Dollar Tree (NASDAQ:DLTR - Get Free Report) was downgraded by research analysts at BNP Paribas from a "strong-buy" rating to a "hold" rating in a research report issued to clients and investors on Thursday,Zacks.com reports.

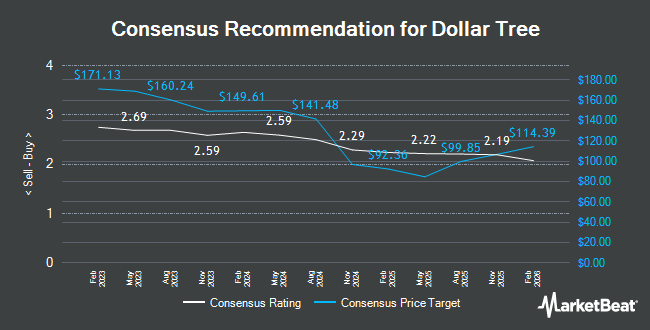

DLTR has been the subject of several other reports. Guggenheim reissued a "buy" rating and issued a $100.00 price objective on shares of Dollar Tree in a research report on Thursday, June 5th. Citigroup reduced their price objective on Dollar Tree from $130.00 to $124.00 and set a "buy" rating for the company in a research report on Thursday. Piper Sandler reduced their price objective on Dollar Tree from $112.00 to $108.00 and set a "neutral" rating for the company in a research report on Thursday. Evercore ISI increased their price objective on Dollar Tree from $108.00 to $110.00 and gave the company an "in-line" rating in a research report on Tuesday, August 26th. Finally, Wells Fargo & Company reissued an "overweight" rating on shares of Dollar Tree in a research report on Wednesday, September 3rd. Eight equities research analysts have rated the stock with a Buy rating, twelve have given a Hold rating and three have given a Sell rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $108.26.

Get Our Latest Research Report on Dollar Tree

Dollar Tree Stock Performance

Dollar Tree stock traded down $1.72 during trading hours on Thursday, reaching $99.40. 7,462,927 shares of the company were exchanged, compared to its average volume of 4,102,163. The firm has a market cap of $20.27 billion, a price-to-earnings ratio of -7.32, a PEG ratio of 1.84 and a beta of 0.89. The company has a current ratio of 1.04, a quick ratio of 0.27 and a debt-to-equity ratio of 0.67. The stock has a 50-day moving average of $110.42 and a 200 day moving average of $91.46. Dollar Tree has a 12 month low of $60.49 and a 12 month high of $118.06.

Dollar Tree (NASDAQ:DLTR - Get Free Report) last announced its earnings results on Wednesday, September 3rd. The company reported $0.77 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.38 by $0.39. The firm had revenue of $4.57 billion during the quarter, compared to analysts' expectations of $4.46 billion. Dollar Tree had a positive return on equity of 23.52% and a negative net margin of 13.46%.The company's revenue was up 12.3% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.67 earnings per share. Dollar Tree has set its FY 2025 guidance at 5.320-5.720 EPS. As a group, research analysts anticipate that Dollar Tree will post 5.39 earnings per share for the current year.

Dollar Tree declared that its Board of Directors has approved a stock repurchase program on Wednesday, July 9th that permits the company to repurchase $2.50 billion in shares. This repurchase authorization permits the company to purchase up to 11.5% of its shares through open market purchases. Shares repurchase programs are typically an indication that the company's board of directors believes its shares are undervalued.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of DLTR. Orion Porfolio Solutions LLC raised its stake in Dollar Tree by 28.2% during the second quarter. Orion Porfolio Solutions LLC now owns 47,735 shares of the company's stock worth $4,728,000 after acquiring an additional 10,497 shares in the last quarter. Advisory Services Network LLC raised its stake in Dollar Tree by 57.5% during the second quarter. Advisory Services Network LLC now owns 22,963 shares of the company's stock worth $2,274,000 after acquiring an additional 8,382 shares in the last quarter. Pitcairn Co. acquired a new position in Dollar Tree during the second quarter worth $556,000. Caxton Associates LLP acquired a new position in Dollar Tree during the second quarter worth $2,492,000. Finally, Semper Augustus Investments Group LLC raised its stake in Dollar Tree by 2.6% during the second quarter. Semper Augustus Investments Group LLC now owns 506,396 shares of the company's stock worth $50,153,000 after acquiring an additional 13,010 shares in the last quarter. 97.40% of the stock is owned by institutional investors.

About Dollar Tree

(

Get Free Report)

Dollar Tree, Inc operates retail discount stores. The company operates in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at the fixed price of $ 1.25. It provides consumable merchandise, which includes everyday consumables, such as household paper and chemicals, food, candy, health, personal care products, and frozen and refrigerated food; variety merchandise comprising toys, durable housewares, gifts, stationery, party goods, greeting cards, softlines, arts and crafts supplies, and other items; and seasonal goods that include Christmas, Easter, Halloween, and Valentine's Day merchandise.

Featured Articles

Before you consider Dollar Tree, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dollar Tree wasn't on the list.

While Dollar Tree currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.