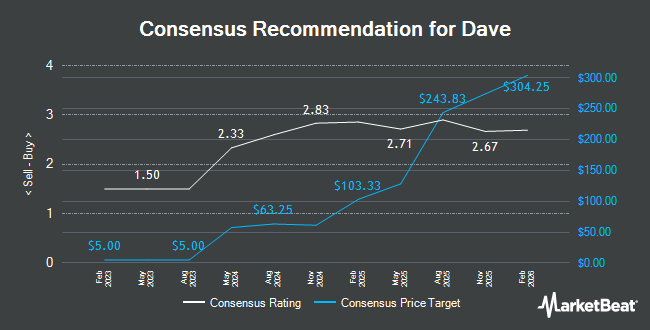

Dave (NASDAQ:DAVE - Get Free Report) had its price objective lifted by investment analysts at Citizens Jmp from $280.00 to $300.00 in a report released on Friday, Marketbeat reports. The firm presently has a "mkt outperform" rating on the fintech company's stock. Citizens Jmp's target price indicates a potential upside of 37.16% from the stock's previous close.

Other analysts have also recently issued reports about the company. BMO Capital Markets reaffirmed an "outperform" rating on shares of Dave in a research report on Tuesday, June 10th. Wall Street Zen cut shares of Dave from a "buy" rating to a "hold" rating in a research note on Saturday, August 9th. Piper Sandler restated a "neutral" rating on shares of Dave in a research report on Tuesday, June 10th. Citigroup restated an "outperform" rating on shares of Dave in a research report on Thursday, August 7th. Finally, JMP Securities lifted their price target on Dave from $280.00 to $300.00 and gave the stock a "market outperform" rating in a report on Friday. Nine research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the stock. According to MarketBeat.com, Dave currently has an average rating of "Moderate Buy" and an average target price of $270.43.

Get Our Latest Stock Report on Dave

Dave Stock Performance

DAVE stock traded down $4.54 during trading hours on Friday, reaching $218.73. The stock had a trading volume of 100,885 shares, compared to its average volume of 501,333. The stock has a market capitalization of $2.95 billion, a PE ratio of 57.74 and a beta of 3.93. The company has a debt-to-equity ratio of 0.35, a current ratio of 9.51 and a quick ratio of 9.51. The stock has a 50-day simple moving average of $211.25 and a 200 day simple moving average of $174.57. Dave has a fifty-two week low of $37.44 and a fifty-two week high of $286.45.

Dave declared that its Board of Directors has approved a stock repurchase plan on Wednesday, August 13th that permits the company to buyback $125.00 million in shares. This buyback authorization permits the fintech company to repurchase up to 5.1% of its stock through open market purchases. Stock buyback plans are usually an indication that the company's board of directors believes its shares are undervalued.

Insiders Place Their Bets

In other Dave news, Director Imran Khan sold 39,534 shares of the business's stock in a transaction dated Monday, September 15th. The stock was sold at an average price of $223.13, for a total transaction of $8,821,221.42. Following the completion of the transaction, the director owned 79,110 shares of the company's stock, valued at approximately $17,651,814.30. The trade was a 33.32% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Jason Wilk sold 81,693 shares of the company's stock in a transaction that occurred on Friday, September 19th. The stock was sold at an average price of $230.28, for a total transaction of $18,812,264.04. Following the transaction, the chief executive officer owned 217,854 shares of the company's stock, valued at approximately $50,167,419.12. This represents a 27.27% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 226,943 shares of company stock valued at $50,301,987. 28.48% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Dave

Several institutional investors and hedge funds have recently made changes to their positions in DAVE. Invesco Ltd. increased its stake in shares of Dave by 2,379.9% in the second quarter. Invesco Ltd. now owns 97,485 shares of the fintech company's stock valued at $26,166,000 after buying an additional 93,554 shares during the period. BNP Paribas Financial Markets raised its stake in Dave by 14,074.9% during the second quarter. BNP Paribas Financial Markets now owns 84,766 shares of the fintech company's stock worth $22,752,000 after buying an additional 84,168 shares during the last quarter. Mane Global Capital Management LP acquired a new stake in Dave during the 2nd quarter worth about $20,035,000. Azora Capital LP acquired a new stake in Dave during the second quarter worth approximately $19,037,000. Finally, Balyasny Asset Management L.P. acquired a new stake in Dave during the second quarter worth approximately $18,807,000. Institutional investors and hedge funds own 18.01% of the company's stock.

Dave Company Profile

(

Get Free Report)

Dave, Inc is a digital banking service. Its products include a budgeting tool to help members manage their upcoming bills to avoid overspending, cash advances through its flagship ExtraCash product to help members avoid punitive overdraft fees, a Side Hustle product, where Dave helps connect members with supplemental work opportunities, and Dave Banking, a modern checking account experience with valuable tools for building long-term financial health.

Featured Articles

Before you consider Dave, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dave wasn't on the list.

While Dave currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.