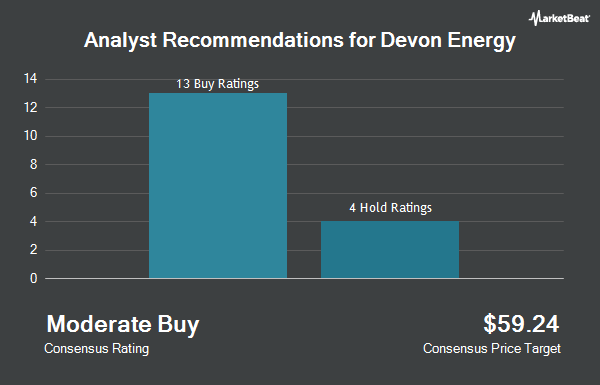

Devon Energy Corporation (NYSE:DVN - Get Free Report) has been assigned an average recommendation of "Moderate Buy" from the twenty-five research firms that are presently covering the company, MarketBeat reports. Ten analysts have rated the stock with a hold recommendation and fifteen have given a buy recommendation to the company. The average 12-month price target among brokers that have covered the stock in the last year is $43.8519.

A number of research analysts have recently weighed in on the company. Raymond James Financial reiterated an "outperform" rating and set a $45.00 price target (up previously from $40.00) on shares of Devon Energy in a report on Tuesday, July 22nd. Piper Sandler restated an "overweight" rating and set a $58.00 price target (up from $53.00) on shares of Devon Energy in a research note on Thursday, July 17th. Bank of America lowered their price objective on Devon Energy from $52.00 to $42.00 and set a "buy" rating on the stock in a research note on Tuesday, April 29th. Wolfe Research boosted their target price on Devon Energy from $47.00 to $49.00 and gave the stock an "outperform" rating in a report on Monday, June 23rd. Finally, Siebert Williams Shank upped their price objective on Devon Energy from $47.00 to $52.00 and gave the stock a "buy" rating in a report on Monday, June 23rd.

Get Our Latest Stock Analysis on DVN

Devon Energy Stock Performance

Shares of DVN traded down $0.05 during mid-day trading on Friday, hitting $31.89. The stock had a trading volume of 4,574,387 shares, compared to its average volume of 9,036,433. The company has a market cap of $20.48 billion, a PE ratio of 7.27, a PEG ratio of 1.82 and a beta of 1.07. The company's fifty day simple moving average is $32.94 and its two-hundred day simple moving average is $33.31. The company has a quick ratio of 0.99, a current ratio of 1.08 and a debt-to-equity ratio of 0.57. Devon Energy has a fifty-two week low of $25.89 and a fifty-two week high of $46.04.

Devon Energy (NYSE:DVN - Get Free Report) last announced its earnings results on Tuesday, May 6th. The energy company reported $1.21 earnings per share for the quarter, missing the consensus estimate of $1.27 by ($0.06). The business had revenue of $4.45 billion for the quarter, compared to the consensus estimate of $4.31 billion. Devon Energy had a net margin of 16.60% and a return on equity of 21.90%. The firm's revenue was up 23.8% on a year-over-year basis. During the same period in the previous year, the firm earned $1.16 EPS. On average, equities analysts expect that Devon Energy will post 4.85 earnings per share for the current year.

Devon Energy Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, June 30th. Stockholders of record on Friday, June 13th were issued a $0.24 dividend. The ex-dividend date was Friday, June 13th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 3.0%. Devon Energy's dividend payout ratio is presently 21.87%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the business. Opal Wealth Advisors LLC acquired a new stake in Devon Energy in the 2nd quarter worth about $25,000. Hurley Capital LLC acquired a new position in shares of Devon Energy during the 4th quarter valued at about $26,000. Financial Gravity Asset Management Inc. purchased a new stake in Devon Energy in the 1st quarter valued at about $26,000. Banque Cantonale Vaudoise purchased a new stake in Devon Energy in the 1st quarter valued at about $26,000. Finally, Accredited Wealth Management LLC acquired a new stake in shares of Devon Energy during the fourth quarter worth about $28,000. 69.72% of the stock is currently owned by institutional investors.

Devon Energy Company Profile

(

Get Free Report)

Devon Energy Corporation, an independent energy company, engages in the exploration, development, and production of oil, natural gas, and natural gas liquids in the United States. It operates in Delaware, Eagle Ford, Anadarko, Williston, and Powder River Basins. The company was founded in 1971 and is headquartered in Oklahoma City, Oklahoma.

See Also

Before you consider Devon Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Devon Energy wasn't on the list.

While Devon Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.