Customers Bancorp (NYSE:CUBI - Free Report) had its price target increased by Stephens from $55.00 to $62.00 in a research report sent to investors on Tuesday morning,Benzinga reports. They currently have an equal weight rating on the bank's stock.

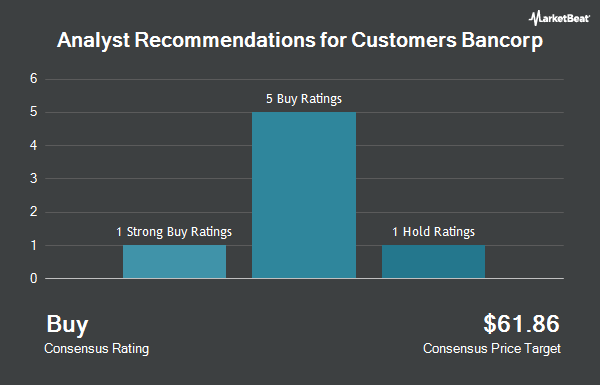

A number of other research analysts have also recently issued reports on CUBI. Keefe, Bruyette & Woods boosted their price objective on shares of Customers Bancorp from $70.00 to $71.00 and gave the company a "market perform" rating in a report on Monday, July 28th. DA Davidson boosted their price objective on shares of Customers Bancorp from $69.00 to $78.00 and gave the company a "buy" rating in a report on Monday, July 28th. Wall Street Zen upgraded shares of Customers Bancorp from a "sell" rating to a "hold" rating in a report on Friday, July 18th. Finally, B. Riley boosted their price objective on shares of Customers Bancorp from $82.00 to $85.00 and gave the company a "buy" rating in a report on Monday, July 28th. Six analysts have rated the stock with a hold rating, three have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat, Customers Bancorp presently has a consensus rating of "Moderate Buy" and a consensus price target of $67.00.

Check Out Our Latest Report on CUBI

Customers Bancorp Price Performance

Shares of NYSE CUBI traded down $1.55 during trading on Tuesday, reaching $62.20. The company had a trading volume of 551,933 shares, compared to its average volume of 373,718. Customers Bancorp has a 52 week low of $40.75 and a 52 week high of $67.19. The stock has a market cap of $1.96 billion, a PE ratio of 15.40 and a beta of 1.59. The company has a debt-to-equity ratio of 0.77, a quick ratio of 0.98 and a current ratio of 0.98. The business's 50 day moving average price is $58.09 and its 200-day moving average price is $53.70.

Customers Bancorp (NYSE:CUBI - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The bank reported $1.80 EPS for the quarter, topping the consensus estimate of $1.50 by $0.30. Customers Bancorp had a net margin of 10.77% and a return on equity of 11.98%. The company had revenue of $206.31 million during the quarter, compared to analysts' expectations of $170.81 million. During the same quarter in the previous year, the company earned $1.49 EPS. Customers Bancorp's revenue was up 3.8% on a year-over-year basis. Analysts expect that Customers Bancorp will post 6.45 earnings per share for the current year.

Hedge Funds Weigh In On Customers Bancorp

Several institutional investors and hedge funds have recently modified their holdings of the stock. Teacher Retirement System of Texas grew its stake in shares of Customers Bancorp by 4.2% in the second quarter. Teacher Retirement System of Texas now owns 4,542 shares of the bank's stock valued at $267,000 after acquiring an additional 185 shares in the last quarter. Y Intercept Hong Kong Ltd bought a new stake in Customers Bancorp during the second quarter worth about $480,000. Envestnet Asset Management Inc. lifted its position in Customers Bancorp by 17.1% during the second quarter. Envestnet Asset Management Inc. now owns 22,328 shares of the bank's stock worth $1,312,000 after purchasing an additional 3,253 shares during the period. First Citizens Bank & Trust Co. bought a new stake in Customers Bancorp during the second quarter worth about $435,000. Finally, Envestnet Portfolio Solutions Inc. bought a new stake in Customers Bancorp during the second quarter worth about $418,000. 89.29% of the stock is currently owned by institutional investors and hedge funds.

About Customers Bancorp

(

Get Free Report)

Customers Bancorp, Inc operates as the bank holding company for Customers Bank that provides financial products and services to individual consumers, and small and middle market businesses. The company provides deposit banking products, which includes commercial and consumer checking, non-interest-bearing and interest-bearing demand, MMDA, savings, and time deposit accounts.

Further Reading

Before you consider Customers Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Customers Bancorp wasn't on the list.

While Customers Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.