DICK'S Sporting Goods (NYSE:DKS - Get Free Report) had its price target hoisted by Barclays from $232.00 to $246.00 in a report issued on Tuesday, MarketBeat Ratings reports. The brokerage currently has an "overweight" rating on the sporting goods retailer's stock. Barclays's price target indicates a potential upside of 11.12% from the stock's current price.

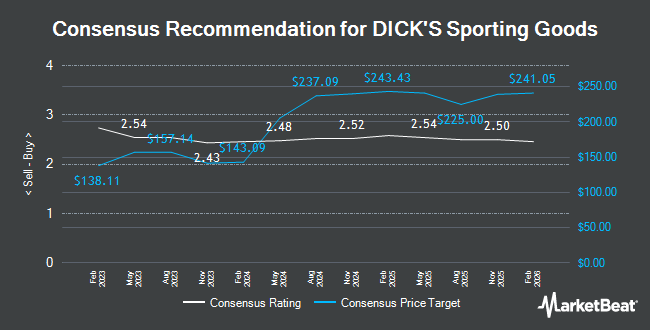

Several other equities analysts have also issued reports on the company. Oppenheimer restated an "outperform" rating and set a $270.00 price target on shares of DICK'S Sporting Goods in a research note on Friday, August 29th. TD Cowen lowered DICK'S Sporting Goods from a "buy" rating to a "hold" rating and set a $216.00 price objective on the stock. in a research note on Thursday, May 15th. Telsey Advisory Group reiterated an "outperform" rating and issued a $255.00 price objective on shares of DICK'S Sporting Goods in a research note on Thursday, August 28th. Gordon Haskett upgraded DICK'S Sporting Goods from a "reduce" rating to a "hold" rating in a research report on Friday, July 25th. Finally, Robert W. Baird decreased their price target on DICK'S Sporting Goods from $230.00 to $185.00 and set a "neutral" rating on the stock in a research report on Friday, May 16th. Nine investment analysts have rated the stock with a Buy rating and eleven have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $232.50.

Get Our Latest Analysis on DKS

DICK'S Sporting Goods Stock Performance

DKS traded down $0.64 on Tuesday, hitting $221.39. 3,440,481 shares of the stock traded hands, compared to its average volume of 2,007,977. DICK'S Sporting Goods has a 52 week low of $166.37 and a 52 week high of $254.60. The company has a current ratio of 1.70, a quick ratio of 0.55 and a debt-to-equity ratio of 0.44. The firm has a market capitalization of $17.72 billion, a PE ratio of 15.46, a P/E/G ratio of 3.18 and a beta of 1.02. The business has a fifty day moving average price of $214.60 and a two-hundred day moving average price of $199.93.

DICK'S Sporting Goods (NYSE:DKS - Get Free Report) last issued its quarterly earnings results on Thursday, August 28th. The sporting goods retailer reported $4.38 earnings per share (EPS) for the quarter, beating the consensus estimate of $4.30 by $0.08. DICK'S Sporting Goods had a return on equity of 36.54% and a net margin of 8.52%.The firm had revenue of $3.65 billion for the quarter, compared to analyst estimates of $3.61 billion. During the same period in the previous year, the company posted $4.37 earnings per share. The company's quarterly revenue was up 5.0% compared to the same quarter last year. DICK'S Sporting Goods has set its FY 2025 guidance at 13.900-14.500 EPS. On average, research analysts predict that DICK'S Sporting Goods will post 13.89 EPS for the current fiscal year.

Insider Buying and Selling

In other news, SVP Elizabeth H. Baran sold 1,830 shares of the stock in a transaction on Wednesday, July 2nd. The stock was sold at an average price of $204.65, for a total value of $374,509.50. Following the transaction, the senior vice president owned 12,465 shares of the company's stock, valued at $2,550,962.25. This represents a 12.80% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, EVP Julie Lodge-Jarrett sold 3,541 shares of the stock in a transaction on Thursday, June 26th. The shares were sold at an average price of $187.00, for a total value of $662,167.00. Following the completion of the transaction, the executive vice president directly owned 19,165 shares in the company, valued at approximately $3,583,855. This trade represents a 15.59% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 69,200 shares of company stock worth $14,462,923 over the last 90 days. 32.55% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

A number of large investors have recently made changes to their positions in DKS. Bessemer Group Inc. grew its stake in DICK'S Sporting Goods by 49.3% in the first quarter. Bessemer Group Inc. now owns 218 shares of the sporting goods retailer's stock valued at $44,000 after acquiring an additional 72 shares during the period. Fifth Third Bancorp grew its stake in DICK'S Sporting Goods by 27.5% in the first quarter. Fifth Third Bancorp now owns 968 shares of the sporting goods retailer's stock valued at $195,000 after acquiring an additional 209 shares during the period. NBC Securities Inc. acquired a new position in DICK'S Sporting Goods in the first quarter valued at about $54,000. Janus Henderson Group PLC grew its stake in DICK'S Sporting Goods by 15.9% in the fourth quarter. Janus Henderson Group PLC now owns 11,640 shares of the sporting goods retailer's stock valued at $2,664,000 after acquiring an additional 1,594 shares during the period. Finally, OneDigital Investment Advisors LLC acquired a new position in DICK'S Sporting Goods in the first quarter valued at about $214,000. Institutional investors and hedge funds own 89.83% of the company's stock.

About DICK'S Sporting Goods

(

Get Free Report)

DICK's Sporting Goods, Inc engages in the retailing of an extensive assortment of authentic sports equipment, apparel, footwear, and accessories. It also offers its products both online and through mobile applications. The company was founded by Richard T. Stack in 1948 and is headquartered in Coraopolis, PA.

Featured Articles

Before you consider DICK'S Sporting Goods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DICK'S Sporting Goods wasn't on the list.

While DICK'S Sporting Goods currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.