group, analysts expect that Cushman & Wakefield will post 1.2 earnings per share for the current fiscal year.

Institutional Investors Weigh In On Cushman & Wakefield

A number of institutional investors have recently added to or reduced their stakes in CWK. Vaughan Nelson Investment Management L.P. grew its stake in Cushman & Wakefield by 46.2% in the 2nd quarter. Vaughan Nelson Investment Management L.P. now owns 12,156,514 shares of the company's stock valued at $134,573,000 after acquiring an additional 3,842,859 shares during the period. Raymond James Financial Inc. acquired a new stake in shares of Cushman & Wakefield in the fourth quarter worth approximately $25,964,000. Deutsche Bank AG boosted its stake in shares of Cushman & Wakefield by 807.1% in the first quarter. Deutsche Bank AG now owns 1,870,044 shares of the company's stock worth $19,112,000 after acquiring an additional 1,663,880 shares during the last quarter. Next Century Growth Investors LLC acquired a new stake in shares of Cushman & Wakefield in the fourth quarter worth approximately $16,580,000. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC boosted its stake in shares of Cushman & Wakefield by 54.7% in the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,067,526 shares of the company's stock worth $40,123,000 after acquiring an additional 1,084,940 shares during the last quarter. Institutional investors and hedge funds own 95.56% of the company's stock.

About Cushman & Wakefield

(

Get Free Report)

Cushman & Wakefield Plc engages in the provision of commercial real estate services. It operates through the following geographical segments: Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC). The Americas segment consists of operations located in the United States, Canada and key markets in Latin America.

Featured Stories

Before you consider Cushman & Wakefield, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cushman & Wakefield wasn't on the list.

While Cushman & Wakefield currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.