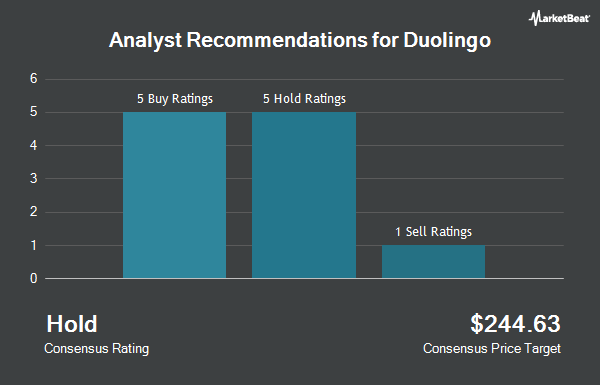

Shares of Duolingo, Inc. (NASDAQ:DUOL - Get Free Report) have been assigned a consensus rating of "Hold" from the twenty-four brokerages that are covering the firm, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell recommendation, eleven have issued a hold recommendation and twelve have issued a buy recommendation on the company. The average 12 month target price among analysts that have updated their coverage on the stock in the last year is $414.0526.

A number of equities research analysts have weighed in on DUOL shares. Citigroup reduced their target price on Duolingo from $400.00 to $375.00 and set a "buy" rating on the stock in a report on Wednesday, September 17th. Raymond James Financial reaffirmed a "market perform" rating on shares of Duolingo in a report on Tuesday, August 26th. Baird R W raised Duolingo to a "hold" rating in a report on Friday, September 5th. Citizens Jmp reduced their target price on Duolingo from $475.00 to $450.00 and set a "mkt outperform" rating on the stock in a report on Monday, July 28th. Finally, Morgan Stanley raised their target price on Duolingo from $480.00 to $500.00 and gave the company an "overweight" rating in a report on Thursday, August 7th.

View Our Latest Stock Analysis on DUOL

Insider Activity at Duolingo

In related news, General Counsel Stephen C. Chen sold 1,515 shares of the firm's stock in a transaction on Tuesday, August 26th. The stock was sold at an average price of $321.36, for a total transaction of $486,860.40. Following the sale, the general counsel owned 32,638 shares of the company's stock, valued at $10,488,547.68. This trade represents a 4.44% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, insider Natalie Glance sold 3,283 shares of the firm's stock in a transaction on Wednesday, October 1st. The shares were sold at an average price of $312.30, for a total value of $1,025,280.90. Following the sale, the insider directly owned 116,171 shares in the company, valued at approximately $36,280,203.30. This trade represents a 2.75% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 83,791 shares of company stock worth $26,462,201 over the last 90 days. 15.67% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Large investors have recently bought and sold shares of the stock. Jefferies Financial Group Inc. bought a new position in Duolingo during the 1st quarter worth $3,772,000. Hsbc Holdings PLC raised its position in shares of Duolingo by 39.0% in the 1st quarter. Hsbc Holdings PLC now owns 3,186 shares of the company's stock worth $995,000 after acquiring an additional 894 shares in the last quarter. Encompass More Asset Management bought a new position in shares of Duolingo in the 1st quarter worth about $762,000. Mirae Asset Global Investments Co. Ltd. raised its position in shares of Duolingo by 965.3% in the 2nd quarter. Mirae Asset Global Investments Co. Ltd. now owns 6,882 shares of the company's stock worth $2,822,000 after acquiring an additional 6,236 shares in the last quarter. Finally, Jump Financial LLC raised its position in shares of Duolingo by 563.7% in the 1st quarter. Jump Financial LLC now owns 104,693 shares of the company's stock worth $32,511,000 after acquiring an additional 88,918 shares in the last quarter. 91.59% of the stock is owned by institutional investors.

Duolingo Trading Down 0.5%

Shares of NASDAQ:DUOL opened at $312.00 on Friday. The company has a market capitalization of $14.30 billion, a P/E ratio of 128.40, a P/E/G ratio of 2.05 and a beta of 0.86. Duolingo has a 1 year low of $256.63 and a 1 year high of $544.93. The company has a debt-to-equity ratio of 0.10, a current ratio of 2.81 and a quick ratio of 2.81. The business's 50 day simple moving average is $312.02 and its 200 day simple moving average is $381.37.

Duolingo (NASDAQ:DUOL - Get Free Report) last issued its earnings results on Wednesday, August 6th. The company reported $0.91 earnings per share for the quarter, beating analysts' consensus estimates of $0.55 by $0.36. The firm had revenue of $252.27 million for the quarter, compared to the consensus estimate of $240.84 million. Duolingo had a return on equity of 13.32% and a net margin of 13.24%.The company's revenue was up 41.5% compared to the same quarter last year. During the same quarter last year, the business posted $0.51 EPS. On average, research analysts anticipate that Duolingo will post 2.03 EPS for the current fiscal year.

About Duolingo

(

Get Free Report)

Duolingo, Inc operates as a mobile learning platform in the United States, the United Kingdom, and internationally. The company offers courses in 40 different languages, including Spanish, English, French, German, Italian, Portuguese, Japanese, and Chinese through its Duolingo app. It also provides a digital English language proficiency assessment exam.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Duolingo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Duolingo wasn't on the list.

While Duolingo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.