Citigroup reissued their buy rating on shares of Diageo (LON:DGE - Free Report) in a research report released on Monday morning, Marketbeat reports.

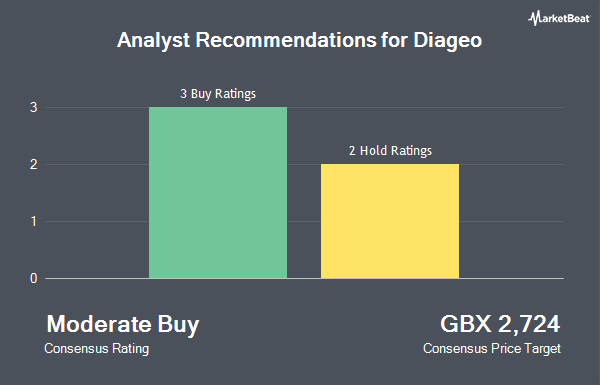

A number of other brokerages have also issued reports on DGE. Royal Bank Of Canada reissued a "sector perform" rating and set a GBX 2,400 ($32.28) target price on shares of Diageo in a research note on Wednesday, July 16th. Deutsche Bank Aktiengesellschaft lifted their price objective on Diageo from GBX 1,960 ($26.36) to GBX 2,010 ($27.03) and gave the company a "hold" rating in a report on Tuesday, July 8th. Finally, Berenberg Bank restated a "buy" rating and issued a GBX 2,372 ($31.90) price objective on shares of Diageo in a report on Wednesday, May 21st. Four equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat, Diageo has a consensus rating of "Moderate Buy" and a consensus target price of GBX 2,393.14 ($32.18).

Read Our Latest Report on DGE

Diageo Price Performance

DGE traded down GBX 5 ($0.07) during trading hours on Monday, hitting GBX 2,021 ($27.18). The company's stock had a trading volume of 3,041,995 shares, compared to its average volume of 4,388,322. The business's 50-day moving average price is GBX 1,918.72 and its 200-day moving average price is GBX 2,067.82. Diageo has a 12 month low of GBX 1,797 ($24.17) and a 12 month high of GBX 2,677 ($36.00). The stock has a market cap of £44.86 billion, a price-to-earnings ratio of 11.32, a P/E/G ratio of 1.75 and a beta of 0.36. The company has a current ratio of 1.94, a quick ratio of 0.62 and a debt-to-equity ratio of 234.57.

Insider Buying and Selling at Diageo

In other news, insider John Alexander Manzoni bought 335 shares of Diageo stock in a transaction on Wednesday, July 9th. The stock was acquired at an average cost of GBX 1,955 ($26.29) per share, for a total transaction of £6,549.25 ($8,807.49). Insiders bought 981 shares of company stock valued at $1,999,510 in the last ninety days. Insiders own 0.11% of the company's stock.

Diageo Company Profile

(

Get Free Report)

Diageo is a global leader in premium drinks, across spirits and beer, a business built on the principles and foundations laid by the giants of the industry.

With over 200 brands sold in 180 countries, our portfolio has remarkable breadth. From centuries-old names to exciting new entrants, and global giants to local legends, we're building the very best brands out there, and with over 30,000 talented people based in over 135 countries, we're a truly global company.

Read More

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.