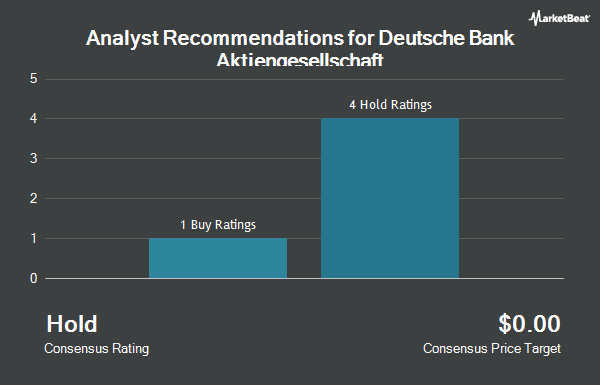

Deutsche Bank Aktiengesellschaft (NYSE:DB - Get Free Report) has been given a consensus recommendation of "Moderate Buy" by the seven brokerages that are presently covering the company, MarketBeat reports. Two investment analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the company.

Several research analysts have commented on the company. Royal Bank Of Canada restated an "outperform" rating on shares of Deutsche Bank Aktiengesellschaft in a report on Monday, March 24th. Cfra Research upgraded shares of Deutsche Bank Aktiengesellschaft from a "moderate sell" rating to a "hold" rating in a research note on Wednesday, April 30th. Finally, Bank of America assumed coverage on Deutsche Bank Aktiengesellschaft in a report on Tuesday, June 10th. They set a "buy" rating for the company.

Read Our Latest Report on Deutsche Bank Aktiengesellschaft

Deutsche Bank Aktiengesellschaft Stock Performance

DB stock traded down $0.35 during midday trading on Friday, reaching $28.90. 2,557,276 shares of the company's stock traded hands, compared to its average volume of 2,541,026. The stock's 50-day moving average is $27.89 and its 200 day moving average is $23.38. The stock has a market cap of $57.57 billion, a P/E ratio of 17.20, a PEG ratio of 0.37 and a beta of 0.97. Deutsche Bank Aktiengesellschaft has a 52-week low of $13.70 and a 52-week high of $30.50. The company has a current ratio of 0.79, a quick ratio of 0.79 and a debt-to-equity ratio of 1.39.

Deutsche Bank Aktiengesellschaft (NYSE:DB - Get Free Report) last announced its quarterly earnings data on Tuesday, April 29th. The bank reported $1.04 EPS for the quarter, beating the consensus estimate of $0.85 by $0.19. The business had revenue of $8.97 billion for the quarter, compared to the consensus estimate of $7.95 billion. Deutsche Bank Aktiengesellschaft had a return on equity of 4.61% and a net margin of 5.76%. As a group, analysts anticipate that Deutsche Bank Aktiengesellschaft will post 2.93 EPS for the current year.

Hedge Funds Weigh In On Deutsche Bank Aktiengesellschaft

Several institutional investors have recently bought and sold shares of the company. Zions Bancorporation National Association UT purchased a new stake in shares of Deutsche Bank Aktiengesellschaft in the 1st quarter valued at approximately $39,000. Farther Finance Advisors LLC increased its holdings in Deutsche Bank Aktiengesellschaft by 96.5% in the first quarter. Farther Finance Advisors LLC now owns 1,629 shares of the bank's stock valued at $39,000 after buying an additional 800 shares during the last quarter. MassMutual Private Wealth & Trust FSB lifted its holdings in Deutsche Bank Aktiengesellschaft by 21.3% during the 1st quarter. MassMutual Private Wealth & Trust FSB now owns 2,412 shares of the bank's stock worth $57,000 after buying an additional 424 shares during the last quarter. Jones Financial Companies Lllp boosted its position in shares of Deutsche Bank Aktiengesellschaft by 1,270.5% during the 4th quarter. Jones Financial Companies Lllp now owns 4,043 shares of the bank's stock worth $69,000 after acquiring an additional 3,748 shares in the last quarter. Finally, Kayne Anderson Rudnick Investment Management LLC lifted its stake in Deutsche Bank Aktiengesellschaft by 28,293.3% in the first quarter. Kayne Anderson Rudnick Investment Management LLC now owns 4,259 shares of the bank's stock valued at $101,000 after buying an additional 4,244 shares during the last quarter. 27.90% of the stock is owned by institutional investors and hedge funds.

About Deutsche Bank Aktiengesellschaft

(

Get Free ReportDeutsche Bank Aktiengesellschaft, a stock corporation, provides corporate and investment banking, and asset management products and services to private individuals, corporate entities, and institutional clients in Germany, the United Kingdom, rest of Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

See Also

Before you consider Deutsche Bank Aktiengesellschaft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Deutsche Bank Aktiengesellschaft wasn't on the list.

While Deutsche Bank Aktiengesellschaft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.