Dianthus Therapeutics (NASDAQ:DNTH - Get Free Report)'s stock had its "sell (d-)" rating reaffirmed by equities research analysts at Weiss Ratings in a research note issued to investors on Friday,Weiss Ratings reports.

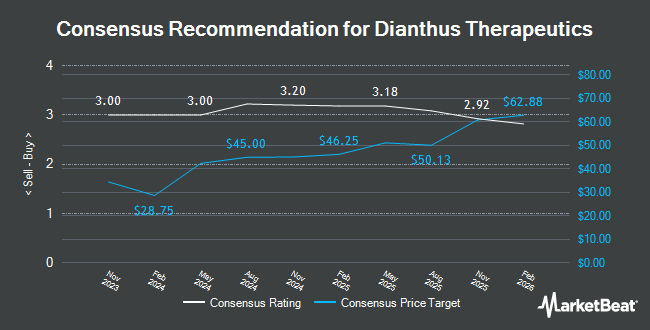

A number of other equities research analysts have also recently weighed in on DNTH. Guggenheim lifted their price objective on shares of Dianthus Therapeutics from $92.00 to $100.00 and gave the company a "buy" rating in a research note on Tuesday, September 9th. Wedbush lifted their price objective on shares of Dianthus Therapeutics from $42.00 to $44.00 and gave the company an "outperform" rating in a research note on Friday, September 12th. Truist Financial initiated coverage on shares of Dianthus Therapeutics in a research note on Tuesday, October 14th. They set a "buy" rating and a $56.00 price objective on the stock. Robert W. Baird lifted their price objective on shares of Dianthus Therapeutics from $50.00 to $67.00 and gave the company an "outperform" rating in a research note on Tuesday, September 9th. Finally, Stifel Nicolaus lifted their price objective on shares of Dianthus Therapeutics from $52.00 to $65.00 and gave the company a "buy" rating in a research note on Friday, September 12th. Ten research analysts have rated the stock with a Buy rating and one has issued a Sell rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $60.88.

Get Our Latest Stock Analysis on Dianthus Therapeutics

Dianthus Therapeutics Stock Down 1.1%

DNTH stock traded down $0.35 during mid-day trading on Friday, reaching $32.92. The company had a trading volume of 779,367 shares, compared to its average volume of 623,093. The stock has a market capitalization of $1.06 billion, a P/E ratio of -10.13 and a beta of 1.58. Dianthus Therapeutics has a one year low of $13.36 and a one year high of $40.16. The stock's 50-day simple moving average is $32.48 and its two-hundred day simple moving average is $23.88.

Dianthus Therapeutics (NASDAQ:DNTH - Get Free Report) last posted its earnings results on Thursday, August 7th. The company reported ($0.88) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.86) by ($0.02). Dianthus Therapeutics had a negative net margin of 2,364.56% and a negative return on equity of 34.72%. The company had revenue of $0.19 million during the quarter, compared to the consensus estimate of $0.87 million. On average, research analysts forecast that Dianthus Therapeutics will post -2.61 EPS for the current fiscal year.

Insider Transactions at Dianthus Therapeutics

In related news, CFO Ryan Savitz sold 20,000 shares of Dianthus Therapeutics stock in a transaction dated Tuesday, September 9th. The stock was sold at an average price of $35.00, for a total transaction of $700,000.00. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. 8.15% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the company. Raymond James Financial Inc. acquired a new position in Dianthus Therapeutics during the second quarter worth about $27,000. US Bancorp DE grew its holdings in Dianthus Therapeutics by 2,013.3% during the first quarter. US Bancorp DE now owns 1,585 shares of the company's stock worth $29,000 after acquiring an additional 1,510 shares during the period. Tower Research Capital LLC TRC grew its holdings in Dianthus Therapeutics by 330.7% during the second quarter. Tower Research Capital LLC TRC now owns 4,320 shares of the company's stock worth $80,000 after acquiring an additional 3,317 shares during the period. AlphaQuest LLC acquired a new position in Dianthus Therapeutics during the second quarter worth about $94,000. Finally, Ethic Inc. purchased a new position in Dianthus Therapeutics in the 3rd quarter worth about $218,000. 47.53% of the stock is owned by institutional investors and hedge funds.

Dianthus Therapeutics Company Profile

(

Get Free Report)

Dianthus Therapeutics, Inc, a clinical-stage biotechnology company, develops complement therapeutics for patients with severe autoimmune and inflammatory diseases. It is developing DNTH103, a monoclonal antibody, which is in Phase 2 clinical trial, for the treatment of generalized myasthenia gravis, multifocal motor neuropathy, and chronic inflammatory demyelinating polyneuropathy.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dianthus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dianthus Therapeutics wasn't on the list.

While Dianthus Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.