Dynavax Technologies (NASDAQ:DVAX - Get Free Report)'s stock had its "sell (d)" rating reaffirmed by investment analysts at Weiss Ratings in a research report issued to clients and investors on Friday,Weiss Ratings reports.

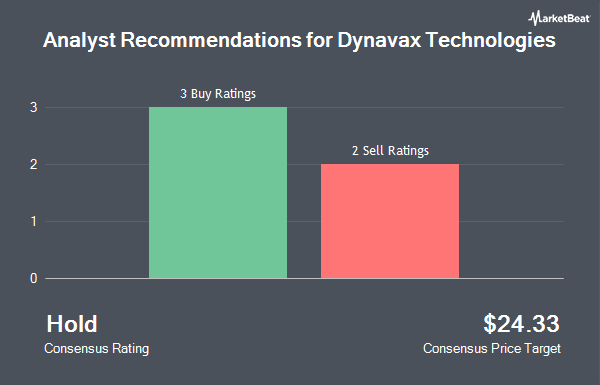

A number of other research analysts have also recently issued reports on the stock. JMP Securities reiterated a "market outperform" rating and set a $32.00 price objective on shares of Dynavax Technologies in a report on Friday, August 22nd. Wall Street Zen upgraded Dynavax Technologies from a "hold" rating to a "buy" rating in a research report on Saturday, August 9th. Three research analysts have rated the stock with a Buy rating and two have assigned a Sell rating to the stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $24.33.

Check Out Our Latest Stock Report on Dynavax Technologies

Dynavax Technologies Stock Performance

DVAX opened at $10.38 on Friday. The company has a quick ratio of 6.01, a current ratio of 6.65 and a debt-to-equity ratio of 0.45. The business has a 50 day moving average of $10.02 and a 200-day moving average of $10.35. Dynavax Technologies has a 12-month low of $9.20 and a 12-month high of $14.63. The stock has a market cap of $1.22 billion, a price-to-earnings ratio of -22.57 and a beta of 1.13.

Dynavax Technologies (NASDAQ:DVAX - Get Free Report) last posted its quarterly earnings data on Thursday, August 7th. The biopharmaceutical company reported $0.14 EPS for the quarter, topping analysts' consensus estimates of $0.12 by $0.02. The firm had revenue of $95.44 million for the quarter, compared to analyst estimates of $87.55 million. Dynavax Technologies had a positive return on equity of 5.10% and a negative net margin of 16.67%. On average, equities research analysts expect that Dynavax Technologies will post 0.32 earnings per share for the current year.

Insider Buying and Selling

In other Dynavax Technologies news, Director Scott Dunseth Myers bought 3,800 shares of the firm's stock in a transaction on Friday, August 22nd. The shares were acquired at an average cost of $10.82 per share, with a total value of $41,116.00. Following the purchase, the director directly owned 35,004 shares of the company's stock, valued at $378,743.28. This trade represents a 12.18% increase in their position. The acquisition was disclosed in a filing with the SEC, which is available through this hyperlink. Insiders own 2.98% of the company's stock.

Hedge Funds Weigh In On Dynavax Technologies

A number of hedge funds and other institutional investors have recently bought and sold shares of the company. Cambridge Investment Research Advisors Inc. purchased a new stake in Dynavax Technologies in the 1st quarter valued at approximately $312,000. GAMMA Investing LLC boosted its holdings in Dynavax Technologies by 88.4% in the first quarter. GAMMA Investing LLC now owns 7,729 shares of the biopharmaceutical company's stock worth $100,000 after purchasing an additional 3,627 shares during the period. Jacobs Levy Equity Management Inc. acquired a new stake in Dynavax Technologies in the first quarter worth $2,477,000. Woodline Partners LP grew its stake in shares of Dynavax Technologies by 48.4% in the first quarter. Woodline Partners LP now owns 1,178,763 shares of the biopharmaceutical company's stock worth $15,289,000 after purchasing an additional 384,288 shares in the last quarter. Finally, Exchange Traded Concepts LLC boosted its stake in Dynavax Technologies by 4.3% during the 2nd quarter. Exchange Traded Concepts LLC now owns 133,601 shares of the biopharmaceutical company's stock valued at $1,325,000 after purchasing an additional 5,523 shares in the last quarter. 96.96% of the stock is currently owned by hedge funds and other institutional investors.

Dynavax Technologies Company Profile

(

Get Free Report)

Dynavax Technologies Corporation, a commercial stage biopharmaceutical company, focuses on developing and commercializing vaccines in the United States. It markets HEPLISAV-B, a hepatitis B vaccine for prevention of infection caused by all known subtypes of hepatitis B virus in age 18 years and older in the United States and Europe.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Dynavax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynavax Technologies wasn't on the list.

While Dynavax Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.