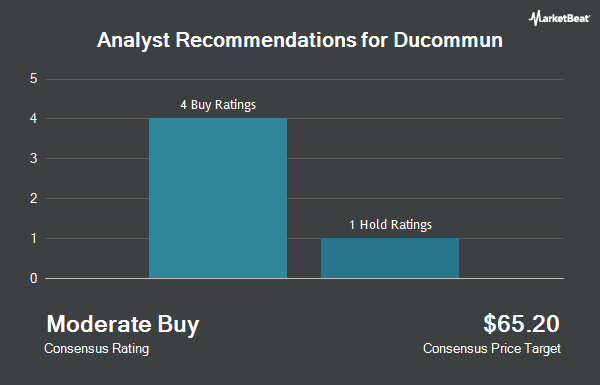

Ducommun Incorporated (NYSE:DCO - Get Free Report) has earned an average rating of "Moderate Buy" from the seven research firms that are covering the stock, MarketBeat.com reports. One equities research analyst has rated the stock with a hold rating and six have issued a buy rating on the company. The average 12-month price target among brokerages that have issued a report on the stock in the last year is $97.50.

A number of equities analysts have recently issued reports on DCO shares. Weiss Ratings restated a "buy (b-)" rating on shares of Ducommun in a research report on Wednesday, October 8th. Zacks Research upgraded Ducommun to a "hold" rating in a research report on Monday, August 11th. Royal Bank Of Canada raised their price objective on Ducommun from $95.00 to $100.00 and gave the stock an "outperform" rating in a research report on Friday, August 8th. Wall Street Zen upgraded Ducommun from a "buy" rating to a "strong-buy" rating in a research report on Sunday, August 10th. Finally, Citigroup restated a "buy" rating and set a $101.00 price objective (up from $91.00) on shares of Ducommun in a research report on Monday, July 14th.

Check Out Our Latest Stock Analysis on DCO

Institutional Investors Weigh In On Ducommun

Several large investors have recently added to or reduced their stakes in the business. Panagora Asset Management Inc. grew its stake in Ducommun by 0.9% during the second quarter. Panagora Asset Management Inc. now owns 13,027 shares of the aerospace company's stock worth $1,076,000 after purchasing an additional 119 shares during the period. CWM LLC grew its stake in Ducommun by 27.7% during the second quarter. CWM LLC now owns 687 shares of the aerospace company's stock worth $57,000 after purchasing an additional 149 shares during the period. The Manufacturers Life Insurance Company grew its stake in Ducommun by 3.2% during the second quarter. The Manufacturers Life Insurance Company now owns 5,014 shares of the aerospace company's stock worth $414,000 after purchasing an additional 155 shares during the period. Arizona State Retirement System grew its stake in Ducommun by 4.8% during the first quarter. Arizona State Retirement System now owns 3,815 shares of the aerospace company's stock worth $221,000 after purchasing an additional 176 shares during the period. Finally, Oliver Luxxe Assets LLC grew its stake in Ducommun by 0.9% during the second quarter. Oliver Luxxe Assets LLC now owns 31,489 shares of the aerospace company's stock worth $2,602,000 after purchasing an additional 267 shares during the period. Institutional investors and hedge funds own 92.15% of the company's stock.

Ducommun Price Performance

Ducommun stock opened at $95.08 on Wednesday. The company has a current ratio of 3.24, a quick ratio of 2.17 and a debt-to-equity ratio of 0.31. The company has a market capitalization of $1.42 billion, a PE ratio of 36.15 and a beta of 1.38. Ducommun has a 12 month low of $51.76 and a 12 month high of $97.48. The stock has a 50-day moving average price of $92.94 and a two-hundred day moving average price of $80.51.

Ducommun (NYSE:DCO - Get Free Report) last posted its earnings results on Thursday, August 7th. The aerospace company reported $0.88 EPS for the quarter, beating the consensus estimate of $0.80 by $0.08. The firm had revenue of $202.26 million during the quarter, compared to the consensus estimate of $199.29 million. Ducommun had a return on equity of 7.61% and a net margin of 5.03%.The business's quarterly revenue was up 2.7% on a year-over-year basis. During the same period last year, the company earned $0.52 earnings per share. Analysts expect that Ducommun will post 3.21 EPS for the current year.

About Ducommun

(

Get Free Report)

Ducommun Incorporated provides engineering and manufacturing services for products and applications used primarily in the aerospace and defense, industrial, medical, and other industries in the United States. The company operates through two segments, Electronic Systems and Structural Systems. The Electronic Systems segment provides cable assemblies and interconnect systems; printed circuit board assemblies; electronic, electromechanical, and mechanical components and assemblies, as well as lightning diversion systems; and radar enclosures, aircraft avionics racks, shipboard communications and control enclosures, printed circuit board assemblies, cable assemblies, wire harnesses, interconnect systems, lightning diversion strips, surge suppressors, conformal shields, and other assemblies.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ducommun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ducommun wasn't on the list.

While Ducommun currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.