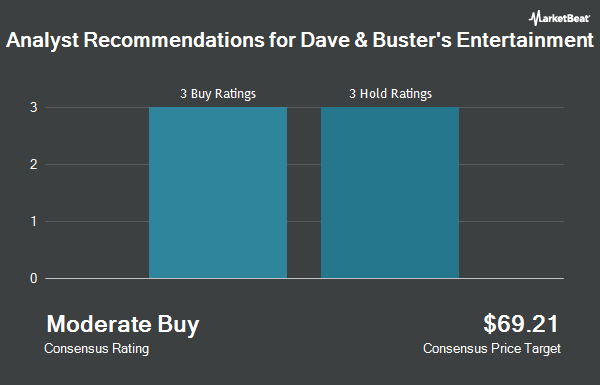

Dave & Buster's Entertainment Inc (NASDAQ:PLAY - Get Free Report) has earned a consensus rating of "Hold" from the eight research firms that are currently covering the firm, MarketBeat Ratings reports. Six research analysts have rated the stock with a hold rating and two have issued a buy rating on the company. The average twelve-month price objective among brokers that have covered the stock in the last year is $33.00.

Several equities analysts have issued reports on PLAY shares. Loop Capital cut their price objective on Dave & Buster's Entertainment from $45.00 to $35.00 and set a "buy" rating for the company in a research report on Tuesday, April 8th. Piper Sandler lowered their target price on Dave & Buster's Entertainment from $33.00 to $22.00 and set a "neutral" rating for the company in a research note on Tuesday, April 8th. Truist Financial lowered their target price on Dave & Buster's Entertainment from $27.00 to $21.00 and set a "hold" rating for the company in a research note on Wednesday, April 2nd. Finally, BMO Capital Markets lowered their target price on Dave & Buster's Entertainment from $47.00 to $30.00 and set an "outperform" rating for the company in a research note on Wednesday, April 9th.

Read Our Latest Report on Dave & Buster's Entertainment

Dave & Buster's Entertainment Price Performance

Shares of Dave & Buster's Entertainment stock traded down $0.09 during midday trading on Friday, hitting $22.17. 230,641 shares of the company were exchanged, compared to its average volume of 1,470,648. The company has a debt-to-equity ratio of 6.38, a current ratio of 0.29 and a quick ratio of 0.19. The firm has a market cap of $765.20 million, a P/E ratio of 11.00 and a beta of 1.94. Dave & Buster's Entertainment has a 52 week low of $15.08 and a 52 week high of $56.60. The firm has a 50 day simple moving average of $19.01 and a 200-day simple moving average of $26.26.

Dave & Buster's Entertainment (NASDAQ:PLAY - Get Free Report) last posted its earnings results on Monday, April 7th. The restaurant operator reported $0.69 EPS for the quarter, topping the consensus estimate of $0.64 by $0.05. Dave & Buster's Entertainment had a return on equity of 44.22% and a net margin of 3.88%. The business had revenue of $534.50 million during the quarter, compared to the consensus estimate of $548.77 million. During the same quarter last year, the company earned $0.88 EPS. Dave & Buster's Entertainment's revenue was down 10.8% on a year-over-year basis. Research analysts forecast that Dave & Buster's Entertainment will post 2.52 earnings per share for the current year.

Institutional Trading of Dave & Buster's Entertainment

Institutional investors and hedge funds have recently bought and sold shares of the stock. US Bancorp DE increased its position in Dave & Buster's Entertainment by 442.0% during the first quarter. US Bancorp DE now owns 1,561 shares of the restaurant operator's stock worth $27,000 after buying an additional 1,273 shares during the last quarter. SBI Securities Co. Ltd. acquired a new position in Dave & Buster's Entertainment during the fourth quarter worth approximately $47,000. KBC Group NV increased its position in Dave & Buster's Entertainment by 81.3% during the fourth quarter. KBC Group NV now owns 1,974 shares of the restaurant operator's stock worth $58,000 after buying an additional 885 shares during the last quarter. Signaturefd LLC increased its position in Dave & Buster's Entertainment by 1,427.5% during the first quarter. Signaturefd LLC now owns 4,277 shares of the restaurant operator's stock worth $75,000 after buying an additional 3,997 shares during the last quarter. Finally, GAMMA Investing LLC increased its position in Dave & Buster's Entertainment by 3,974.8% during the first quarter. GAMMA Investing LLC now owns 4,360 shares of the restaurant operator's stock worth $77,000 after buying an additional 4,253 shares during the last quarter. Institutional investors own 91.45% of the company's stock.

Dave & Buster's Entertainment Company Profile

(

Get Free ReportDave & Buster's Entertainment, Inc owns and operates entertainment and dining venues for adults and families. Its venues offer a menu of entrees and appetizers, as well as a selection of non-alcoholic and alcoholic beverages; and an assortment of entertainment attractions centered on playing games and watching live sports, and other televised events.

Read More

Before you consider Dave & Buster's Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dave & Buster's Entertainment wasn't on the list.

While Dave & Buster's Entertainment currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.