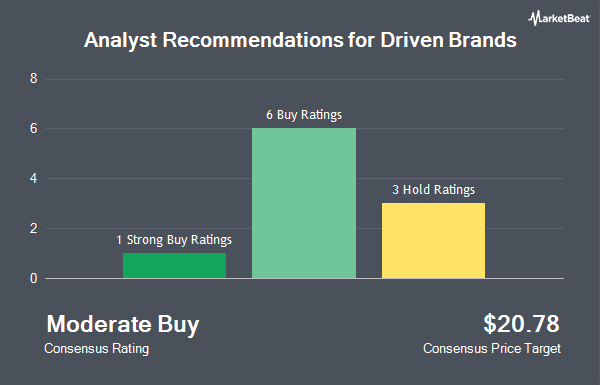

Driven Brands Holdings Inc. (NASDAQ:DRVN - Get Free Report) has been given an average rating of "Moderate Buy" by the eleven analysts that are currently covering the company, Marketbeat.com reports. Three equities research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the company. The average 12 month target price among brokers that have covered the stock in the last year is $21.00.

Several analysts have recently issued reports on DRVN shares. Benchmark started coverage on shares of Driven Brands in a research report on Friday, April 4th. They issued a "buy" rating and a $22.00 target price on the stock. BTIG Research started coverage on shares of Driven Brands in a research report on Monday, June 30th. They issued a "buy" rating and a $22.00 target price on the stock. Wall Street Zen raised shares of Driven Brands from a "hold" rating to a "buy" rating in a research report on Saturday, July 5th. The Goldman Sachs Group assumed coverage on shares of Driven Brands in a research report on Tuesday, June 3rd. They issued a "neutral" rating and a $20.00 target price on the stock. Finally, Canaccord Genuity Group raised their price objective on shares of Driven Brands from $23.00 to $24.00 and gave the stock a "buy" rating in a research report on Friday, June 27th.

Read Our Latest Report on DRVN

Hedge Funds Weigh In On Driven Brands

A number of hedge funds have recently made changes to their positions in the stock. Hennessy Advisors Inc. bought a new stake in Driven Brands during the second quarter worth $10,562,000. Rhumbline Advisers raised its position in Driven Brands by 5.2% in the 1st quarter. Rhumbline Advisers now owns 86,478 shares of the company's stock worth $1,482,000 after purchasing an additional 4,243 shares during the period. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC boosted its holdings in Driven Brands by 22.7% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 139,321 shares of the company's stock valued at $2,388,000 after acquiring an additional 25,806 shares during the period. Seven Six Capital Management LLC increased its stake in shares of Driven Brands by 34.5% during the first quarter. Seven Six Capital Management LLC now owns 202,600 shares of the company's stock valued at $3,473,000 after buying an additional 52,000 shares during the period. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of Driven Brands by 4.4% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 35,597 shares of the company's stock worth $610,000 after acquiring an additional 1,493 shares in the last quarter. 77.08% of the stock is currently owned by institutional investors.

Driven Brands Price Performance

Shares of Driven Brands stock traded up $0.01 during trading on Friday, hitting $17.10. The stock had a trading volume of 381,731 shares, compared to its average volume of 580,551. The company has a current ratio of 1.47, a quick ratio of 1.33 and a debt-to-equity ratio of 4.07. The business's 50-day moving average is $17.54 and its 200 day moving average is $16.88. The firm has a market cap of $2.81 billion, a price-to-earnings ratio of -9.45, a P/E/G ratio of 0.98 and a beta of 1.09. Driven Brands has a 12 month low of $12.73 and a 12 month high of $18.72.

Driven Brands (NASDAQ:DRVN - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The company reported $0.27 EPS for the quarter, topping the consensus estimate of $0.23 by $0.04. The business had revenue of $516.16 million for the quarter, compared to analysts' expectations of $492.19 million. Driven Brands had a negative net margin of 12.75% and a positive return on equity of 19.61%. The business's quarterly revenue was up 7.1% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.23 EPS. As a group, sell-side analysts anticipate that Driven Brands will post 0.85 earnings per share for the current year.

Driven Brands Company Profile

(

Get Free ReportDriven Brands Holdings Inc, together with its subsidiaries, provides automotive services to retail and commercial customers in the United States, Canada, and internationally. It offers various services, such as paint, collision, glass, repair, car wash, oil change, and maintenance services. The company also distributes automotive parts, including radiators, air conditioning components, and exhaust products to automotive repair shops, auto parts stores, body shops, and other auto repair outlets; windshields and glass accessories through a network of distribution centers; and consumable products, such as oil filters and wiper blades, as well as training services to repair and maintenance, and paint and collision shops.

See Also

Before you consider Driven Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Driven Brands wasn't on the list.

While Driven Brands currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.