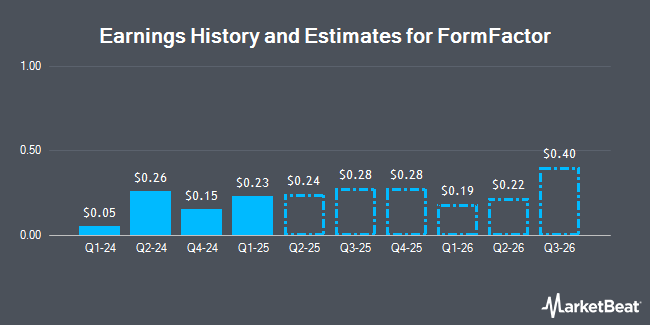

FormFactor, Inc. (NASDAQ:FORM - Free Report) - Analysts at DA Davidson cut their FY2025 earnings per share estimates for shares of FormFactor in a note issued to investors on Thursday, July 31st. DA Davidson analyst T. Diffely now forecasts that the semiconductor company will post earnings of $0.64 per share for the year, down from their previous estimate of $0.74. DA Davidson has a "Buy" rating and a $45.00 price objective on the stock. The consensus estimate for FormFactor's current full-year earnings is $0.90 per share. DA Davidson also issued estimates for FormFactor's FY2026 earnings at $1.15 EPS.

FormFactor (NASDAQ:FORM - Get Free Report) last released its quarterly earnings data on Wednesday, July 30th. The semiconductor company reported $0.27 EPS for the quarter, missing analysts' consensus estimates of $0.30 by ($0.03). The firm had revenue of $195.80 million for the quarter, compared to analyst estimates of $190.17 million. FormFactor had a return on equity of 5.57% and a net margin of 5.75%. The company's quarterly revenue was down .8% on a year-over-year basis. During the same quarter in the previous year, the company earned $0.35 earnings per share.

Other analysts also recently issued reports about the company. Stifel Nicolaus lowered their price target on FormFactor from $34.00 to $31.00 and set a "hold" rating for the company in a report on Thursday, July 31st. Needham & Company LLC reissued a "hold" rating on shares of FormFactor in a research report on Thursday, May 1st. Evercore ISI decreased their price objective on shares of FormFactor from $43.00 to $33.00 and set an "in-line" rating for the company in a research report on Thursday, May 1st. Wall Street Zen cut shares of FormFactor from a "hold" rating to a "sell" rating in a research report on Saturday. Finally, B. Riley upped their price objective on shares of FormFactor from $26.00 to $32.00 and gave the company a "neutral" rating in a research report on Thursday, May 1st. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating and two have assigned a buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $41.14.

Get Our Latest Stock Report on FormFactor

FormFactor Trading Up 0.5%

Shares of FORM stock traded up $0.15 on Friday, reaching $29.45. 516,927 shares of the stock were exchanged, compared to its average volume of 826,461. FormFactor has a 1-year low of $22.58 and a 1-year high of $51.68. The stock has a market cap of $2.27 billion, a P/E ratio of 52.56 and a beta of 1.16. The company has a quick ratio of 3.34, a current ratio of 4.24 and a debt-to-equity ratio of 0.01. The firm has a 50 day moving average of $33.82 and a two-hundred day moving average of $32.78.

Insider Transactions at FormFactor

In other FormFactor news, Director Dennis Thomas St sold 3,000 shares of the business's stock in a transaction dated Thursday, May 29th. The shares were sold at an average price of $31.24, for a total value of $93,720.00. Following the transaction, the director directly owned 40,957 shares in the company, valued at $1,279,496.68. The trade was a 6.82% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 0.96% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors have recently bought and sold shares of the company. JPMorgan Chase & Co. grew its stake in FormFactor by 118.1% during the fourth quarter. JPMorgan Chase & Co. now owns 509,399 shares of the semiconductor company's stock worth $22,414,000 after buying an additional 275,824 shares in the last quarter. Norges Bank acquired a new position in shares of FormFactor during the 4th quarter valued at $12,446,000. Pictet Asset Management Holding SA lifted its position in shares of FormFactor by 16.7% during the 4th quarter. Pictet Asset Management Holding SA now owns 11,290 shares of the semiconductor company's stock valued at $497,000 after acquiring an additional 1,614 shares during the period. Franklin Resources Inc. increased its stake in FormFactor by 2.2% during the 4th quarter. Franklin Resources Inc. now owns 397,219 shares of the semiconductor company's stock valued at $17,478,000 after purchasing an additional 8,475 shares in the last quarter. Finally, Geode Capital Management LLC increased its stake in FormFactor by 1.8% during the 4th quarter. Geode Capital Management LLC now owns 2,103,612 shares of the semiconductor company's stock valued at $92,577,000 after purchasing an additional 36,438 shares in the last quarter. Institutional investors and hedge funds own 98.76% of the company's stock.

FormFactor Company Profile

(

Get Free Report)

FormFactor, Inc designs, manufactures, and sells probe cards, analytical probes, probe stations, metrology systems, thermal systems, and cryogenic systems to semiconductor companies and scientific institutions in the United States, Taiwan, South Korea, China, Europe, Japan, Malaysia, Singapore, and internationally.

Read More

Before you consider FormFactor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FormFactor wasn't on the list.

While FormFactor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.